Weekly Market Update 8/25/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

How many degrees does the earth rotate each hour?

-

Which U.S. state is the only state to grow its own coffee beans?

Answers at the bottom.

Market News

-

A busy week for economic news and reports, with tomorrow being the climax at the Jackson Hole Economic Policy Symposium, hosted by the Kansas City Fed. The meeting, including dozens of central bankers, policymakers, academics and economists, will include a speech from Chairman Powell on the direction of monetary policy. Markets may be in for a rude awakening from a Fed still on a war path to bring down inflation with as many rate hikes as needed, even if that means hurting growth and increasing the unemployment rate.

-

Russia is reported to be offering steep discounts on long-term deals in an effort to secure future oil sales in Asia for the production that will no longer be allowed to be imported into the European Union as of the end of this year. India imported more of their oil this summer from Saudi Arabia as their imports from Russia, in July in particular, fell for the first time since March. Reports show a decline of about 7.3% in Russian imports to India as their imports from Saudi Arabia rose by 25% to 824,700 bpd in July.

-

This week has been the highly anticipated and followed ProFarmer Tour, which will wrap up this afternoon. More information is available in the chart and commodity sections below, but the tour has certainly been supportive the markets so far.

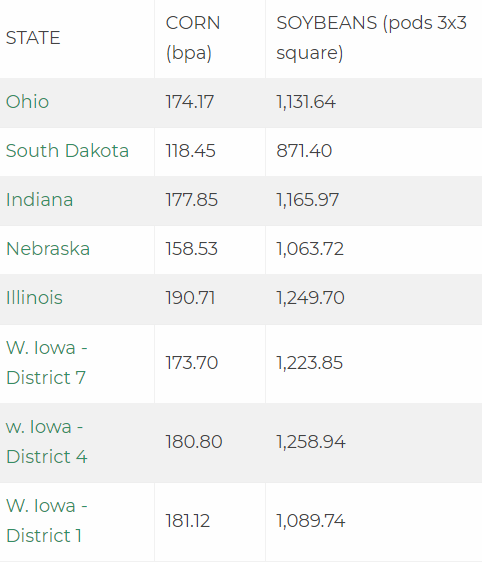

| ProFarmer Results |

|

|

Weather

The forecast in the coming days holds a nice change - a decent shot at moisture over the weekend for the majority of our draw area. Additional chances are hanging out in the forecast at the beginning of next week. Let's hope that these rains are priming the pump for more to come. Daytime highs look to remain consistent in the mid-90's and upper 80's, with nighttime lows around 60.

|

|

Corn

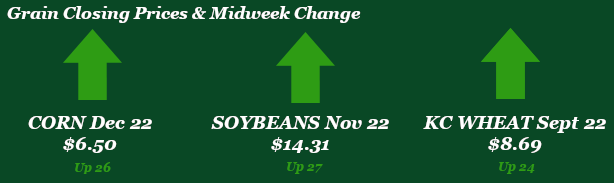

Corn closed up on the week, but down on the day today. Corn is seeing support on Monday’s crop ratings as conditions continue to decline, but wheat and beans seem to be tugging on corn futures today. Corn futures closed up almost 27 cents on the week, but down for the day at 7 cents lower. Friday’s CFTC showed managed money adding 11,778 longs on the week to total 153,840 contracts. Export inspections this week were uneventful at 29.2 million bushels, up from last week’s 21.2 million bushels, but still shy of the 10-week average of 36.7 million bushels. Monday afternoon held news of declining conditions for corn with the U.S. aggregate showing conditions at 55%, down 2% week over week and well below the 62% good to excellent average. Corn conditions for Kansas took a hit, down 3% to 26% good to excellent and well below the 54% good to excellent last year. Ethanol stocks, production, and supply were all up on the week with a decrease in demand. The Pro Farmer Crop Tour kicked off this week in Ohio and South Dakota with yields in South Dakota coming in at 118.45 bpa. Ohio hit 174.17, Indiana hit 177.85 bpa, Illinois hit 190.71 bpa, and Nebraska in at 158.53 bpa. Iowa District 7 came in at 173.70 bpa, District 4 at 180.8 bpa, and District 1 at 181.12 bpa. The crop tour yield has come in at an average of 6.3 bushels above USDA’s final national average corn yield since 2001 according to Brian Grete, Pro Farmer newsletter editor. Locally, basis is strong as corn conditions and available supply hang in the balance.

Wheat

KC wheat was a steady riser to start the week but has been taking a step back so far today. Wheat was a follower of corn getting support from the ProFarmer tour, crop conditions taking another hit, and Paris wheat having momentum to start the week. Export inspections were so-so for wheat with 21.8 million bushels shipped. White wheat was the leading variety and Japan was the number one destination. Currently wheat is behind on USDA’s seasonal pace but there is plenty of time in the market year to catch up. Export sales has been delayed today. Managed money sold off 503 contracts lowering the current long to 7,520 contracts. Wheat is on the back burner today with the ProFarmer tour looking to finish up. Paris wheat closed lower with cash values out of the Black Sea showed cheaper offers. It is telling that China is looking elsewhere than the Black Sea region for wheat. Even with shipments coming out of there some remain skeptical of the follow through from the region.

Soybeans

Beans started off the week with a bang following corn’s lead from the ProFarmer tour. Corn has not looked good in areas and some soybean areas haven’t been the greatest but there is still hope with some timely moisture within the next 10 days would go a long way of keeping this crop sizeable. The tour wraps up today and should be in the “honey hole” for soybeans with strong yield numbers. We are seeing a pull back today with better numbers coming out of the tour and favorable chances for rain over the next 7 days. Export inspections were fine for beans with 25.2 million bushels shipped. China was again the number one destination. Export sales number have been delayed due to USDA website issues. The CFTC report had managed money as sellers of 2,173 bringing the long to 99,336. Something to keep in mind Brazil’s Conab reported yesterday they estimated the country’s 22/23 soybean crop at a record 150.4 million tonnes, well above last year’s 126mmt and the USDA’s projection of 149mmt. Now we have a ways to go before that crop is realized but again something to keep an eye on.

Milo

Milo seeing a jump this week not only on corn futures, but on local basis as well. Basis popped earlier in the week as the crop looks less than desirable and everyone wants their fair share. Monday’s crop conditions also showed a 2% decline to 25% good to excellent across the U.S. Kansas conditions took a 1% hit, falling in at 26% good to excellent. Export inspections on Monday showed 1.7 million bushels versus last week’s 2.4 and the 10-week average of 4.1 million bushels.

Trivia Answers

-

Fifteen degrees

-

Hawaii