Weekly Market Update 1/13/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

How many phases does the moon have?

-

In 2016, what famous musician won the Nobel Prize for Literature?

Answers at the bottom.

Market News

-

Stock markets are mixed today after the Labor Department's weekly jobless claims report showed an unexpected rise in first-time unemployment filings for last week, rising to 230,000. The Bureau of Labor Statistics' December producer price index (PPI) showed a 9.7% increase year-over-year in wholesale prices, the biggest jump on record since 2010. The December Consumer Price Index (CPI) released this week showed the cost of goods rose at a 7.0% year-over-year rate, the highest in nearly 40 years.

-

The Biden administration is considering lowering the 2022 ethanol blending mandate amid backlash from refining lobbyists. In December, the Environmental Protection Agency issued a biofuel blending mandate proposal that cut ethanol requirements for 2020 and 2021 but restored them to 15 billion gallons for 2022. But, in recent weeks, administration officials have considered rolling back the 15 billion gallon mandate when the final rule is issued later this year.

-

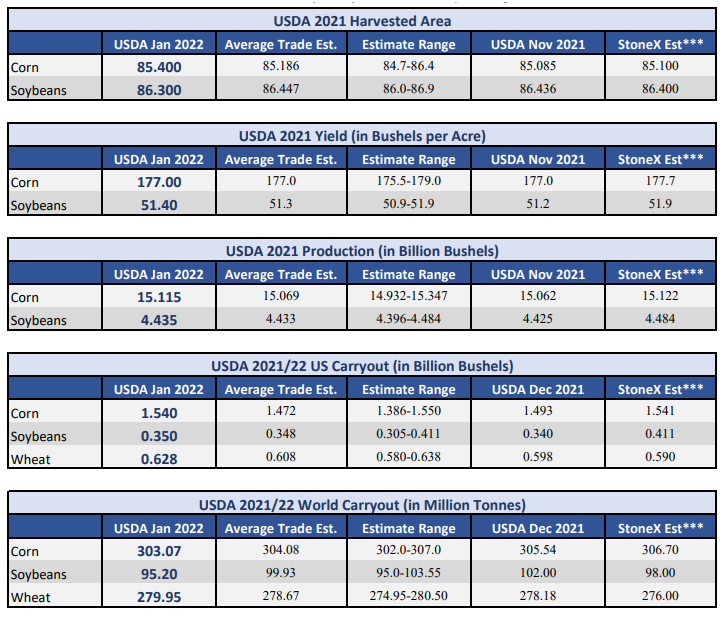

Yesterday was a huge data dump from USDA: January WASDE, Quarterly Stocks Report, Crop Production, and Winter Wheat Seedings. Overall, there were no huge surprises to really get the market excited. Check out the below table, as well as the commodity sections, for more specific information.

-

We are currently enrolling bushels in our Alpine Pro contract for corn and milo. This is a contract that prices futures by a combination of committee pricing and a proprietary rules-based algorithm. This contract is especially unique because of its provision that allows a farmer to be released from the contract penalty-free in the case of verified crop failure. The deadline to enroll is January 21st. Reach out to a grain team member if you'd like more information.

| 1/12/22 USDA Report Recap |

|

|

Weather

More of the same - low chances of precipitation paired with temperatures leaning above normal. Mostly sunny weather dominates the forecast, while highs remain in the 40s and 50s for the next week. Saturday does stick out with highs only in the upper-20s to low-30s across GCC country. The drought monitor currently has most of western Kansas classified as in a moderate drought, with parts of southwest Kansas marked as extreme drought.

|

|

Corn

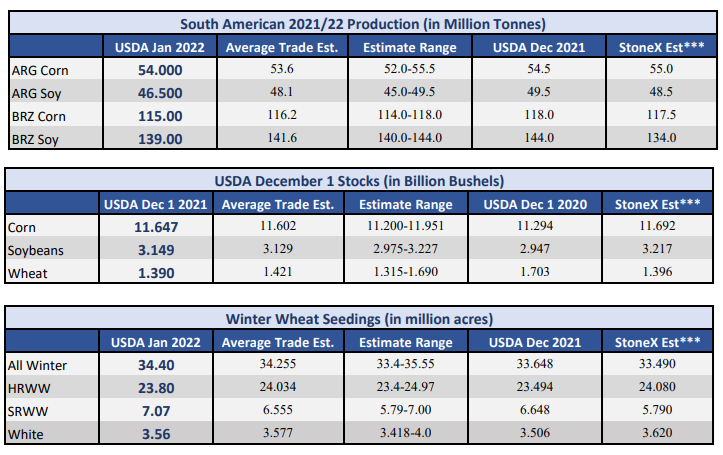

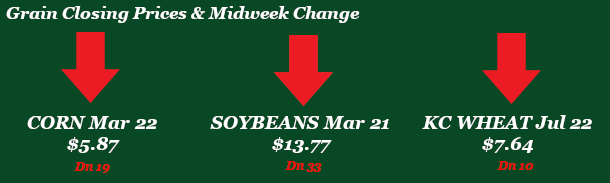

Corn is struggling today, after USDA pretty much met what was already built into the markets in yesterday's reports. USDA printed final 2021 production numbers, leaving yield unchanged at 177.0 but bumping up planted/harvested acres, increasing total production to 15.115 billion bushels. Ethanol demand was increased, but offset by decreases in export demand. Net result was a 47 million bushel increase to US carryout. 2021/22 world carryout was decreased to 303.07, largely because of cuts to the South American crop. Brazil's corn was lowered 3MMT, to 115.0MMT and Argentina's was lowered slightly from 54.5MMT last month to 54.0MMT. These cuts still have production higher than many estimates, including Brazil's CONAB pegging their crop at 112.9MMT. All eyes will remain on South American forecasts. Brazil has caught some showers this week, while Argentina faces record heat ahead of rains forecasted Sunday and into the 6-10 day. Export sales this morning were lower thean expected at 18.0 million bushels. Inspections were on the high end of estimates at 40.3 million bushels, but shipments are still well below last year's pace.

Wheat

Nothing earth shattering came from the January WASDE and stocks report, which is a little surprising considering this report has historically been volatile for the market. Wheat markets pulling back on the bearish winter wheat planting, stocks, and supply and demand data from the reports. Winter wheat plantings were pegged at 34.4 million acres, slightly higher than the average trade guess of 34.26 million acres. This is also a 2% increase from plantings last year. With higher prices over planting season Kansas saw an increase of 200k acres from last year. The WASDE showed exports take a 15 million bushels hit which led to an increase in carry out making the market hang out in the red and with a downward outlook for the near future. Export inspections were sub-par reporting 8.6 million bushels inspected to ship. Export sales were also a dud reporting 9.7 million bushels sold, HRS was the leader at 3.5 million bushels. Last Friday the CFTC report had KC wheat pulling back 7,593 contracts lowering the current long to 51,813. Something to keep in mind and could be a market mover in the future is the drought conditions across the plains. If this dry spell continues the wheat market could be on the rise

Soybeans

No new bullish news for beans to grab hold of and run like a kid with scissors. Today the market is washing away all the “old” bullish stories and settling in from the WASDE and stocks report. Over all soybeans stocks in the U.S. saw a slight increase and was within trade ranges. The USDA left export demand unchanged for beans which was a bit surprising, but they are wanting to get a clearer picture on the South America crop. The USDA lowered Argentina 3mmt to 46.5mmt and Brazil beans down 5mmt to 139mmt. This was still higher than private firms have been pegging these bean crops. Rains are on the way in South America and the dry spell looks to be out of sight and out of mind. Remember that even with the crops lowered South America will still have a record bean crop. Export inspections were below trade estimates at 33.3 million bushels inspected to ship. Export sales were underwhelming as well reporting 27 million bushels sold. Friday’s CFTC report showed soybeans adding 839 contracts to the current long of 98,919 contracts. Soybeans maybe settling into a down trend with rains in South America and no new bullish stories popping up.

Milo

Carryout for milo tightened up 4 million bushels to 33 million. The main reason for this was yield lowered 3 bushels per acres. Export inspections for milo were decent at 7.9 million bushels shipped. Export sales were meh totaling 800,000 bushels. This was the second straight week of less than 1 million bushels sold.

Trivia Answers

-

The moon has 8 phases. In order, they are: new Moon, waxing crescent, first quarter, waxing gibbous, full Moon, waning gibbous, third quarter and waning crescent.

-

Bob Dylan won the 2016 Nobel Prize in Literature "for having created new poetic expressions within the great American song tradition."