Weekly Market Update 4/28/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What legendary gunslinger's cousin helped settle the town of Ulysses, Kansas in 1885?

-

Which two U.S. states have never recorded a temperature above 100 degrees Fahrenheit?

Answers at the bottom.

Market News

-

Volatility remains in the outside markets. The Dow Jones has had a trading range of over 900 points this week. Currently the Dow is up 13.93 points on the day at 33,315.86. The S&P 500 has seen a 126-point trading range this week, currently up 14.05 points on the day at 4,198.01. The NASDAQ has trending down after hitting highs earlier in the week. We have seen a 500 plus point trading range for the week. The NASDAQ is currently up 23.55 points on the day at 12,512.48.

-

We saw WTI crude dip below $100 earlier in the week reaching a low of $95.45 but is currently trying to push through highs for the week at $103.46 up $1.44 on the day. Crude will also continue to be very volatile based off of current policies in the U.S. and the Russia Ukraine war raging on.

-

In the social media world Tesla founder Elon Musk bought Twitter for an astounding 44 billion dollars. This sent the Twitter world into a frenzy. He is reportedly planning to take Twitter private as well.

-

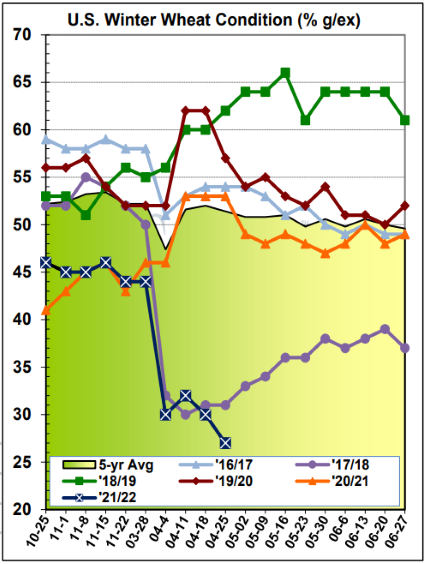

U.S. winter wheat ratings fell for the second week to 27% good to excellent as of 4/24. In the last 10 years, the three prior worst crops did not drop below the 30% mark for spring ratings. Kansas took a 7% drop in ratings this week to 26% good to excellent as drought conditions persist in most of the state. Oklahoma, Michigan, and Illinois were all down 5% on the week, Washington was down 4%, and Nebraska and South Dakota were both down 3%.

| Winter Wheat G/EX |

|

|

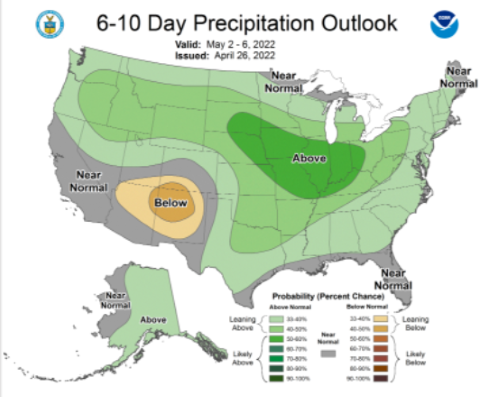

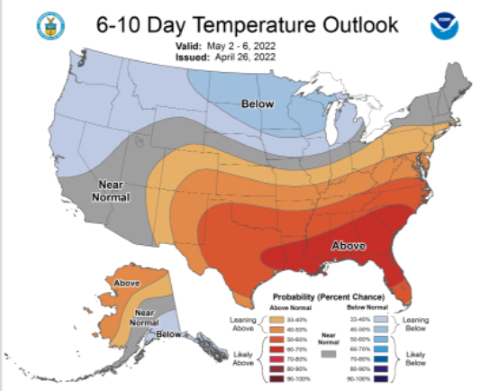

Weather

The 6-10 day forecast looks to carry higher-than-normal tempuratures with a better-than-normal chance of precipitation. Into the weekend temps look to cool some with highs in the 70s and lows in the 40s. Look for tempuratures to warm back up at the beginning of next week as they sneak back up into the 80s for highs. Precipitation chances look to be anywhere from 25%-40% for next week.

|

|

Corn

Corn has been a steady riser this week but feels like it is limping to the finish line to end the week. Corn got a nice shot of adrenaline to start the week with the crop progress report showing planted corn at 7% complete below last year’s pace of 16% and the 5-year average of 15%. The south has made progress, but it’s the north that has been slowed by cool and wet weather. If there is one thing to hang our hat on though is not to bet against the U.S. farmer, we know gap can be closed in a hurry. Export inspections were pretty impressive at 65 million bushels shipped; this was above the highest trade estimates. Export sales were lackluster to say the least this week, 34.1 million bushels of old crop and 33.2 million bushels of new crop sold. If anyone is looking at these numbers for a bullish headline or momentum, they are looking at the new crop sales. Once again, we saw managed money adding to their historic long position, adding 9,158 contracts bringing the long to 379,110 contracts. Corn looks like it will trade both side of the market today, without much in storylines for bulls we could see a close in the red for the first time this week.

Wheat

Wheat seems content to trend at current levels, finding support from declining winter wheat conditions and delayed spring wheat planting. Cool, wet weather in the Northern Plains had spring wheat pegged at 13% planted. Meanwhile, winter wheat conditions remain poor – see the chart above for more information. Export inspections were below expectations this week at only 4.1 million bushels for HRW, trailing behind last week’s 6.6 million number. Export sales were pathetic with HRW reporting net cancellations of 0.1 million bushels of old crop and 0.4 bushels of new crop. Friday’s CFTC report indicated that managed money was a small buyer of HRW, adding 449 contracts to bring the net long up to 49,841 contracts. The conflict rages on in the Black Sea, with some officials in Russia even hinting at the use of nuclear weapons… scary, but time will tell. There are reports of Ukraine shipping corn and wheat to Poland to be able to hit their ports for export, but this is a challenging and slow way to get the grains to market. Parts of our draw area received precipitation over the weekend and last night, but everyone is still crossing their fingers for the wheat to get a substantial drink.

Soybeans

Beans are lower today and on the week. Cool, wet weather patterns across much of the Midwest has delayed planting, although it’s too early to get too concerned yet. USDA estimates the crop at 3% planted, below the 5% 5-year average. Export inspections this week were disappointing, barely hitting the low end of estimates at 22.1 million bushels. Export sales were also a non-starter at 17.7 million bushels of old crop and 21.3 million bushels of new crop. Managed money was a net buyer of beans according to Friday’s CFTC report, adding 7,850 contracts to bring the net long up to 179,723 contracts. Notably, beans are also finding support from a tighter global balance sheet for oils, as Canadian canola acres are lowered while Indonesia bans palm oil exports.

Milo

Cash prices are grinding higher this week on strength in corn futures, while basis remains largely flat. New crop cash prices are attractive and are worth some consideration. Export inspections were lower this week at 6.6 million bushels, down from last week’s 12.7 million and well below the 10-week average of 9.8 million. Export sales were nothing to write home about, with only 0.5 million bushels sold in the old crop slot and no new crop sales. USDA estimates that the milo crop is 19% planted, slightly below the 21% 5-year average. The Texas crop is pegged at 19% planted.

Trivia Answers

-

Wyatt Earp. His cousin, George Washington Earp, helped to settle the 137 year-old town.

-

Alaska and Hawaii