Weekly Market Update 3/31/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Five schools have made more than 10 Final Four appearances. Which teams are they?

-

What school has made the most NCAA Tournament appearances without making it to the Final Four?

Answers at the bottom.

Market News

-

Another volatile week as the markets continue to trade headlines out of the Black Sea. Tuesday's large market selloff can be attributed to news that Russia was beginning to withdraw some troops around Kyiv and that peace talks are "constructive." Then headlines Wednesday pushed markets back higher as it was reported that Russia was actually bringing in more troops and had continued bombing around Kyiv. Putin also put out a statement last week that would demand Russian gas exports to the EU to be paid for in roubles instead of dollars or euros starting this week. The Kremlin has since backed off their demands, promising a gradual shift. Expect the market to continue closely following the headline of the day.

-

In an effort to calm rising energy prices, the Biden administration has announced plans to release up to 180 million barrels of oil from strategic reserves. This is the third time in the last six months that the U.S.has tapped into reserves and is the largest release in history. The energy market remains volatile as traders try to put a dollar figure on the back-and-forth battle between global supply and demand amid Chinese COVID lockdowns, the ongoing conflict in the Black Sea, and OPEC output increases.

-

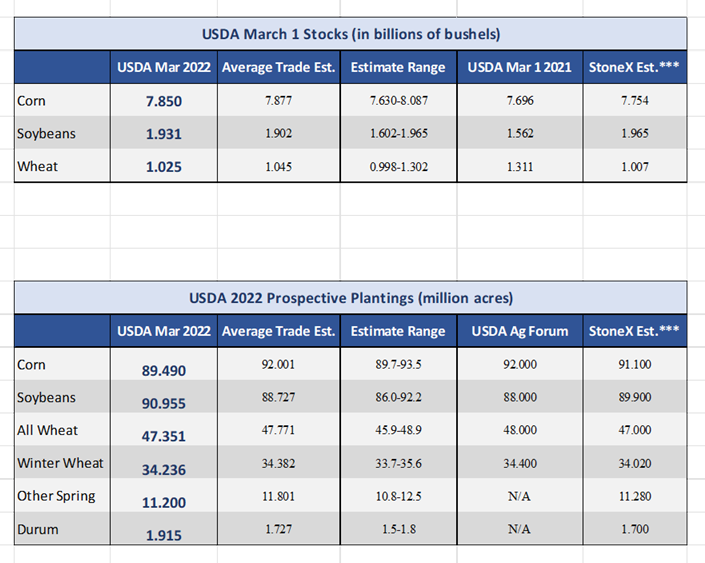

This morning USDA released the Prospective Plantings and Quarterly Grain Stocks Report. The biggest curveballs were lower-than-expected corn acres, paired with higher-than-expected bean acres. Check out the commodity sections for more information.

| March 31st USDA Prospective Plantings and Quarterly Stocks Report |

|

|

Weather

Mostly mild temperatures are in store for the next several days, with highs in the 60s and 70s and nighttime lows dipping to the 30s and 40s. Forecasts hold some chances for rain tomorrow and early next week, which would be welcome as wheat comes out of dormancy and we quickly approach the planting of fall crops.

|

|

Corn

Over the past week December corn futures have gone from seeing a little bit of pressure on “peace talks” to making new highs on quarterly reports. Rumors of a possible cease fire and troops withdrawing from Kyiv pressured the market, but news quickly turned to what were called “constructive” talks and markets went back to thinner trade. Friday’s CFTC showed corn adding to its long fund position at 384K contracts. Monday’s export inspections pegged corn at 63.2 million bushels, up from last week’s pace of 58.9 million bushels and higher than the 10-week average of 52.5 million bushels. Ethanol stocks saw a slight jump week over week while production saw a slight decrease. Thursday’s export sales came in fairly disheartening at 25.1 million bushels for the current marketing year versus last week’s 38.5 million bushels and the 10-week average of 45.5 million bushels. New crop export sales came in at 11.3 million bushels. The big news this week for corn was the 2.5-million-acre cut that the USDA made to corn plantings. The USDA Quarterly Stocks and Prospective Plantings report pegged acres at a surprising 89.49 million, down from USDA’s Ag Forum estimate of 92 million acres. March 1 corn stocks were in line with analyst’s estimates at 7.85 billion bushels. Locally, end user markets seem mostly quiet, but June/July demand could pick up at any time. Elevator basis is steady.

Wheat

The beginning of the week for wheat was fueled by peace talks between Russia and Ukraine which was a non-starter after some misleading headlines. The news initially led to wheat close to limit down and closed 45 cent down on the day. We have flip-flopped and have now recovered losses from Monday and Tuesday and are roughly 40 cents up on the day today. Most traders have been waiting for the quarterly stocks report and prospective acres report from the USDA today. Wheat didn’t have much for surprises with stocks and planted acres reported. Stocks saw a decrease from March 1, which was expected. The USDA reported 1.025 billion bushels in U.S. stocks down from 1.311 billion bushels. Winter wheat planted acres were reported at 34.236 million acres just below the average trade estimates. Most of the momentum today is coming from corn. Export inspections were weak again at 12.5 million bushels shipped, in line with the past few weeks. Japan led the way out of the PNW, but we did see shipments out of the Gulf to Nigeria and Colombia. Export sales were also sub-par with 3.5 million bushels of old crop sold and 3 million bushels of new crop. Crop conditions for wheat reported Kansas improving by 7% to 32% good to excellent. The CFTC report from last Friday saw KC Wheat add 1,553 contracts to the existing long of 45,789 contracts.

Soybeans

Soybeans and corn were the big “surprises” from the acres report. Soybean acres were reported at 90.955 million acres up from the USDA Ag Forum earlier this winter and also higher than average trade estimates. With the prices of fertilizer through the fall and winter skyrocketing many expected a switch to beans for acres, but I’m not sure many anticipated close to 91 million acres or even over 90 million. This is the main reason beans are down on the day and I expect them to close in the red as trader digest these numbers. Do we see a switch back to corn for acres come the July WASDE report? Export inspections for beans were in line with trade expectations at 23.1 million bushels shipped. Export sales were strong again this week at 48 million bushels of old crop and 2 million of new crop sales. The CFTC report showed managed money as buyers of 3,502 contracts adding to the long of 174,192 contracts. A little South American news came out this week from Itau BBA, a Brazilian investment bank estimates the country’s 22/23 soybean planted area would only increase by 0.5% from the current season. That would be the smallest acreage gain in more than 15 years. I think this news can be taken with a grain of salt and we can expect a much larger increase in soybeans planted.

Milo

Milo has a weaker feel to it, even with the corn futures rally. Export inspections for milo were decent at 13.5 million bushels versus 13.2 million bushels last week and the 10-week average of 7.4 million bushels. Thursday’s export sales pegged milo with a cancellation at -0.6 million bushels for the current marketing year, and no new crop sales. Locally basis feels weak.

Trivia Answers

-

Kansas, Duke, Kentucky, UCLA and North Carolina

-

BYU. They have appeared in 30 NCAA tournaments without a Final Four.