Weekly Market Update 3/17/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Happy St. Patrick's Day! What US river is dyed green to celebrate?

-

What is the lowest-seeded team to ever win the NCAA Men's Basketball Tournament?

Answers at the bottom.

Market News

-

Russia/Ukraine Update: Today marks the start of the fourth week of Russia's invasion of Ukraine and the headlines seem to keep flipping back and forth. Ukrainian President Zelensky virtually addressed Congress yesterday to ask for more assistance and repeatedly called for a no-fly zone. So far, the U.S. has resisted that request, but President Biden did announce an additional $800 million in military support for Ukraine yesterday. Meanwhile, a few headlines point towards some progress on a tentative peace plan, including a ceasefire and Russian withdrawal if Kyiv declares neutrality and accepts limits on its armed forces. Expect markets to remain volatile as the headlines change.

-

The Federal Reserve approved their first interest rate increase in more than three years in an effort to combat inflation. At yesterday's meeting, the Federal Open Market Committee agreed to raising rates by a quarter percentage point. Fed officials also penciled in increases for each of their six remaining meetings this year and three more hikes in 2023. Chairman Jerome Powell hinted that the Fed could begin reducing their balance sheet as early as May.

-

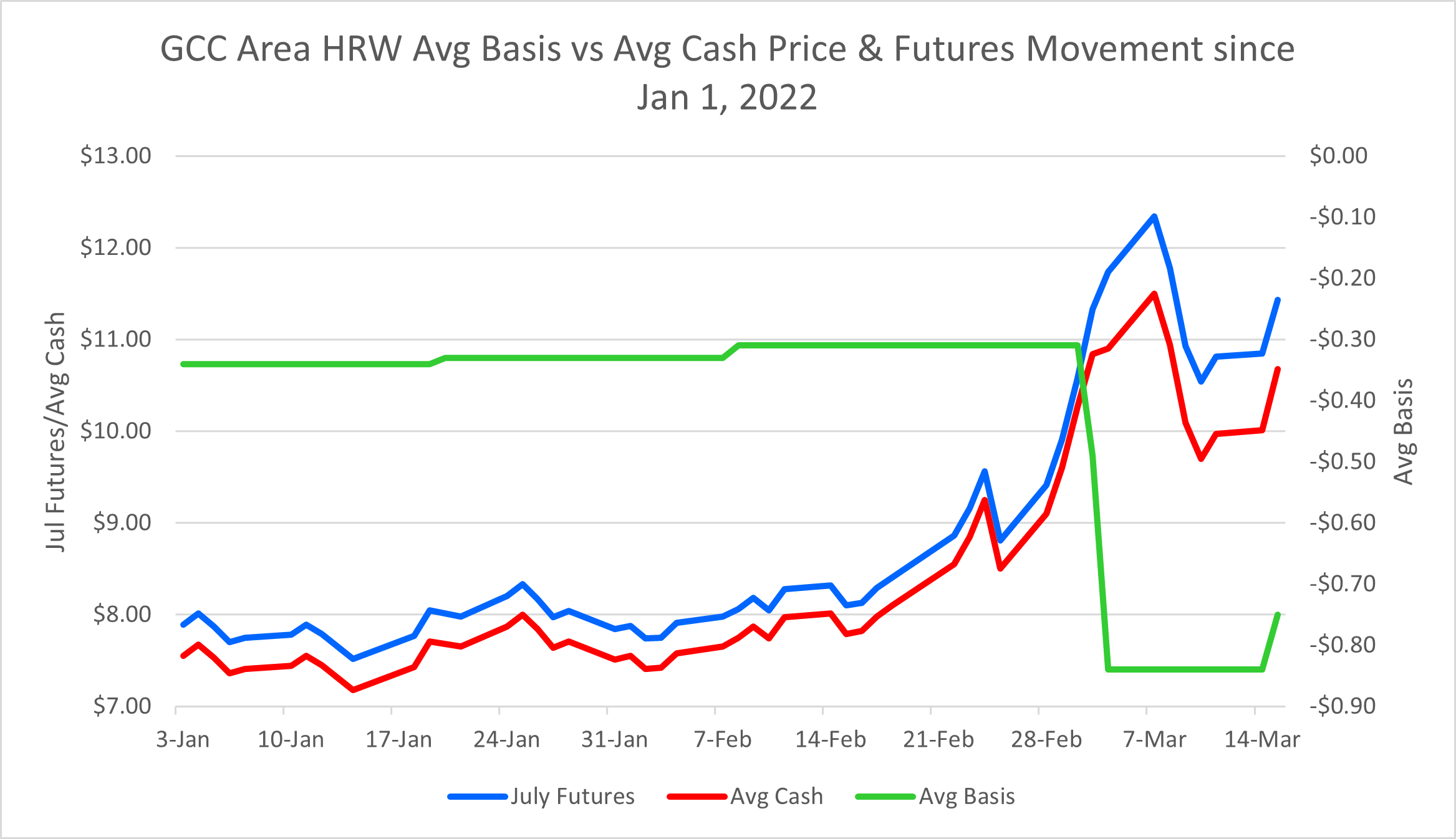

Chart Commentary: The wheat market has made some big moves since January 1st. With the run up in futures on the Russo-Ukrainian War, wheat has been trading at historically high prices. So why the dump in basis? As headlines give way to a volatile market U.S. wheat continues to increase in price, with little in the way of wheat sales to the end-user. Many end-users have halted buying with these historically high prices, leaving the elevator to take a step back and analyze the market. Dropping basis has allowed the elevator to continue to buy wheat from the farmer that wants to sell while futures are strong, and has added some protection from the risk of an unknown sales market. Even with the basis drop, cash price moves so heavily in tandem with futures that the farmer is still able to sell levels that have not been seen in close to a decade. The cash price has moved more than $4.30 since the beginning of 2022.

|

|

Weather

Some relief has come into sight for dry western Kansas, with high chances of precipitation via a winter storm tonight and showers early next week. The weekend looks to be beautiful, with highs in the 60s and 70s, before settling into a pattern of 40s and 50s next week. Nighttime lows are forecasted to continue hovering around freezing for the near future.

|

|

Corn

December Corn futures are seeing a bump today, trying to regain the losses from yesterday and earlier in the week. Markets have been thin with few traders wanting to throw their hat in the ring. This creates more volatility and is not a healthy market to trade in. Decent rains have been falling in South America leading to reports saying there will be a strong corn crop this year. Export inspections were subpar to begin the week at 45.1 million bushels shipped. This dragged the market lower with bulls hoping for better numbers. Export sales report this morning showed 72.3 million bushels sold. This is a very strong number and above trade estimates. Japan led the way with 22 million bushels and “unknown” at 12 million. Flash sales throughout the week have been solid for corn as well. Spain bought some US corn this week and this is significant due to Spain always buying their corn from Ukraine. The war has opened different export markets for US grain that have not traditionally been there. With the war in Ukraine still going on and no end in sight as of right now, Ukraine farmers may not be able to plant much if any corn this year. Ukraine’s corn planting season falls in line with the US planting season. This could lead to exports for corn and other commodities staying strong through spring and summer. Last Friday’s CFTC report showed funds adding 19,562 contracts to the existing long position of 368,784 contracts.

Wheat

More volatility in wheat this week as volumes run thin, lacking any sort of interest or participation in the futures market. Headlines this week for wheat have been somewhat conflicting with Putin stating that Russia may halt exports of grains, including wheat, while other headlines reported exports out of Russia could still move under certain quotas. Ceasefire talks have been thrown around, adding some pressure to the wheat market, but little in the way of progress has been made. U.S. export inspections for wheat this week were lacking, coming in below trade expectations at 10.4 million bushels. Export sales also came in lower than expected at 5.4 million bushels and saw some HRW cancellations of .2 million bushels. Friday’s CFTC showed managed money holding its long position at 44,706 contracts. Locally, elevator basis took a dive, as the ability to sell wheat to end-users is close to nonexistent.

Soybeans

Soybeans have seen a little futures market weakness this week despite China continuing to pull on U.S. supplies and new crop bean exports continuing their record pace. Tuesday’s February NOPA crush came in right on the dot of the average of analyst’s estimates at 165.1 million bushels vs a 165.0 average. The crush number is down from 182.2 million bushels last month but well above last year’s 155.2-million-bushel number. Friday’s CFTC report has soybean managed money long at 171,714 contracts. Locally, basis is fairly flat.

Milo

Export inspections were solid for milo with 10.2 million bushels shipped. This matches the 3-week high for export inspections. This is also above the 10-week average of 5.9 million bushels. Export sales were also good with 4.3 million bushels sold, the highest in 4 weeks and just below the 10-week average of 5.5 million. Milo basis has remained flat this week.

Trivia Answers

-

The Chicago River

-

The Villanova Wildcats were the eighth seed when they won the 1985 national title.