Weekly Market Update 10/28/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Which U.S. state is the largest producer of pumpkins?

-

On this day in history, construction on the St. Louis Gateway Arch was completed - what year was that? Bonus: How tall is the arch?

Answers at the bottom.

Market News

-

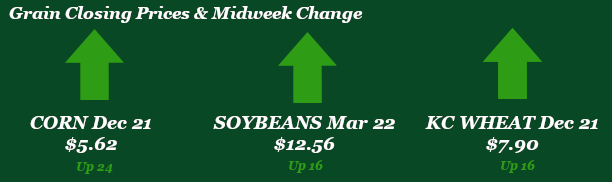

Wild week of double-digit gains in commodities, largely driven by technical trading, fund buying, and harvest delays due to rains in the Midwest. December 2021 corn is posting its highest levels since August, while Kansas City wheat sticks out as a shining star reaching multi-year highs. December 2022 corn futures are trading new contract highs, as many analysts suspect the battle for acres between corn and soybeans has already begun. Volatile, high-priced markets can be challenging to navigate. Reach out to a grain team member if you need help honing your marketing strategy.

-

Stocks higher today, with the S&P 500 adding nearly 1% and Nasdaq jumping 1.4%. Both of these indexes closed at record highs. DJIA rose 239 points today, closing just under its own record. Nearly half of S&P 500 companies have reported their third-quarter earnings, with a large majority delivering better-than-expected results. The climb in stocks comes despite a disappointing economic report today - GDP growth was pegged at 2.0%, below the 2.8% expected. Weekly initial jobless claims came in at 281,000, below the average trade guess.

-

Energy markets are mixed today after losses yesterday. The larger-than-expected build on crude stocks support the move lower, while outbreaks of coronavirus in China, Russia, and western Europe also weigh on the market. The Department of Energy reported a 4.3 million barrel rise in crude stocks last week, more than double the 1.9 million barrel gain forecasted by analysts. The hefty stocks build is attributed to a large jump in net imports of crude oil, while refinery processing remains slow.

|

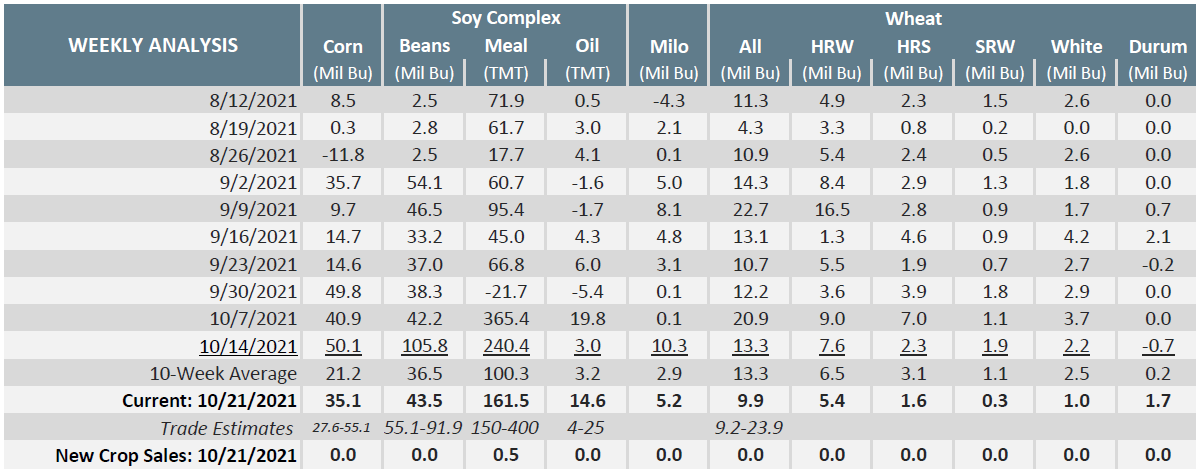

Export Sales Report |

|

|

Weather

Weather the last few days hasn't been ideal, with high winds and foggy mornings not doing much in the way of helping fall harvest progress. Cooler temperatures dominate the forecast for the foreseeable future, with daytime highs cooling down to the 50s over the weekend, with freezing nighttime temperatures forecasted in the early part of next week. Tuesday and Wednesday currently show chances for precipitation across our draw area.

|

|

Corn

Technicals are the driving force in corn this week as the news front is fairly quiet. With inflation expected to increase, seems grain buying is where the money is at. Over the past week December corn futures have gained almost a quarter. Friday’s CFTC showed corn funds still sitting long at 219K contracts. Monday’s export inspections pegged corn at 21.5 million bushels versus 41.3 million bushels last week and the 10-week average of 25.8 million bushels. Crop progress this week showed corn harvest 66% complete with Kansas at 84% complete. Ethanol production held a nice little jump on Wednesday at 1,106 tbpd. Thursday’s export sales pegged corn at 35.1 million bushels vs 50.1 million bushels last week and the 10-week average of 21.2 million bushels. Locally basis is steady.

Wheat

You better put your seatbelt on because wheat has been jacked up on Mountain Dew and is going to the moon. The past couple of days have seen overnights in the red, but once that sun is shining wheat is bright eyed and bushytailed ready to jump to green. Fund buying has been part of the reason and overall bullish outlook with the stocks situation. Wheat has also piggy bagged off of corn yesterday with the strong ethanol numbers to get a boost. Export inspections this week were a snoozer and came in below trade expectations at 5.2 million bushels shipped. Export sales were more of the same at 9.9 million bushels sold, towards the lower end of estimates. Last Friday’s CFTC report showed KC Wheat as overall sellers decreasing the long by 896 contracts to 47,390 contracts. Crop progress reported winter wheat at 80% planted up from last week’s 70%, but still behind last year’s pace of 84%. Kansas reported 84% planted jumping 9% from last week and ahead of the 5-year pace of 80% done. Wheat is looking to finish the week and month strong and in the green. This should happen with the bears in hibernation.

Soybeans

Harvest is still chugging along and soybeans have been quiet on the news cycle this week. Beans have stayed in the green, but this is more of a product of playing follow the leader with wheat and corn. Export inspections from Monday showed 77.3 million bushels shipped which were “OK”, but still lagging behind what was wanted to catch up after Hurricane Ida. Export sales were weak and below trade expectations at 43.5 million bushels sold. Beans were sellers from last Friday’s CFTC report. The long was decreased by 10,903 contracts to 18,165 contacts overall. Harvest is pegged at 73% complete in the U.S. still behind last year’s pace of 82% complete, but ahead of the 5-year average of 70%. Kansas is 57% complete behind last year’s 76% completed at this time, but still ahead of the 5-year average of 54%. Out of all of the commodities soybeans seem to be the most bearish, with increased stocks and acres expected and South America bean crop looking good so far.

Milo

Export inspections on milo this week came in at 3.2 million bushels versus 1.5 million bushels last week and the 10-week average of 2.4 million bushels. Monday’s crop report pegged sorghum harvest at 71% complete with Kansas at 61% complete. Thursday’s export sales report has milo at 5.2 million bushels versus 10.3 million bushels last week and the 10-week average of 2.9 million bushels. Not too much on the news front for milo either. Locally basis is flat.

Trivia Answers

-

Illinois. They harvest more than twice as many pumpkin acres as any of the other top states, at 15,900 acres.

-

1965. It is 630 feet tall.