Weekly Market Update 4/21/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What crop was grown in the early 1900's in southwest Kansas that started as an experiment and eventually became successful enough to develop the land in the area for growth of the industry?

-

What is the name of the Kansas restaurant started by Daniel Boone's great-grandson, which is still in business today, 165 years later?

Answers at the bottom.

Market News

-

Since the 1960's weekly unemployment claims are holding near their lowest levels for the 9th consecutive week. Jobless claims for the week ending April 16th were 184,000, while continuing claims for the week ending April 9th were at 1.417 million. As of last week, the 4-week moving average for new jobless claims was at 177,250. Pre-pandemic claims were averaging about 218,000 per week. Last month's claims reached the lowest level since 1968 at 166,000. Amid a pandemic, inflation, and an unpresidented couple of years, the labor market is a bright spot in a struggling economy.

-

Stock market took a dip today as steady corporate earning results were seen in spite of elevated inflation levels and further tightening from the Fed. Deepak Puri, Deutche Bank's wealth management officer told Yahoo! Finanace, "The big question is whether the earnings can really sustain this kind of marco backdrop of slower growth and [tighter] Fed policy...It seems certain companies can - historically that's been the case. What's different this time is really the trifecta, which is higher costs of capital, quantitative tightening, plus a lack of...a big fiscal stimulus." 2017 and 2018 held a similar market when the Fed last raised rates, but reduction in corporate tax rates helped cushion some of the burden. This afternoon the S&P 500 is down 50 points, DOW is down 236 points, and the NASDAQ is down 239 points.

-

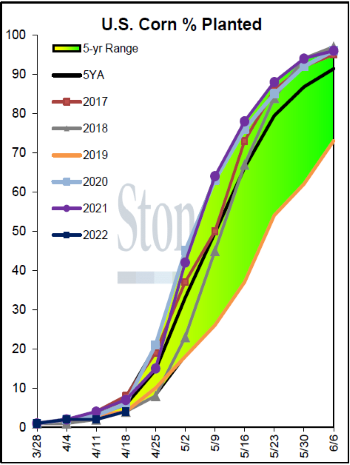

Corn planting across the U.S. is off-pace as mixed, unfavorable conditions such as cold temps, moisture dumps, and drought keep farmers out of the field. Corn planting progress came in at 4%, up a mere 2% from last week, below last year's 7% and the average of 6%. In spite of drought, Kansas was the second most progressive state behind North Carolina, gaining 7% WoW to 12% complete. This is versus last year's progress of 14% and the average of 11%. Missouri, Iowa, Illinois, Indiana, Ohio, Kentucky and Tennessee are all well off-pace YoY and compared to their by-state average.

| % of US Corn Planted |

|

|

Weather

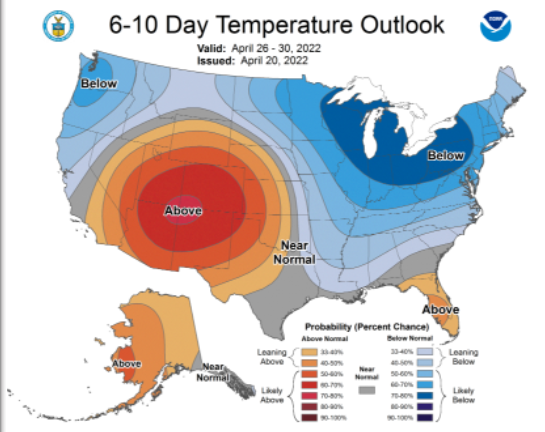

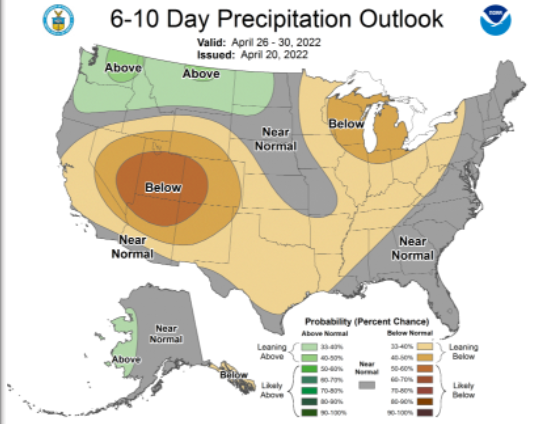

Southwest Kansas weather looks to stay warm and dry for the next 10 days as temps look to be above normal, and precipitation looks to fail meeting the needs of the wheat crop. Tempuratures look to step off into the weekend with highs in the 60s and 70s and lows in the 30s, but will quickly change into next week with highs in the 80s and 90s and lows in the 40s and 50s. There is a high wind watch in effect starting at noon on Friday and continuing into Saturday.

|

|

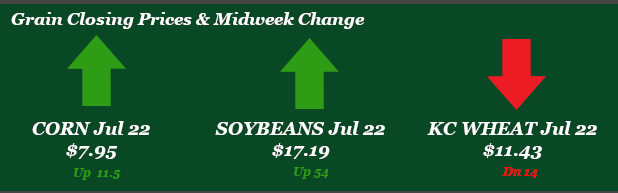

Corn

No real ground has been gained this week for the corn market; whatever we gain one day we give back the next. Bulls need headlines and news to feed off of and there has been a lack of news this week. EIA data stated that production was down again last week, and this is the lowest production since September of ’21, not a bullish story. Export inspections were a non-starter earlier this week with 44.8 million bushels shipped, trending towards the low end of trade estimates. Export sales were not any better at 34.6 million bushels of old crop and 15.3 million bushels of new crop sold. Old crop bushels were below average trade guesses. The CFTC report was delayed until Monday due to Good Friday. The report showed corn adding 7,646 contracts to the long position of 369,952 contracts. Managed money has been pouring money into commodities over the past 18 months and this is one reason we see that inflated long position, but this has also fueled the rally in corn and given the potential for $8.00 December corn futures. Crop progress report showed corn at 4% planting completed for the U.S. below the 5-year average of 6%. Kansas got bumped up to 12% just ahead of the 5-year average of 11%. Corn planting in the U.S. as a whole has been slowed by unseasonal cool weather and moisture in the corn belt and northern plains. This is fine for April, but if this continues into May, we may have a real problem on our hands.

Wheat

Weakness is the theme of today’s wheat market, plagued by poor export sales this morning in a lighter volume session. Export sales were disappointing today for HRW, with a net cancellation of 2.1 million bushels of old crop and net sales of 3.0 million for new crop. All wheat was reported with sales of only 1.0 million bushels of old crop and 8.8 million bushels of new. On the flip slide, export inspections were an improvement from last week at 6.1 million bushels of HRW shipped. U.S. export offers have remained overpriced in the global marketplace, limiting demand to importers looking for either quality or protein. Egypt’s GASC approved India as a wheat source earlier in the week, as the world market looks for ways to replace Ukraine’s crop. Managed money was a net buyer of wheat, adding 4,363 contracts to bring their net long up to 49,392 contracts. USDA lowered winter wheat conditions this week by 2%, coming in at 30% good-to-excellent – well below the 5-year average of 51%. Kansas conditions were lowered 1% to 33% good-to-excellent. U.S. wheat country remains mostly in some form of drought, with all of us in western Kansas desperately crossing our fingers that the chances of rain the next few days come to fruition.

Soybeans

Despite a move lower today, beans have grinded higher on the week. March NOPA crush numbers came in a hair short of the average trade estimate, but still set a new March record at 181.8 million bushels crushed. This pulls cumulative September-March crush four million bushels ahead of last year, but there’s still some work to do to hit USDA’s estimated +3.5% year-on-year crush before the end of August. Export sales this week were disappointing in the old crop slot at 16.9 million bushels, but the new crop slot was reported at a HUGE 45.6 million bushels sold. New crop bean sales continue at a record pace. Export inspections were also higher on the week at 35.7 million bushels, ahead of the 10-week average of 31.5 million. CFTC report indicated that the funds were net buyers of beans, adding 8,218 contracts to bring the net long up to 171,873 contracts. As expected, U.S. bean planting is below the average pace at just 1% planted. Conditions are less than ideal, as the Northern Plains are too wet, the Southern Plains are too dry, and cool, wet weather seems to be sticking around in much of the Corn Belt.

Milo

Export inspections for milo were decent at 12.5 million bushels shipped, ahead of the 10-week average of 9.1 million bushels. Export sales were a net negative due to cancellations. No flash sales were reported this week. Basis for milo remains firm and not gaining any traction. With no China in the market for milo there is no premium for basis.

Trivia Answers

-

Sugar Beets

-

In 1857 construction was completed on the Hays House in Council Grove, (owned by Seth Hays) and the Hays House soon became a favored spot for buying supplies and acquiring a decent meal.