Weekly Market Update 5/19/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

The Kentucky Derby took place on May 7th, what are the other 2 legs of the Triple Crown?

-

What famous Indy Car race takes place during the month of May?

Answers at the bottom.

Market News

-

Stocks are mostly lower in a choppy trading session today, as markets are struggling to recover from a sharp sell-off yesterday. The S&P 500 registered its worse decline since June 2020 yesterday, down roughly 19% from its all-time high in January. The Dow fell more than 300 points in the same session to close at its lowest level since Matrch 2021.This followed weaker-than-expected quarterly results from big-box U.S. retailers that stoked continued fears of inflationary pressure on corporate earnings. This week, Federal Reserve Chair Jerome Powell strongly signaled two more 50 basis point interest rate hikes were likely in the coming central bank policy-setting meetings.

-

Indonesia has indicated that they will lift their ban on exports of palm oil starting next week, a move that could ease a tight global market and possibly releive some of the pressure on food prices. Indonesia accounts for nearly 60% of global palm oil production, and their ban last month had pushed some demand to soybean oil.

-

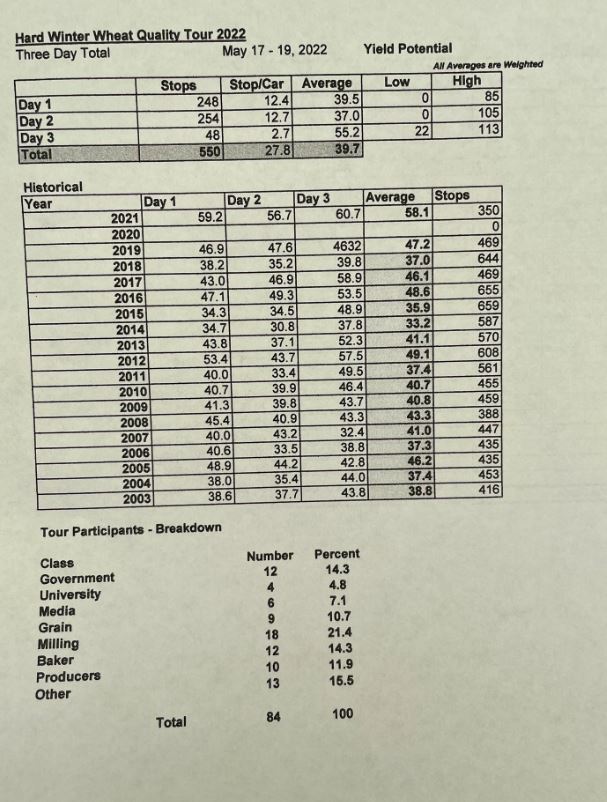

This week was the always highly anticipated Kansas Wheat Tour. Their final estimate, released today, pegged the Kansas crop at 261 million bushels. That's 10 million bushels less than the USDA estimate in the May WASDE. The 2022 Kansas wheat yield was forecasted at 39.7 bushels per acre, down from the 5-year tour average of 47.4 bushels per acre.

| Kansas Wheat Tour Results |

|

|

Weather

Much of our Ulysses and Garden City draw areas received rains last night, while parts of our nothern territory missed it. Decent chances for precipitation are holding in the forecast for early next week. Temperatures will be taking a big swing down headed into the weekend, with Saturday's high only in the upper-50s. Mild temperatures are sticking around into the following week, with highs forecasted in the 60s and 70s through Thursday.

|

|

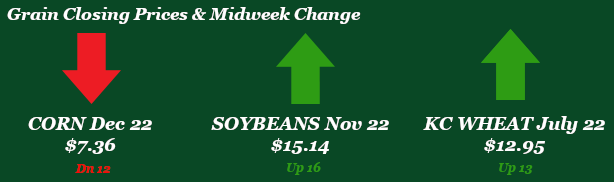

Corn

Weekend wheat headlines out of India strengthened wheat and pulled corn higher on the open Sunday night and into Monday morning, but headline trade was short-lived. Monday’s export inspections were weaker for corn at 40.8 million bushels versus the previous week at 58.2 million bushels and the 10-week average of 58.8 million bushels. Inspections sit below last year and below the 5-year average. Crop progress has corn planting still lagging as rains continue in the Midwest. Planting progress was pegged at 49% complete versus 22% last week, 78% last year, and the 5-year average of 67%. Wednesday’s ethanol showed production just a tick higher with stocks down and demand up. Ethanol bids in Kansas seem to be doing ok, even with bids decreasing over the past week or so. Thursday’s export sales remain weak at 17.1 million bushels versus 7.6 million bushels last week and the 10-week average of 41.1 million bushels. New crop sales showed 23.2 million bushels. While corn is still well off its lows, the market could be looking at support levels of 7.00-7.10. Even with planting delays corn is still going into hydrated soil, and export demand is weak. These fundamentals could keep a lid on significant upside. Southwest Kansas demand feels somewhat strong as basis continues to creep higher.

Wheat

What a roller coaster ride wheat has been on this week. Over the weekend India announced a ban on wheat exports. This cause Sunday’s overnight market to gap higher and finish limit up into Monday’s trading session. This was followed by another gap higher and then a fast sell off into the morning close on news India would allow shipments to go through that were already booked. Today we are seeing a sell off and getting back to Friday’s market level. Wheat closed the gap from Sunday night from the selling pressure aided by news of Russia opening Ukraine ports, if sanctions are lifted. We will find out if they are just blowing smoke or are serious. Export inspections came in at 12.8 million bushels with Mexico being the number one destination. Old crop export sales were nonexistent with 300k bushels being sold; new crop saw 12 million bushels sold. Last Friday’s CFTC report showed managed money adding 2,964 contracts to the existing long of 42,913. Crop progress saw wheat take a 2% hit on Monday’s report coming in at 27% good to excellent for the U.S. Kansas saw a 4% drop to 24% good to excellent.

Soybeans

Wheat sky-rocketed to start the week and the bean complex followed, pretty easy math there. NOPA released April’s crush report Monday afternoon. Crush showed 169.8 million bushels, right near the low end of the trade estimate range and down from the 181.8 million bushels last month, and two million below the April record of 2020, though still above the 160.3 in April of 2021. Crop progress showed soybeans take a jump to 30% planted for the U.S. A much need sight, but the north is still lagging with cool and wet weather. Kansas is ahead of the 5-year pace of 28% with 32% of the planting complete. Planting progress is the big topic for most when it come to beans, though its not to late for major bean areas we are approaching the deadline for getting them in the ground in a hurry. The Dakota’s and Minnesota are the main concerns at this point. For only the 3rd time this month we saw a flash-sale and this happen to be soybeans. On Wednesday private exporters reported sales of 229,200 metric tons of soybeans to unknown destinations with the majority being for the 22/23 marketing year. Export inspections this week were decent for beans with 28.8 million bushels shipped, just ahead of the 10-week average. Export sales were strong at 27.7 million bushels of old crop and 5.5 million of new crop sold. Managed money sold off 22,592 contracts according to last Friday’s CFTC report, bringing the long down to 130,661 contracts.

Milo

Milo still not in the spotlight as corn futures wane and export sales are cancelled. Export inspections came in on the weaker side at 7.8 million bushels versus 10.6 million bushels last week and the 10.1 million bushel 10-week-average. Export sales showed cancellations of 2.7 million bushels with no new crop sales to be had. Planting pace was in line with last year at 26%, up 4% from last week. On the week, pace still sits lower than the 5-year average of 30%. Locally milo is uneventful, and basis is flat.

Trivia Answers

-

The Preakness Stakes and The Belmont Stakes

-

The Indianapolis 500