Weekly Market Update 2/17/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Who was the shortest serving U.S. president?

-

What is the oldest continuously held sporting event in the United States?

Answers at the bottom.

Market News

-

News about the ongoing conflict between Russia and the Ukraine changes by the day and remains a major driving force behind the markets. Russia claims that some of their forces have begun to withdraw from near Ukraine's borders and denies plans to invade, while the United States continues to warn that Russia could invade Ukraine "any day" amid escalating tenstons in the region. It's estimated that 150,000 Russian troops are massed near Ukraine's borders, and U.S. officials have urged all Americans to immediately leave Ukraine. For now, it seems like we wait for the other shoe to drop.

-

Stocks are pressured today by the Russia-Ukraine situation, as well as new insight on the Federal Reserve's plans to tighten monetary policy and higher-than-expected weekly unemployment data. Initial joblesss claims were reported this morning at 248,000 against an expected 218,000. However, even with the rise in filings from the previous week, jobless claims are still hovering near pre-pandemic levels.

-

Energy markets also under pressure today. Russia-Ukraine is also a major headline here, as well as reports that the Iran nuclear deal is in its final stages. The broad objective of the agreement is lifting sanctions against Iran, including ones that have slashed their oil sales, in exchange for restrictions on Iran's nuclear activities that extend the time it would need to produce enough enriched uranium for an atomic bomb.

|

|

Weather

This week's headline could be "weather whiplash" with 30-degree temperatures and snowfall today, highs in the 50s and 60s tomorrow and into the weekend, and then back down in the 20s early next week. Our area mostly falls in the very lowest below average temperature category in the 6-10 day forecast. This week's drought monitor continues to show drought conditions across Kansas, with parts of central Kansas being moved from moderate drought (D1) to severe drought (D2).

|

|

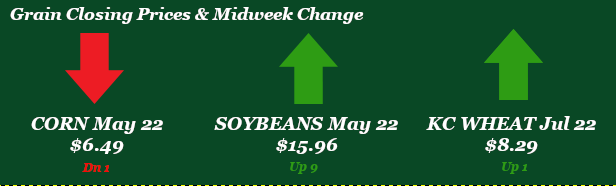

Corn

The Russia/Ukraine dance keeps humming along and making for another volatile week. Tuesday was a harsh down day on news of Russia partially pulling back forces from the Ukraine border, but the saber rattling has continued with neither side conceding any ground. Today corn is trying to finish in the green and is teetering around unchanged for the day so far. Export inspections for corn reported Monday were strong for corn at 57.3 million bushels inspected to ship, China was the number one destination with 16.3 million bushels. Followed by Mexico with 13.6 million bushels and Japan at 11.5 million bushels. Export sales were in line with estimates showing 32.3 million bushels sold, Japan being the top buyer. The CFTC report from last Friday pegged corn as sellers of 35,219 contracts lowering the long to 337,332 contracts. EIA data for the week ending 2/11/22 showed an increase in ethanol production from prior week’s 994k to 1009k barrels per day this week. It is estimated that 104 million bushels of corn was used for this week’s production, up from prior week’s 102.5 million bushels.

Wheat

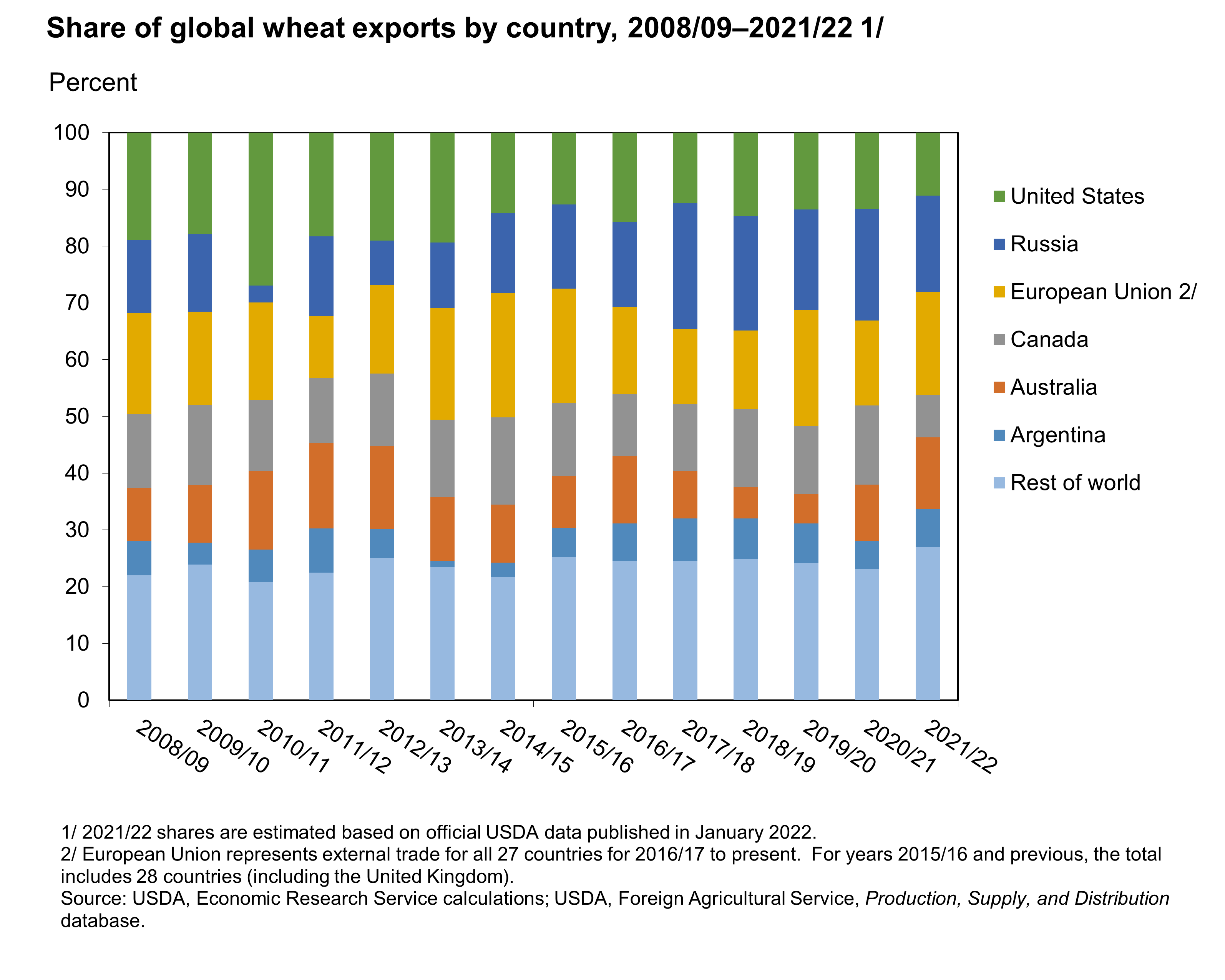

July Kansas City wheat saw a nice pop in futures early this week but settled back into its 8.00-8.30 trading range that it has seemed comfortable with. Friday’s CFTC report showed KC wheat managed money still holding a long at 34,473 contracts. Monday pegged export inspections for all wheat at 16 million bushels, not much change from last week. Hard red winter wheat came in at 6.5 million bushels versus 7.2 million bushels last week and the 5.0 million-bushel 10-week average. Export sales came in at 4.3 million bushels for all wheat versus 3.1 million bushels last week and the 10-week average of 11.1 million bushels. Hard red winter wheat came in at 2.6 million bushels, up from last week’s 1.6 million bushels, but off the 10-week average of 4.4 million bushels. Black Sea tensions continue to drive the market in wheat as Russian military operations continue despite Russia saying they have no plans to invade. The CME Black Sea wheat contract showed the lowest open interest since 2018, crediting Russia-Ukraine tensions and the export tax on wheat. SovCon upped the 2022 Russian wheat crop forecast to 84.8 million metric tonnes stating ideal weather and good fertilizer availability. Southwest Kansas dryland wheat is in need of moisture, even with recent precipitation. Locally basis feels flat.

Soybeans

Soybean futures continue to see strength on South American crop issues and flash sales to Mexico, China, and Unknown destinations. Beans did see some correction earlier in the week as prices dropped 20 cents, but it didn’t seem to faze prices for long. Friday’s CFTC report added 11,827 contracts to an already long managed money position, pegging numbers at 166,315 contracts. Monday’s export inspections pegged beans at 42.4 million bushels down slightly from last week’s 45.6 million bushels and below the 10-week average of 59.7 million bushels. Export sales this week came in at 50 million bushels versus last week’s 58.7 million bushels and compared to the 10-week average of 35.2 million bushels. New crop soybean export sales are currently on track to hit a record pace. Locally basis remains flat.

Milo

Milo saw export inspections at 7.2 million bushels above the 10-week average of 5.9 million bushels. Export sales reported 5.8 million bushels sold for old crop and a cancellation of 2.1 million bushels for new crop. Nothing too significant on the sales front.

And.... just for fun this week, because everyone loves it.

Coffee

Tight global inventories are driving the coffee market, keeping prices firm. Why is this important? Because coffee is a primary fueler of the American farmer, that’s why. Arabica coffee inventories fell to a 22-year low of 1.028 million bags, while robusta coffee inventories hit a 3+ year low of 8,931 lots. The Green Coffee association reported Tuesday that January green coffee inventories fell -.06% month over month and -0.8% year over year to 5,795,841 bags. Arabica coffee rallied to a 10+ year nearby-futures high last Thursday because of global supplies. Supply issues, unfavorable weather in SA, and Brazilian real strength are supporting the coffee market currently. However, there seems to be some bearish news on the horizon with adequate rains forecasted that will benefit the country’s coffee crop.

Trivia Answers

-

William Henry Harrison got sick and died just 31 days after his inauguration in 1841.

-

The Kentucky Derby, which has been held since 1875.