Weekly Market Update 12/16/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What pop Christmas hit was released in 1984 but did not rank in the charts until 2017?

-

In A Christmas Story, what is the name of the department short that has the item in the window that Ralphie wants? Bonus: What is the item?

Answers at the bottom.

Market News

-

Damaging and fatal winds raced across the Midwest yesterday with some areas reporting in excess of 100 mph wind gusts. Kansas Highway Patrol stated this morning via their Twitter account that the state had 51 non-injury accidents, 20 injury accidents, and 2 fatal accident resulting in 3 fatalities. Visibility was mere feet as dirt from freshly plowed and newly planted fields swept across the state.

-

100,000 Russian troops have massed at the Ukraine border as a 7-year-long tensions over a political and trade deal seem as though they are coming to a head. Ukraine has warned that Russia is trying to invade, while Russia seems to deny the accusations, stating they can place troops wherever they’d like. The U.S. and NATO have described this move as “unusual.” Ukraine’s governments says Moscow cannot stop Kiev from having closer ties to NATO if they so choose.

-

Outside markets took a little dip today as the FED rally seemed to be more of a dud, though record highs are still being traded. The DJIA is down slightly at 35,895.15, the S & P 500 at 4,668.54, and the NASDAQ at 1,180.44. Crude oil saw a little bump late in the day, trading over $72.00.

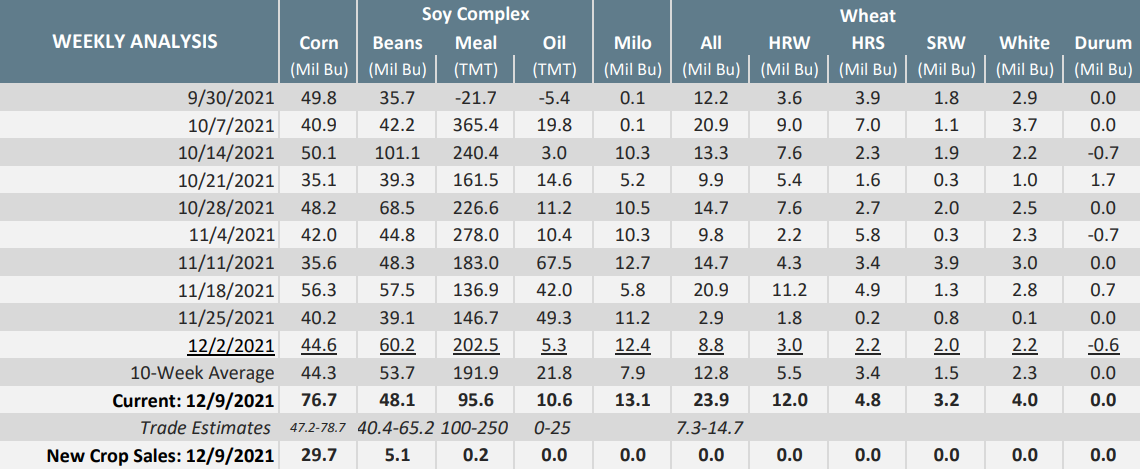

| Export Sales Report |

|

|

Weather

Dry, mostly sunny weather continues to dominate the forecast. Highs next week are expected to be mostly in the upper 40s and 50s, with nighttime lows in the 20s. Chances for rain remain hard to come by. Western Kansas was hit particularly hard by devastating winds yesterday, with some areas reporting gusts up to 100 mph. Our thoughts are with those affected by wind damages and fires.

|

|

Corn

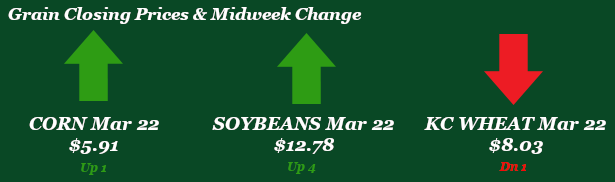

Over the past week corn has traded a roughly 15-cent range with markets mixed on thin trade as the holiday season is upon us. Charts do seem to hold some support though. Friday’s CFTC shows corn funds remaining long at 332,501 contracts, an increase from the previous week of about 17K contracts. Monday’s export Inspections came in with no enthusiasm at 31.9 million bushels versus the 31.8 mb 10-week average and last week’s 30.5 mb. Ethanol stocks showed a 419-thousand-barrel increase Wednesday as production took a slight dip to 1,087 thousand bpd. Thursday’s export sales looked much more promising with corn at 76.7 mb versus 44.6 mb last week and the 44.3 mb 10-week average. Market is mostly quiet though Brazil dryness has eyebrows raised with its effect on the Safrinah corn crop. Locally basis stays flat.

Wheat

Wheat is seeing recovery today after a massive fund selloff sent wheat cratering in yesterday’s session. March Kansas City wheat moved below the 50-day moving average yesterday, prompting liquidation. Export inspections were lower this week, with HRW reported at 3.2 million bushels. Inspections for all classes of wheat were steady at 9.0 million. Export sales were the highest of the last 10 weeks at 12.0 million, with a whole host of buyers including Peru, Mexico, and Japan. Lots of global factors have been at play this week, with Russia increasing their wheat export tax, while estimates of the Australian crop have been increased. Paris wheat markets remain volatile as tensions build between Russia and the Ukraine. Yesterday’s massive windstorm across already-dry parts of HRW country is sure to create worry about the U.S. crop, as the extended forecast remains unseasonably warm and incredibly dry headed into the holidays. Although the market has been volatile, there are still some attractive selling opportunities for new crop wheat that are worth considering.

Soybeans

It took beans three days to climb back above Monday’s massive selloff losses, but here we are. South American weather remains a focal point, with parts of Brazil and Argentina receiving rain while other parts remain dry. Forecasts are drier, with Paraguay being an area of concern although not a major producer. The next month is critical as the crop is in a full vegetative state, but regardless all signs are pointing to a monster South American crop. Chinese demand is quiet, not only for U.S. beans but for South American beans as well. Export inspections this week were reported at 63.3 million bushels, below the range of estimates and down from the previous week at 85.8 million. Export sales are reported at 48.1 million bushels of old crop and 5.1 bushels of new crop, lower week-on-week. November NOPA crush numbers were disappointing, with crush reported at 179.5 million. This is about 2 million lower than the trade was looking for, but still is the second best for the month of November ever.

Milo

Milo is just about as unenthusiastic as corn. Export inspections on Monday came in at 4.7 million bushels versus last week at 6.7 mb and the 10-week average of 3.8 mb. Thursday’s export sales looked much more appealing at numbers came in at 13.1 mb versus 12.4 mb last week and the 10-week average of 7.9 mb. Dryness in southwest Kansas, input costs on corn, and energy uncertainties could entice more producers to put milo under a pivot for the 2022 crop year as margin uncertainty looms. Locally basis stays flat.

Trivia Answers

-

"Last Christmas" by Wham!

-

The department store is Higbee's. The item that Raphie wants is a Daisy "Red Ryder" carbine action two-hundred shot range model air rifle.