Weekly Market Update 7/21/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Which country produces the most coffee in the world?

-

What is the rarest M&M color?

Answers at the bottom.

Market News

-

Stock markets are higher in a choppy trading session following a slew of mixed earnings and a surprise rate hike (0.50%) from the European Central Bank. This was their first rate increase in 11 years, and was much twice as high as the market was expecting. The U.S. labor market softened this week, with first-time unemployment claims at 251,000 last week, the most since November 2021.

-

The energy market is sliding lower today amid fears of recession and demand questions. Production from Libya is back online and could see as much as 1 million barrels per day of production, easing some global supply concerns. The bears seem to be in control for the time being as crude oil prices continue to bounce off that $95 mark.

-

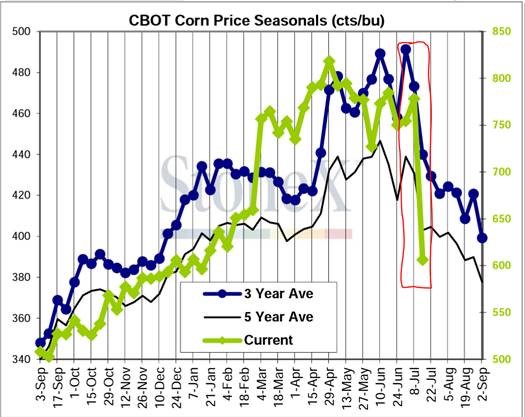

Commodity markets lately have been absolutely wild, with lots of movement and large daily ranges. We've included the corn seasonality chart below as some food for thought. Despite current market volatility, the corn market is following seasonal trends headed into the end of July.

|

|

Weather

It's really nice to see Kansas in the above average area for chances of precipitation - there are scattered chances for showers across our territory throughout the next week. Temperatures are "cooling off" into the 90s and 80s starting next week, a welcome change from the 100+ we've had the last few weeks.

|

|

Corn

December corn continues to ride the struggle bus as futures deteriorate and fund sell off continues. Dec futures closed at 5.73 ½, just 2 ½ cents off the low for the week. Corn has lost another 30 cents over the past week. Friday’s CFTC report showed another 21,693 contracts in sell off, putting fund longs at 151,174 contracts. Monday pegged export inspections at 42.3 million bushels, up from last week’s 36.8 million bushels, but still off the 10-week average of 49.7. Export sales for the week came in at 1.3 million bushels versus last week’s 2.3 million bushels. New crop saw sales of 22.4 million bushels. Crop conditions for the week stayed steady at 64% good to excellent, in line with last year and the average. Kansas conditions were not so lucky with the crop needing rain, as conditions took a 9% hit at 47% good to excellent. For the week ethanol stocks were down slightly with demand and production both up. Locally basis is flat.

Wheat

Wheat has traded both sides of the market today and is fighting to stay in the green. Monday brought a positive sign finishing the day up 30+ cents, Paris wheat being higher gave the U.S. market some strength and news earlier in the week that Egypt was looking for wheat and the U.S. being a potential seller. Export inspections this week were sad with 6.8 million bushels shipped, under the lowest trade guesses. Mexico and Nigeria were the number one destinations. Export sales weren’t anything special either with 18.8 million bushels sold within trade estimates. HRS led the way at 6.8 million bushels sold. Crop progress pegged winter wheat at 70% completed in the U.S. with Kansas standing at 99% complete. Spring wheat conditions bumped 1% to 71% good to excellent light years ahead of last year’s 9% good to excellent. Managed money has continued to cut their long position selling 5,650 contracts. The net long is currently sitting at 16,387 contracts.

Soybeans

Monday saw good day to the positive for beans but since has taken a tumble, mostly coming from improving forecasts with stronger chances of rain in the 7-10 day. Beans can hold out longer than corn at this point for moisture. Soybean conditions dropped 1% to 61% good to excellent for the U.S. while Kansas saw a much bigger drop of 6% to 56% good to excellent. The crop progress report started the downward trend for the week with traders expecting a bigger drop in crop conditions. Export inspections were weak at 13.3 million bushels shipped, below trade expectations. China was the number one destination with 5 million bushels heading their way. Export sales were above the 10-week average and for the first time in the last 3 weeks we don’t have a net cancellation. Old crop sales totaled 7.5 million bushels and new crop sold 9.4 million bushels. China was by far the number one buyer. For the year this keeps soybeans at USDA’s seasonal sales pace. Managed money sold off beans last week to the tune of 9,337 contracts but still carry a long position of 95,711 contracts. For today look for beans to stay in the red as they have hitched themselves to corn and crude.

Milo

Milo is riding the struggle bus with corn, losing 30 cents on the week. Export inspections for the week came in at 4.4 million bushels versus 7.2 million bushels last week and lower than the 10-week average of 6.5 million bushels. Export sales came in at 0.2 million bushels for the week. This week’s crop conditions were not favorable for milo, down 5% to 35% good to excellent. Kansas conditions dropped 10% to 40% as all crops are in need of moisture. Locally basis is flat.

Trivia Answers

-

Brazil

-

Brown