Weekly Market Update 8/26/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What was the first National Park established east of the Mississippi River?

-

What is the oldest National Park in the U.S.?

Answers at the bottom.

Market News

-

Last week grains ran lower on news the EPA would recommend lower biofuels mandates, using 2020 as a baseline. With this news market action was hard, but real results of mandates won’t be quick. These decisions usually take months if not years and the courts will typically have a say too.

-

The DOW is up over 400 points from last Friday and looking to finish the week strong. Currently sitting at 35,378.89 down 26.61 points on the day. The S&P 500 broke 4500 points on Wednesday (first time in the S&P history) and is just off the highs for the week sitting at 4,482.95 down 13.24 points today. The NASDAQ broke the 15,000 point mark this week for the first time in its history as well. Currently sitting at 15,007.7 down 34.16 points today.

-

Crude inventories fell to about 432.6 million barrels, their lowest since January 2020. Draws were shown in every PADD, with the exception of PADD 5, the West Coast. Refiners have ramped up production to 92.4% of operable capacity, holding relatively steady since June.

|

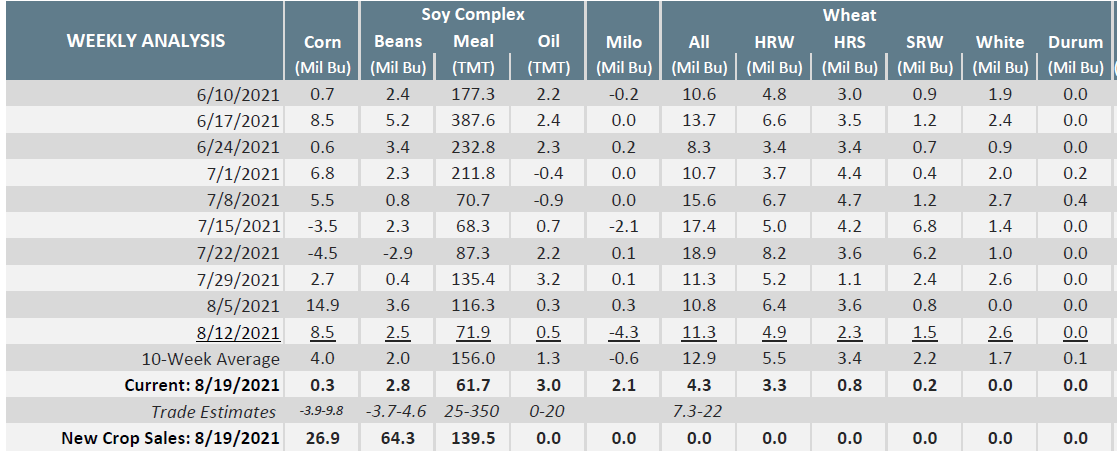

Export Sales Report |

|

|

Weather

Another week, another hot, dry forecast. NOAA predicts hotter-than-normal temperatures and normal chances of precipitation in their 6-10 day extended forecast. Highs remain mostly in the 90s for the next week, with Sunday holding the only real chance for rain. The drought monitor is relatively unchanged week-on-week. Dry pockets of Iowa, South Dakota, and Minnesota are forecasted to receive some much-needed moisture in the coming week, while the U.S. gulf coast looks to receive tropical storm rains as their harvest continues.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Despite a week of mixed trade, December corn still finds itself recovering some of last week’s losses, up over a dime on the week. Last Friday markets charged down as Reuters released a story indicating that the EPA was considering lowering biofuels blending mandates. That headline paired with a bearish ProFarmer Tour final number hammered the market at the end of last week. The tour’s estimated corn yield came in at 177 bpa (higher than the August USDA WASDE number at 174.6 bpa), putting total corn production at 15.116 billion bushels. Export inspections on Monday were smack dab in the middle of the range of estimates at 28.5 million bushels. Export sales this morning were reported at 0.3 million bushels of old crop and 26.9 million bushels of new crop, with old crop hindered by a large Chinese cancellation. However, there have been some flash sales reported to Mexico this week as concerns about the crop entice some demand. Crop conditions on Monday came in a point lower than expected, down 2% to 60% good-to-excellent. The market has found support with conditions lagging behind the five-year average of 65%. Rains are expected in parts of the belt in the coming week, but is it too little too late at this point in the growing season? Time will tell. Local basis remains flat as we inch closer to harvest. We have some elevators in drier areas that could see a few loads as early as next week.

Wheat

Wheat has been mixed this week but is trying to stage a come back to levels before the run-down last Friday. Markets are following the EU today with the issues over the pond still running the market higher. Export inspections for last week were stronger than the average trade guess coming in at 24.2 million bushels shipped. Export sales were very underwhelming at 4.3 million bushels sold, well below trade estimates. Spring harvest is chugging along at 77% complete, up 19% from last week. KC wheat adding 1,785 contracts to the current long of 46,548 contracts reported last Friday.

Soybeans

Soybeans have regained losses from last Friday’s reaction from the EPA news. You could call this week a correction from the market action to end last week. With rain in the forecast over the weekend for many growing areas in the north and east markets are taking a slight break today. The consecutive days of flash sales end at 11 or 12 straight days, but China is back in the bean market this morning with a flash sale of 133,000mt and another 132,150mt to unknown. Export inspections report was within range this week but nothing to shake a stick at report 7.9 million bushels shipped this week. Export sales for old crop were 2.8 million bushels sold with new crop having decent sales of 64.3 million bushels. Crop progress showed beans taking a step back by 1% this to 56% good to excellent, nothing of a surprise with slight decrease. Soybean funds were buyers this week too. Adding 5,531 contracts to the current long of 97,179 contracts.

Milo

Milo a little stronger on the week with this slight uptick in corn futures, while local basis is flat to weaker. Export inspections were solid this week at 5.1 million bushels, up from the previous week at 2.2 million. The big chunk of what was shipped is headed to China via the gulf. Export sales were reported at 2.1 million bushels for old crop and no new crop. Crop conditions this week were up 2% to 62% good-to-excellent, with the biggest increase seen in Oklahoma. Kansas conditions were unchanged at 62%.

Trivia Answers

-

Acadia National Park, est. 1916 located on Mt. Desert Island in Maine

-

Yellowstone National Park, est. 1872