Weekly Market Update 2/10/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What teams have not appeared in a single Super Bowl?

-

What famous jeweler makes the Vince Lombardi Trophy?

Answers at the bottom.

Market News

-

Russia-Ukraine tension update: Russia and Belarus have started 10 days of joint, large-scale military exercises, as fears of a Russia invasion remain. Belarus has a long border with Ukraine and they are a close Russian ally. France called the move a "violent gesture" while it is belived that this is Russia's biggest deployment since the Cold War. The U.S. and other western countries say that an attack by Russia could come at any time.

-

Stock market seems to be wavering as inflation rates rose significantly from 2021. S & P 500 down 67, DOW down 460, and Nasdaq down 217. WTI Crude saw some upside today but trading both sides of unchanged after lunch.

-

U.S. inflation has hit its highest level in 40 years as prices rose 7.5% from 2021. The rise in the Consumer Price Index survey was the largest it has been since February of 1982. CPI rose 0.6% from December 2021, but still down from October's monthly rise of 0.9%.

-

February WASDE seemed like a mixed bag as markets turned higher while the numbers could have easily pushed the market lower. Soybeans were really the shining star (which doesn't say much) as South American production continues to get cut, along with SA exports. Overnight markets were pulled higher mostly by beans, but late in the trading day markets saw a corrective downturn.

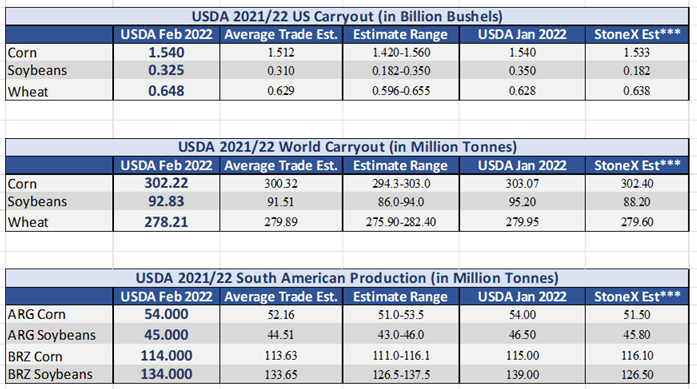

| FEBRUARY WASDE SNAPSHOT |

|

|

Weather

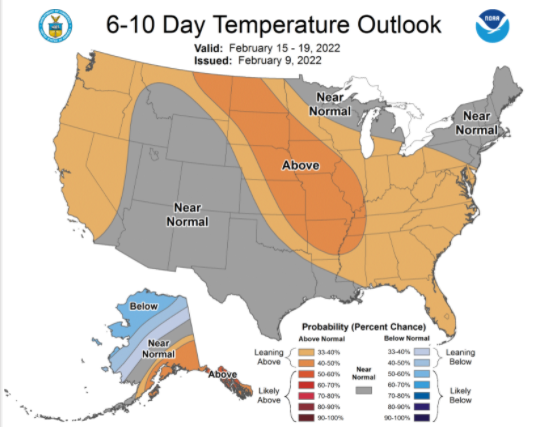

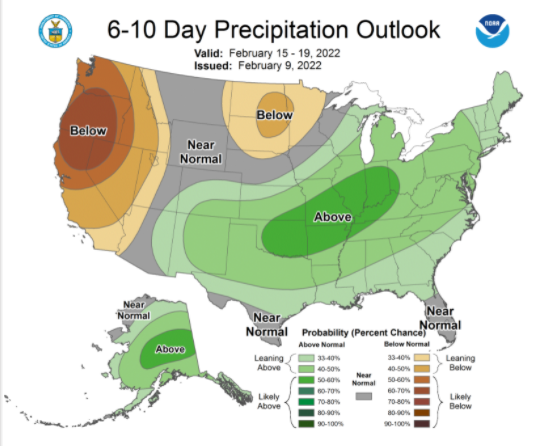

The 6 to 10 day forecast looks a little more hopeful as we appraoch mid-February. Temps for southwest Kansas look to be about normal, and there is potential for ABOVE normal precipitation on some thirsty wheat areas. Temps heading into the weekend and into next week look to have highs in the 50's and 60's with lows hitting anywhere from the high teens to low 30's.

|

|

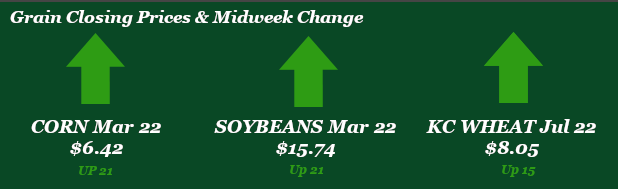

Corn

Yesterday’s WASDE report was easily the focal point of this week’s markets, but even that was mostly lackluster. Domestic balance sheets were unchanged, leaving U.S. corn carryout at 1.540 billion bushels – compared to the average trade guess of 1.512MMT. World carryout was lowered to 302.22MMT, down 850k MT, higher than the average trade guess of 300.32MMT. All eyes were on how much USDA would slash South American corn production, but the cuts were lower than expected with Argentina’s corn crop left unchanged at 54MMT while the Brazilian corn crop was cut 1MMT to 134MMT. Meanwhile, Brazil’s CONAB released their production numbers this morning, pegging their corn crop at 112MMT. This is likely why we are seeing good board action today, as well as the strength in beans. Export sales this morning were on the low end of trade estimates at 23.2 million bushels, down significantly from the previous week at 46.3 million. Export inspections were reported at 41.5 million bushels. This week’s EIA data showed a decline in ethanol production, to 994k barrels/day compared to last week’s 1,041k. CFTC report on Friday indicated that the funds were buyers of corn, purchasing 6,446 contracts to bring the net long up to 372,551 contracts.

Wheat

Wheat is experiencing a midday sell off. Not surprising we are seeing a very volatile day with a 30 plus cent trading range today. The week started with a rally spurred by StatsCan from Canada releasing a reduction in wheat stocks to 15.56mmt from 17.3mmt. Yesterday we saw the USDA release the February WASDE which reported U.S. carryout increasing by 20 million bushels with the majority of that coming from exports falling 15 million bushels. Even with the increased carryout soybeans and corn were able to keep wheat rallying. The sell of today started shortly after export sales were reported and were below expectations at 3.1 million bushels of old crop sold and 1.8 of new crop. Without any fresh news for bulls to feed on the market turned south in a hurry. Export inspections this week were solid at 15.3 million bushels shipped, towards the higher end of estimates. The CFTC report from Friday showed KC wheat as sellers of 2,835 contracts lowering the long to 37,799 contracts. The geopolitical landscape is still on shaky footing regarding Russia and Ukraine. Looks like a wait and see situation for now. With most of the snow melted off from last week forecasts are looking dry for the next week.

Soybeans

Soybeans have been the leader in the clubhouse this week. The WASDE showed lowered soybean stocks for South America, but not as extensive a reduction as traders were looking for. Once again, the USDA kicked the can down the road, and we will see how big a reduction is made for March’s WASDE report. This morning started off with a bang with Conab (similar to the USDA but for South America) cutting soybean production extensively to 125.4mmt. This rallied hard but we are seeing a hard sell off across all commodities. Export inspections were within trade guesses at 44.8 million bushels inspected to ship. Export sales were strong in beans reporting 58.7 million bushels of old crop sold above top trade estimates and 32.9 million bushels of new crop sold. This supports South America having production issues and China has been the number 1 buyer of soybeans because of this. Friday’s CFTC report showed beans as buyers of 39,593 contracts raising the current long position to 154,488 contracts. Traders will be keeping a close eye on production issues in South America and the export sales that could come the United States way.

Milo

Like always, milo is along for the ride as the corn market digests this month’s WASDE report. As for its own slice of the WASDE, U.S. milo balance sheets were unchanged with carryout remaining at 33 million bushels. Export sales were reported at net sales of 5.5 million bushels, up from the previous week at 3.2 million, but tailing behind the 10-week average of 9.7 million. Inspections were reported at 6.1 million bushels, up from the previous week at 5.0 million. Local basis is steady.

Trivia Answers

-

Cleveland Browns, Detroit Lions, Houston Texans, and Jacksonville Jaguars

-

Tiffany & Company