Weekly Market Update 12/29/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

How large is the Times Square New Year's Eve Ball in diameter?

-

What do people in the Southern United States eat for good luck on New Year's?

Answers at the bottom.

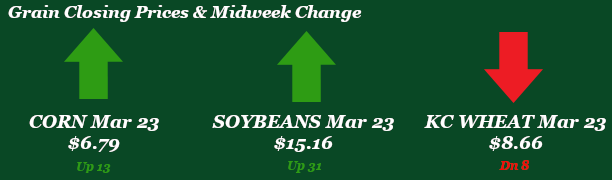

Market News

-

Happy New Year's from Garden City Co-op - we wish you and your families a healthy, prosperous 2023! The commodity markets and GCC locations will be closed on Monday, January 2nd in observance of the holiday. Markets have been choppy in this short holiday week, with a lack of any real market-moving headlines.

-

Export sales report for this week is delayed until tomorrow with the Monday holiday. Inspections showed corn at 33.7 million bushels, up from last week's 32.6 million. Beans were lower than last week at 64.4 million bushels. Milo higher on the week at 1.7 million bushels. All wheat was reported at 10.3 million bushels, down from last week at 11.2 million. Corn and milo both have some legwork to catch back up and hit the USDA's current estimate.

-

After China made a series of moves in recent weeks to ease COVID restrictions on testing and lockdowns, positivity was shown by the market that a reopening was underway. Yet, the reality is that a large-scale outbreak appears to be happening and is creating serious doubts about official data coming out of the country. A leaked report from top Chinese health officials indicated that as many as almost 250 million people in China had Covid-19 in the first 20 days of December. If correct, the estimate – which has not been officially confirmed – would account for roughly 18% of China’s 1.4 billion people and represent the largest Covid-19 outbreak to date globally. Some countries, including the US, are even enacting new travel rules on Chinese visitors. Overall enthusiasm about demand appears to be fizzling.

-

Stock markets are higher today headed into the final trading days of 2022. Dow is up 383 points (1.1%), S&P is up 1.9%, and the Nasdaq climbed 2.6%. This movement follows a broad selloff in yesterday's session as recession fears continue to weigh on investors in a losing month and year. The major averages are headed toward their worst year since 2008. The Dow has lost 8.8%, while the S&P 500 shed 19.7%. Meanwhile, the Nasdaq is the dog of the three, down 33.6% as investors dumped growth stocks.

Weather

Warmer than average temperatures and above average chances for precipitation - a nice combination after last week's frigidness. Temperatures are forecasted to hang out in the 40s or warmer for most of this week and next, with a nice chance for moisture next Monday.

|

|

|

Trivia Answers

-

12 feet

-

Black-eyed peas