Weekly Market Update 3/10/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Name two teams to win more than one NCAA men's basketball championship in the last ten tournaments (2011 onward)...

-

Baylor has won the Big 12 Women's Basketball Championship every year there has been a tournament since 2011, with the exception of one year. Who won that year? (Hint: 2017)

Answers at the bottom.

Market News

-

We are now entering the third week of the Russian invasion of the Ukraine, and it seems like we are no closer to a solution than when the conflict began. Russia and Ukraine's foreign ministers met for talks in Turkey today, but the discussions failed to achieve a cease-fire or an agreeement over safe passage for civilians fleeing Mariupol. President Joe Biden announced on Tuesday that his adminstration was banning Russian oil, natural gas and coal imports to the US. On the same day, Russian President Vladimir Putin announced that Russia would be banning exports of certain commodities and raw materials. The Russian cabinet has yet to announce exactly which commodities would be banned and what countries they would be banned from.

-

Today's been a volatile trading session in the energies, as the market continues to way supply disruption concerns. Putin said Russia, who supplies a third of Europe's gas and 7% of global oil, would continue to meet its contractual obligations on energy supplies. Comments out of the United Arab Emirates (UAE) are also adding to the volatility. Yesterday. a UAE ambassador said that their country would encourage OPEC to consider higher oil output. Today, UAE's Energy Minister said that the country is commited to only increasing production according to already existing agreements. Other things weighing on the market are moves by the United States to ease sanctions on Venezuelan oil and efforts to wrap up the Iranian nuclear deal, which could lead to increased oil supply.

-

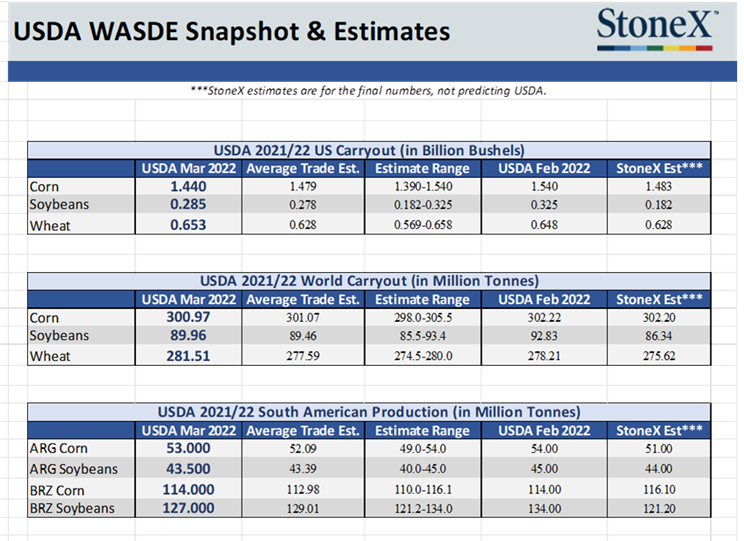

While certainly not the market's focal point, yesterday USDA did release the March WASDE. It was mostly as expected, with decreases to US and world carryout for both corn and beans. However, wheat carryouts were increased despite the market expecting lowered US and global carryouts. More information in the commodity sections and the below graphic. The next major report to be looking for is Quarterly Grain Stocks, which will be released on March 31st.

|

|

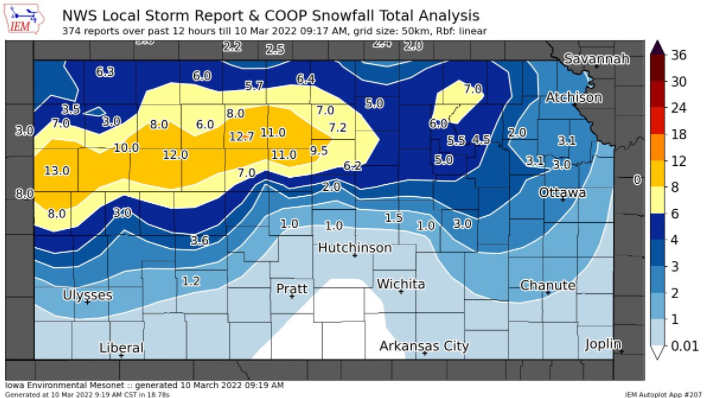

Weather

If the markets didn't have us whiplashed enough, the weather has finished off the job. After last week's warm temperatures, this week cooled off with snowfall across most of the state overnight. Tomorrow looks to continue the cool pattern, with temperatures then warming up into the 50s and 60s into the weekend and ithroughout next week. Chances for precipitation following this snow are slim-to-none, with this week's drought monitor confirming what we already know - most of the US plains and all of Texas are in some sort of drought.

|

|

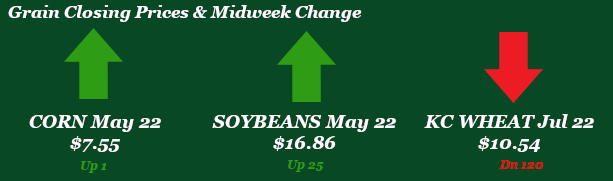

Corn

December corn hit a new contract high this week at 6.54 ¾ as the market has experienced abnormal volatility since Russia invaded Ukraine on 2/24. Futures have traded a 77 ½ cent range since the last week of February with the widest daily range being 49 cents. The export market has also reacted to the turmoil overseas. Russia and Ukraine make up about 15.5% of the world’s corn exports (roughly 13% being from Ukraine), and the market is now shopping U.S. corn with no corn projected to come out of Ukraine. U.S. export sales hit a whopping 84.4 million bushels for the week ending 3/3/22. Export inspections saw a little tick up this week coming in at 62.3 million bushels versus last week at 61.2 and versus the 10-week average of 46.7 million bushels. Wednesday’s WASDE was fairly uneventful as U.S. carryout fell in the range of analyst’s estimates at 1.440 billion bushels and world carryout came in at 300.97 million metric tonnes. USDA pegged Argentina corn at 53 MT and Brazil corn at 114 MT, both within the range of analyst’s estimates. Ethanol stocks were up on the week as was production, though demand took a dip. Corn spreads have started narrowing as the market digests the Russia-Ukraine news with CK/CN topping out thus far at a 52 ½ cent inverse and closed today at a 29 ¾ cent inverse. Locally elevator basis stays flat.

Wheat

Have we reached the top in the wheat market? We are in the midst of our 3rd straight day in the red and were limit down yesterday at 85 cents, Tuesday we touched limit down but recovered from the bottom. Peace talks between Russia and Ukraine have deteriorated once again. Bulls have few headlines to go off right now and need fed to keep this skyrocket going. Export inspections this week for wheat were a non-starter at 12.6 million bushels shipped, right at the low end of estimates. Export sales were solid for wheat at the higher end of estimates 11.3 million bushels sold. HRS was the leader at 6.1 million bushels sold. Yesterday we had the March WASDE report, but it has been put on the back burner for the prior mentioned war. The highlight of the WASDE was wheat exports being reduced resulting in a carry out of 653 million bushels, an increase from previous months 648 million bushels. The funds from last Friday’s CFTC report had KC wheat net buyers of 4,701 contracts increasing the net long to 45,481. This week is likely to be the opposite after a hard down swing the past 3 days. Wheat crop conditions in Kansas drop 1% good to excellent. This snow will help across the Midwest, but rains are need through the rest of march and into April.

Soybeans

The wait is over for the USDA to reduce their South American soybean production numbers. The WASDE showed a reduction in both Brazil and Argentina soybeans by a combined 8.5mmt. Then this morning CONAB (the Brazilian version of USDA) dropped their official number again, this time to 122.77mmt. With those reductions the market has plenty to gobble up and trade higher. Throw in some very strong export sales numbers as well at 84.4 million bushels sold, almost double the trade expectations. We have plenty of news and numbers to have a strong day. Export inspections this week reported 62.3 million bushels shipped, close to the high end of estimates. CFTC report from Friday showed beans as sellers of 4,613 contracts reducing the long to 175,721 contracts.

Milo

Milo has been fairly quiet over the past week. Export inspections came in at 8.1 million bushels versus 5.8 million bushels the previous week and versus the 10-week average of 5.8 million bushels. Export sales this morning were pegged at .3 million bushels, down from last week’s 4.0 million bushels and down from the 10-week average of 6.2 million bushels. Locally basis is weaker.

Trivia Answers

-

Connecticut (2011, 2014) and Villanova (2016, 2018)

-

West Virginia