Weekly Market Update 3/18/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What team has won the most National Titles in the history of the NCAA Tournament?

-

What are the odds of filling out a perfect NCAA Tournament Bracket?

Answers at the bottom.

Market News

-

Happy Spring! This Saturday marks the first official day of Spring and it looks like we will get warm temperatures to match.

-

Bulls haven’t been able to keep control of the energy markets as U.S. crude and fuel inventories grew this week and COVID-19 continues to cloud the prospects for demand recovery. WTI crude oil down, trading around $61. Brent crude also coming off last week’s highs, around $65 today. Texas Attorney General Ken Paxton released a statement late yesterday that Texas and several other U.S. states have sued the Biden administration over his decision to revoke a key permit for the Keystone XL pipeline.

-

US Dollar recovering today after falling from yesterday’s Fed meeting, in which they improved economic forecasts but indicated that they don’t expect to hike interest rates through 2023. Dow and S&P 500 closed at new records yesterday, with the Dow trading above 33,000 for the first time ever.

-

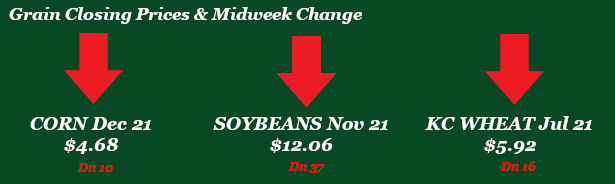

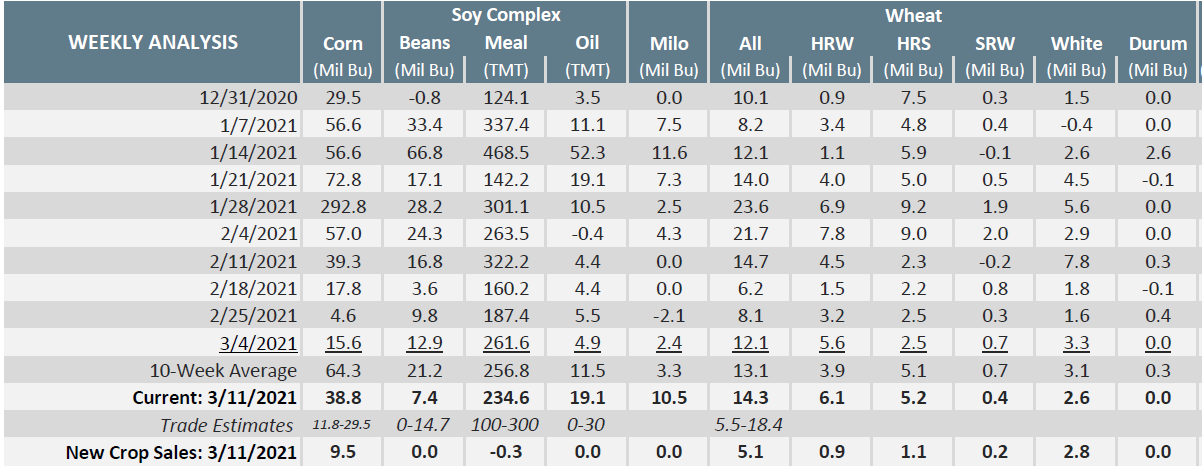

Another solid Export Sales report this week, old crop corn at 38.8 million bushels, beans at 7.4 million, milo at 10.5 million and wheat at 14.3 million. Also a dab of new crop corn and wheat sold. Graphic below shows how this stacks up compared with previous weeks and trade estimates.

|

Export Sales Report |

|

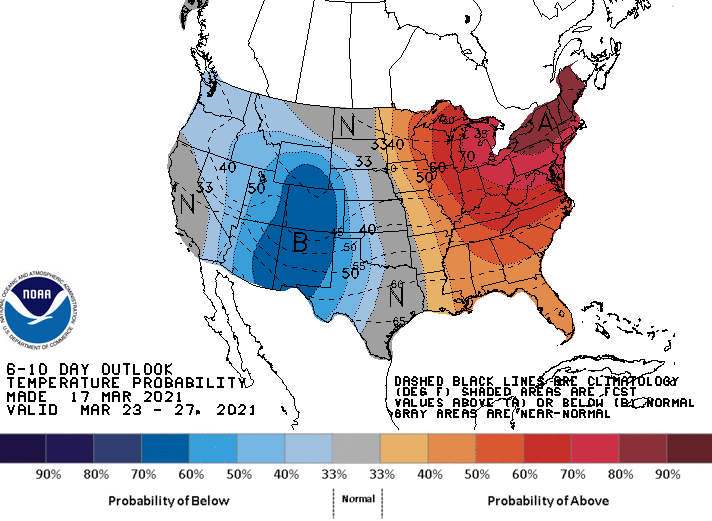

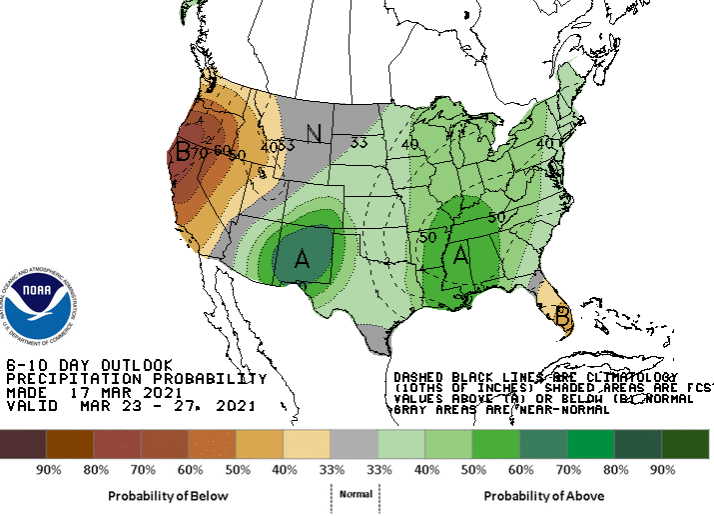

Weather

Last weekend’s showers provided our draw area with a much-needed drink. Rain reports ranged from 1.5” in the south to over 3” in parts of our northern territory. Temperatures are forecasted to warm up to the 60s this weekend, then slightly cool off early next week with chances for rain.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Over the past week nearby corn futures have managed to gain some strength while Dec corn isn’t so lucky. CK has managed to trade a roughly 27-cent range with upside while CZ has only seen a 12-cent range with some downside. Friday’s CFTC had corn funds long at 356K. Monday’s export inspections report held some large numbers, coming in at 86.6 million bushels versus last week at 65.9 million bushels and versus the 10-week average at 54.2 million bushels. China’s buying spree started Tuesday with 1.156 million tonnes and continued into Wednesday with 1.224 million tonnes and Thursday with .696 million tones. This week’s ethanol report held a drop in stocks and an increase in production with demand up and supply down. Production is still sitting about 10% below pre-covid levels. Is this a new norm? Export sales report this morning were above trade estimates at 38.8 million bushels versus last week at 15.6 million bushels and versus the 10-week average of 64.3 million bushels. Funds this morning were estimated long at 371K contracts. Locally, basis is steady.

Wheat

Wheat was buoyed to start the week by strong export inspections and flash sales of corn. This week’s inspections reported 25.1 million bushels shipped. Well above the average trade estimate. These were able to keep bears at bay to begin the week, but with the beneficial rains across the plains and Russia increasing their crop size (increased from 76.2 million mt to 79.3 million mt) have dragged the market back down. Export sales came in at 14.3 million bushels for old crop and 5.1 million bushels of new crop. This was right in line with what trade estimates pegged for wheat. CFTC report showed funds sold off just over 4,000 contracts for the week, but still hold a net long position of 47,664 contracts. Expect weakness in wheat into next week with more favorable weather predicted across the plains and little news for wheat to rally from.

Soybeans

Beans have been moving sideways this week. Export inspections showed 19.1 million bushels shipped and right in line with trade estimates. Same goes for export sales this week as well, 7.4 million bushels of soybeans sold this week. South America weather has improved with areas able to ship and cutting underway. This has put pressure on bean prices along with moisture in the U.S. Funds showed little movement this week, buying just over 4,000 contracts with an overall long position of 159,601 contracts. February crush numbers came in weaker than expected at 155.2 million bushels, more than 13 million below the average trade guess. Crush numbers were slowed by the cold snap that shut off power to some and had others selling natural gas for profit. Without any big news or big sales beans should be steady as she goes. Patiently waiting for the acres and production report at the end of the month.

Milo

Milo export inspections looked good this week at 9.2 million bushels versus 7.5 million bushels last week and versus the 6.2 million bushel 10-week average. Export sales also looked good this week for milo. Sales came in at 10.5 million bushels versus last week at 2.4 million bushels and the 10-week average of 3.3 million bushels. Old crop milo basis looks to weaken while new crop milo basis is seeing some strength.

Trivia Answers

-

UCLA with 11 titles, followed by Kentucky (8) and North Carolina (6).

-

According to NCAA, the odds of a perfect bracket are 1 in 9,223,372,036,854,775,808 if you just guess or flip a coin. That's 1 in 9.2 quintillion.