Weekly Market Update 2/25/21

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

1. Which are the only two states in the U.S. that commercially grow coffee?

2. How many cups of coffee are consumed in the U.S. per year?

Answers at the bottom.

Market News

|

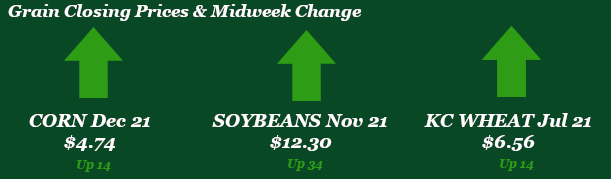

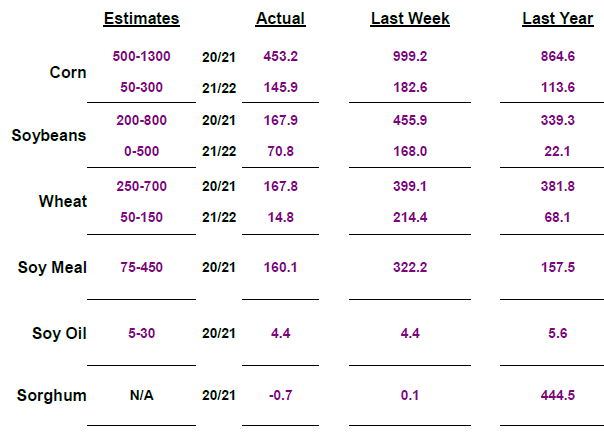

Export Sales Week Ending 2/18/2021 (in thousand tonnes) |

|

Weather

-

Stocks took a sharp turn today as a quick rise in treasury yields worried investors. DJIA was down 500+ points, coming down off all-time highs. NASDAQ was down 440+ points, and S & P was down 80+ points.

-

U.S. Dollar Index sitting lower at 90.14, flirting with the 90.00 support.

-

Front month WTI Crude Oil is sitting around 63.50, gaining over 21% in the past month. Saudi Arabia and Russia are headed for an OPEC+ meeting with opinions on whether to add crude supply to the market in April.

-

While energy prices skyrocketed last week under duress of the winter storm and sub-zero temps, many look for prices to gradually creep back lower in the coming weeks. Diesel prices look set to continue an upward trend as prices jumped 17 cents in just 2 weeks, the largest jump in recent history.

-

Cancellations in corn and bean sales to China and unknown paired with disappointing export sales weighed on grain markets today.

|

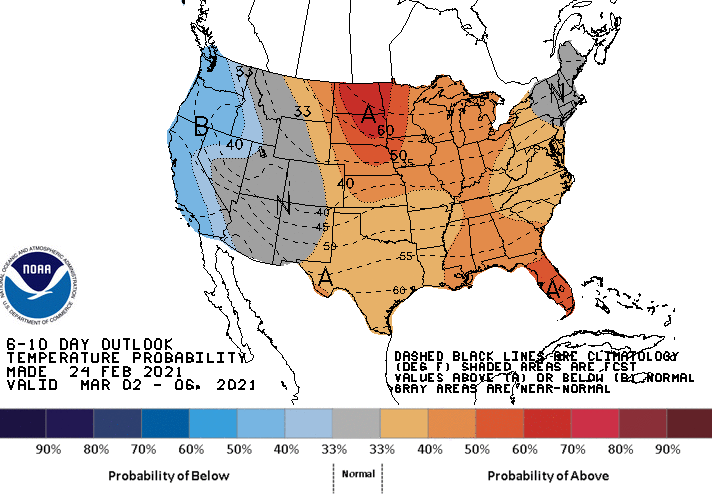

Temperature 6-10 Day |

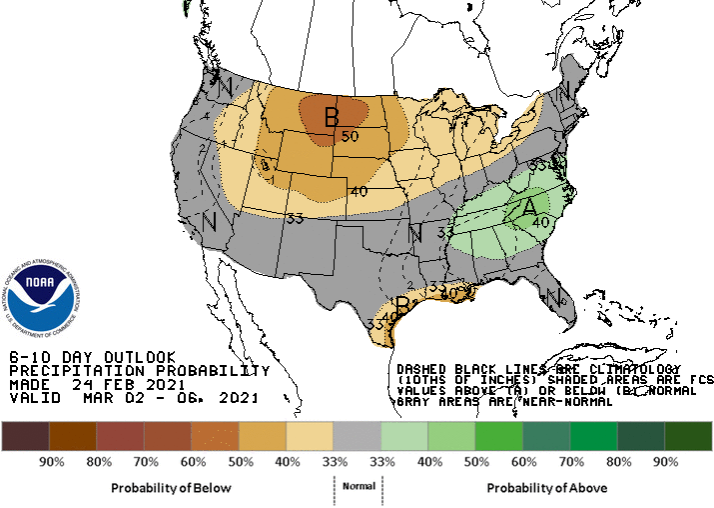

Precipitation 6-10 Day |

|---|---|

|

|

Corn

After grinding up most of the week, corn is sharply down today on disappointing export sales. Export sales came in this morning at 17.8 million bushels of old crop and 5.7 million of new crop – below the range of estimates. Notably, there were no new sales to China after their return from holiday last week. Inspections were okay at 48.5 million bushels, down slightly from last week’s 51.8 million. Wednesday’s EIA report indicated what most assumed – that last week’s cold snap caused ethanol plant closures. Production was down 252K barrels per day to 658K barrels per day. Compare this with the prior week at 911K per day and 1.054K in the same week last year. Last week’s Ag Outlook Forum pegged 2021 corn acres at 92.0 million, up from last year’s 90.8 million. Carryout was estimated at 1.552 bbu and cash price was estimated at $4.20. It will be interesting to see what adjustments, if any, come in the March WASDE. Traders will continue to watch South American weather, as rains have delayed corn and soybean harvest, as well as planting of the second crop. Brazil’s second corn crop safrinha is currently 23% planted, compared to 51% at this time last year. However, keep in mind that they are still forecasted to have a record 2020/2021 corn crop. Locally, basis has stayed steady to slightly higher. Cash opportunities in old crop and new crop are attractive.

Wheat

Wheat has been choppy and volatile to say the least this week. Crop progress and conditions were released Monday afternoon, Kansas saw a 3% decrease in good to excellent from January to February for a total of 40% good to excellent. Oklahoma saw the worst decrease of 13% good to excellent. Most of the change can be attributed to the cold snap and winter kill concerns. With the crop progress and conditions report along with weak export sales for the week ending in 2/18/21 this led to a very volatile wheat market for the week. Export sales came in at 1.5 million bushels this week, well below average trade estimates. Wheat is still long 57,133 contracts, but for the week saw a sell off 2,959 contracts. Even with the up and down week wheat is still up overall roughly 10 cents.

Soybeans

Beans have been a steady riser before today and the release of disappointing export sales. Weather was a strong factor in the poor export sales this week with ports slowing and/or closing, and truck freight halted to a standstill due to snow & freezing conditions. We also saw 345k tonnes cancelled. Export sales this week totaled 8.8 million bushels, this was below the trade estimate. Even with the poor week in exports cumulative sales are still running 18% ahead of USDA estimates. The CFTC report shows funds long 161,410 contracts, pulling back 10,360 contracts this week. South America is still behind on harvest and markets have been and will continue watching this and weather closely. Demand remains strong for beans and with stocks remaining tight expect the nearby months to stay strong.

Milo

Cash prices remain strong as nearby basis remains steady, new crop basis ticks higher, and the board continues to creep up. There is chatter in this area that nearby basis could start to feel pressure as elevators look to get out of their milo programs ahead of wheat harvest. There were no new milo export sales this week. Inspections were 4.9 million bushels versus last week at 2.8 million. For what it’s worth, export sales are currently 19% ahead of the pace needed to hit the USDA export estimate, while shipments are 1% ahead of the pace needed.

Trivia Answers

1. Hawaii and California. Puerto Rico, a U.S. territory, also has a thriving coffee industry.

2. Approximately 146 billion cups