Weekly Market Update 8/19/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What actress lied about her age to get a part on That 70's Show?

-

In what area of the world was milo first grown?

Answers at the bottom.

Market News

-

This week is the always highly anticipated ProFarmer Crop Tour. The tour officially ends today, but state results so far are pointing towards better-than-USDA corn yields and below average soybean yields. Check out the commodity sections for more information. If you're interested in following along or seeing the social media posts from the tour, it can be followed using #PFtour21.

-

Stocks are mixed to lower today after a two day selloff. The market is starting to get jitters about a potential change in monetary policy after minutes from the Federal Reserve's July meeting indicated that asset tapering could begin this year instead of next. The minutes were also supportive of an already-stronger-on-the-week U.S. dollar index, which reached a nine-month high today. Initial jobless claims fell to 348,000 last week, a new pandemic low and better than economists predicted.

-

Energy markets are selling off today with WTI crude oil trading below $63/bbl at one point, the lowest price since May. Yesterday's EIA report surprised analysts by reporting a build of gasoline inventories. This could be a sign of weakening demand caused by the end of the summer driving season and a resurgance of coronavirus cases in parts of the country. The EIA report also showed larger than expected draws in crude oil and distillate.

|

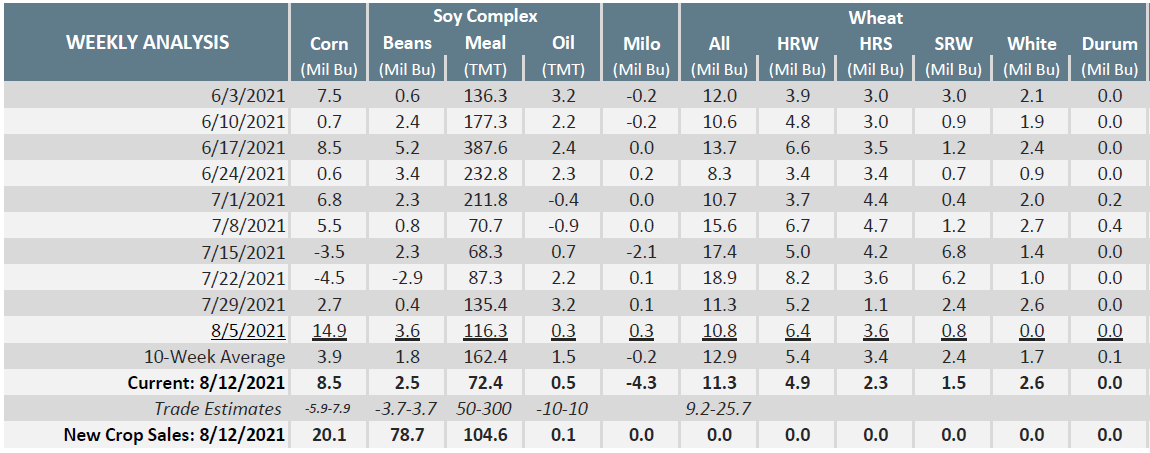

Export Sales Report |

|

|

Weather

More of the same for this area, with NOAA predicting above average temperatures and average chances for precipitation in the 6-10 day forecast. Highs in the upper 90s and even breaking 100 through the weekend and to start the week, cooling off to the upper 80s mid-week. There are some slight chances for rain over the weekend and next week. No big changes in the drought monitor week-on-week.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

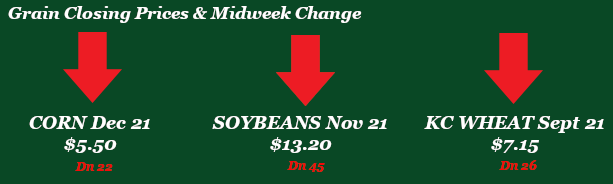

Corn

Corn doesn’t look quite as shiny as it did a week ago, losing over 22 cents on the week. Pro Farmer tour being conducted this week has many raising eyebrows at what yield will be reflected, as many states estimated yield numbers are coming in above the USDA’s yield estimate. For the past 8 years the Pro Farmer tour has estimated yields under USDA projections. Friday’s CFTC report had corn funds adding 12,406 contracts to the long position. Monday’s export inspections had no good news for corn, coming in at 29.7 million bushels. Crop conditions for corn declined to 62% good to excellent this week while the market expected no change to conditions. Wednesday’s ethanol report showed declining stocks for the sixth straight week, coming in at 973k barrels per day. Export sales this morning came in at 8.5 million bushels, which was slightly above market expectations for corn. New crop corn sales came in at 20.1 million bushels. Locally basis is steady for corn.

Wheat

Wheat has been a bummer this week after receiving some go-go juice at the end of last week from the August WASDE report. World wheat markets have influence and dragged U.S. lower for the week. With fall harvest approaching and limited news in the wheat complex, wheat could be a follower for the next few weeks. Export inspections were in line with projections totaling 16.2 million bushels. Export sale weren’t very impressive totaling 11.3 million bushels sold well at the bottom end of guesses. Funds showed KC wheat as net buyers for last week. Adding 3,778 contracts to the current long position of 35,933 contracts. Crop progress pegged spring wheat harvest at 58% complete jumping 20% from last week. Spring wheat crop condition increase a percentage point to 11% good to excellent, nothing earth shattering there. Look for wheat to follow corn for now unless we get some news to spur the bulls back into action.

Soybeans

The ProFarmer crop tour has been taking place this week and will be wrapping up today. Good yield potential in Illinois and Western Iowa were found yesterday which is dragging the bean market down today, but projected rains in those areas need to be realized over the next handful of days. Overall, the crop tour has reported below average bean yields and pointing to a tight balance sheet. Rain projections look strong over the next 7 days and extends south into Kansas as well. Export inspections were inline with projections totaling 16.2 million bushels. Export inspections for last week were at the top of trade estimates totaling 10.2 million bushels shipped. Export sales were also strong, showing 72.4 million bushels of old crop sold and 104.6 million bushels of new crop as well. 11 straight days of flash sales for beans, China has been a steady buyer, nothing huge but consistent. The July NOPA Crush report was released this week. Crush showed 155.1 million bushels, down four million from the average trade estimate and a million below the most pessimistic trade estimate; that was down from 172.8 million bushels last July but still above 152.4 million bushels in June. Cumulative Sept-June crush stands at 1860 million bushels, now 14 million behind last year’s pace, with the USDA looking for only a 10 MBU entire-year crush decline. Soybean fund were buyers for last week as well. Adding 13,362 contract to the current long of 91,648 contracts.

Milo

Milo seeing pressure all around on basis and corn futures. Monday’s export inspections came in at 2.2 million bushels for milo versus the 10-week average of 2.5 million bushels. Crop conditions for milo came in at 60% good to excellent, declining from last week’s 63% good to excellent. This morning’s export sales held 4.3 million bushels in cancellations, and some are attributing that to a rise in ocean freight rates. Locally basis feels weak.

Trivia Answers

-

Mila Kunis. She was 14 when she auditioned for the role of Jackie Burkhart, and they wanted the cast to be 18 and older.

-

The earliest known record of milo is in northeast Africa, near the Egyptian-Sudanese border.