Weekly Market Update 11/03/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Who was the first American woman in space?

-

Who did the U.S. buy Florida from?

Answers at the bottom.

Market News

-

Commodities have been whiplashing this week amid changing news regarding Russia's participation in the agreement allowing the shipment of Ukrainian grain exports through the Black Sea. Over the weekend, Russia suspended their participation after an attack on Russian warships that they blamed on Ukraine, which sent markets soaring on Monday. However, markets fell on Wednesday after Russia announced that they would rejoin the agreement. Russian officials say that they are still retaining the right to leave the agreement if Ukraine violates their promises ensuring the safety of Russian vessels.

- Chinese customs updated their list of approved Brazilian corn exporters on Wednesday, a move that could reshape global trade flows and could mean less corn from the U.S. into China. Historically, China has relied on the United States and Ukraine for most of its corn supplies. This isn't necessarily bearish news for U.S. corn, as it could push traditional Brazilian corn importers like Spain and Egypt to shift purchases to the United States.

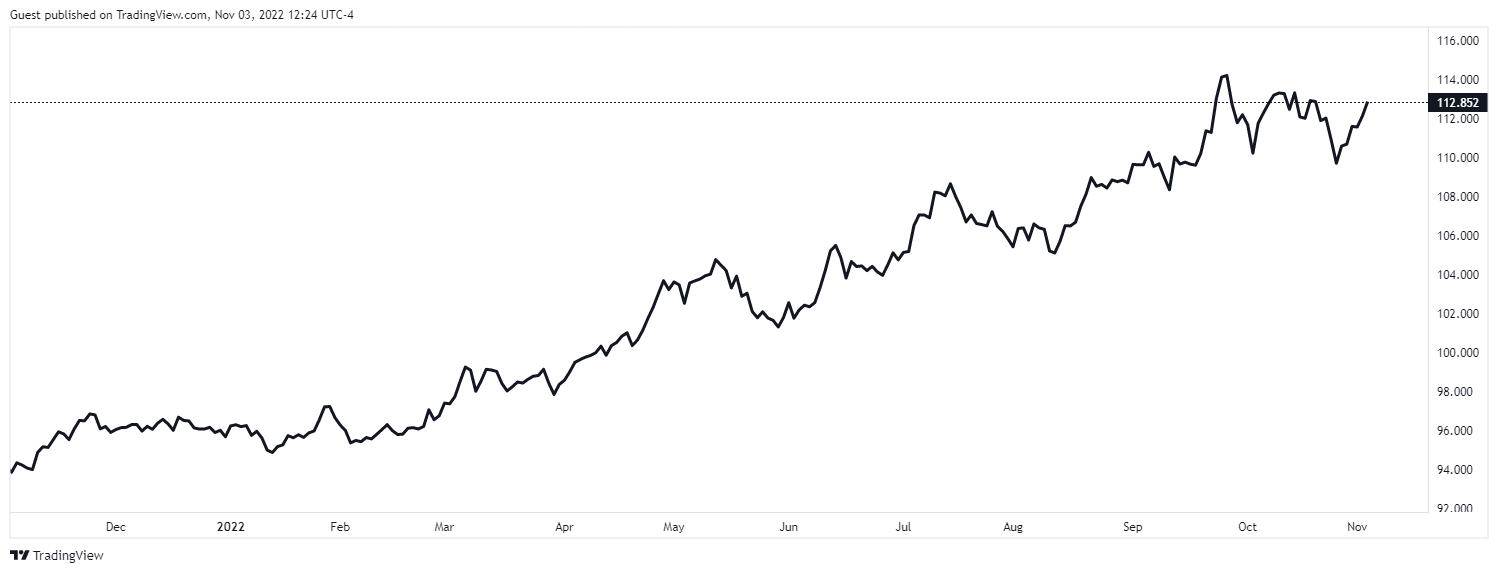

- The dollar is firmer and stocks are lower today, after the Federal Reserve signalled that U.S. interest rates will likely peak at a higher rate than expected. The Fed raised interest rates by 75 basis points yesterday, the fourth such increase in a row. Chairman Jerome Powell said yesterday, in no uncertain terms, that it is too early for the market to think about a pause in hikes in their fight against rising consumer prices and inflation.

|

U.S. Dollar Index |

|

|

Weather

Cooler temperatures just might be here to stay, with next week's highs mostly in the 60s and nighttime lows in the 30s. There are some scattered chances across GCC country for showers tomorrow - and it's going to be chilly, with highs in the mid-40s. The drought monitor remains unchanged, with southwest Kansas covered in the ugly maroon of D4 drought.

|

|

|

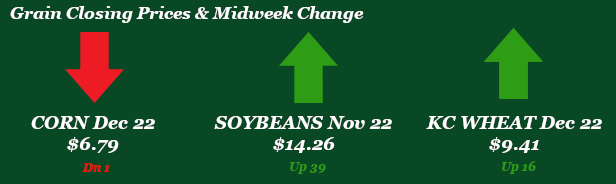

Corn

Corn came out of the gate this week bullish on the news Russia had pulled out of the export agreement. Corn was more of a follower of wheat with this news but still had enough juice to game higher and have consecutive days in the green. Russia agreed to rejoin the export deal late Tuesday night in a surprise move which led to double digit losses on the day for corn. With a surging dollar and subpar export sales corn is back tracking once again. Export inspections were in line with trade estimates this week at 16.6 million bushels shipped. China, Mexico, & Japan were the top 3 destinations in that order. Export sales were once again sub-par with only 14.7 million bushels sold. Mexico & Japan were the top destinations. With these horrible export sales, the U.S. is currently 13% behind the USDA progress. This will put pressure on the USDA to reduce exports in the December WASDE or possibly the November WASDE next week. The U.S. has reached 76% completion for harvest well ahead of the 5-year average of 64%. Kansas hit 90% complete ahead of the 5-year average as well of 83%. Managed money still has a significant long for corn at 264,374 contracts, 10,113 were added reported from last week’s CFTC report.

Wheat

Wheat surged higher early in the week after news that Russia was pulling out of the Ukrainian export deal, trading near the limit at times Monday. After Wednesday’s news that the deal was back on, the wheat market was sent into a tailspin and gave back most of its gains. The wheat market has been and will likely continue to be very sensitive to headlines. CFTC report on Friday showed managed money cut their net long by 1,644 contracts to 24,626 long. Export inspections this week were reported at 1.8 million bushels of HRW, up from the previous week but still trailing behind the 10-week average of 5.9 million. Export sales for all wheat were on the low end of estimates at 12.8 million bushels, with USDA failing to report by-class wheat sales today. Drought across the southern Plains remains critical, with nationwide winter wheat reported at only 28% good-to-excellent, compared to the 5-year average of 50%. Kansas is estimated at 24% good-to-excellent. Rains in the coming week looked to be headed for our area, but have shifted east, leaving western Kansas, eastern Colorado and the panhandles dry. Parts of Oklahoma and central to eastern Kansas are expected to get some decent moisture. Basis remains steady in our area.

Soybeans

Beans have been on a ride higher this week but experiencing some pressure to start today. The move higher was in large part due to Russia pulling out of the grain corridor deal with Ukraine and Turkey over the weekend, also a dryer weather pattern going through part of South America aided the move too. Tuesday night in a surprisingly quick move Russia rejoined the export deal and we are back to business as usual. Pressure today is coming from the U.S. dollar making a move higher this morning after the Fed increasing rates by 75bps, coupled with not so stellar export sales and we have a cocktail to see red today. Export inspections this week were in line with expectations at 94.6 million bushels shipped. China was by far the number one destination with 76.3 million bushels going there. Export sales were as great with 30.5 million bushels sold. This keeps soybeans on pace with USDA targets, but the margin is getting thin. China was also the top buyer. Crop progress report showed soybeans moving up to 88% harvested for the U.S. ahead of the 5-year average of 78%. Managed money added 8,549 contracts raising the long position to 75,411 contracts.

Milo

Export inspections were the highest amount in the last 10 weeks with 2.8 million bushels shipped. Sudan and Kenya were the top destinations. This still puts milo 3% behind USDA yearly pace. Export sales were almost nonexistent with 500k sold. Mexico was the sole buyer, and we are well of export sales progress as well. China is a big influencer for export sales and inspections and without them stepping in the USDA may have to reduce projections for both. Milo harvest hit 77% complete just behind last year’s pace of 79%. Basis for milo remains firm and well above historical numbers.

Trivia Answers

-

Sally Ride (1983)

-

Spain