Weekly Market Update 1/12/23

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

On this day in 1969 the New York Jets beat the Baltimore Colt 16-7. Who was the Jets famous quarterback who guaranteed the win and also won the game’s MVP?

-

This American entrepreneur and founder of Amazon was born today in 1964 in Albuquerque, New Mexico.

Answers at the bottom.

Market News

-

Major data dump day from the USDA. The release of the January WASDE, quarterly stocks report, winter wheat seedings, & 2022 annual crop production summary. Get the scoop below within each commodity section below.

-

December CPI data falls for the 6th straight month to a final reading of 6.5%. This is after reaching a 40-year high of 9.1% last year. Core Inflation ended the year at 5.7% near the lower end of its trading range for 2022. Energy and goods saw the majority of the pricing decelerations. Gasoline was down 9.4% and fuel oil was down 16.6% during the month. Overall goods was down .3% led by used car and truck prices falling for the 6th straight month at -2.5%.

-

More of the same continues to push the energy complex higher. News that Russian Deputy Prime Minister stated that Russia is not having issues securing export deals for February contracts mixed with anticipation for Chinese oil demand recovery have fueled the bulls. Additionally, the CPI data came in right as expected.

-

The Dow Jones, S&P 500, and NASDAQ all putting highs for the week today following a favorable report with lower inflation. Each has been steadily trending up this week following a sluggish start to the new year.

|

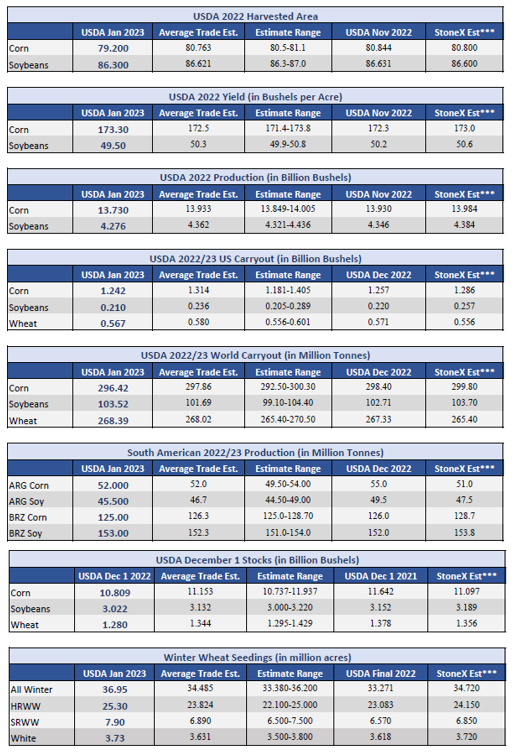

USDA January Reports Snapshot |

|

|

Weather

With the 6-10 day forecast temperatures are expected to be mid 40s to high 50s, leaning above normal so far, so good. On the precipitation side also leaning above normal, with between a 40% & 50% chance of rain/snow showers later in the week, with a 10-20 mph windspeed to be expected.

|

|

|

Corn

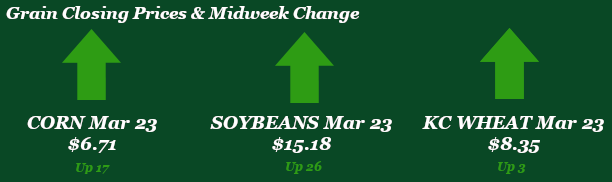

Today is the big day! The USDA released their monthly WASDE report along with quarterly stocks report for a big numbers crunching day. After treading water for much of the week with little direction corn looks to have direction after the release of the WASDE and stocks report. For those expecting a bearish report you might want to hide because we are seeing green with a brighter outlook than expected. Changes across the balance sheet for corn, USDA making cuts to demand as expected with exports and feed down, but this was offset by a reduction of harvested acres and see the yield jump1bpa ultimately wiping out any demand loss. We now see some pricing opportunity creep its head out of the dark with possibly a floor being put in around the $6.50 level. Export inspections for corn was a non-starter at 15.7 million bushels shipped close to the low end of estimates. Mexico led the way with over 9 million bushels, most coming out of the interior. Followed by China with just over 5 million bushels. Export sales were very poor at 10.1 million bushels sold below trade estimates. This is the lowest weekly number we’ve seen since the first week of October. Mexico was the leader for sales with just over 8 million bushels. Last Friday’s CFTC showed managed money adding to their long position by buying 37,142 contracts raising the long to 196,457. With the recent downturn before today’s WASDE traders found value and buying opportunities.

Wheat

After a choppy, lower start to the week, today’s USDA data dump has wheat higher by double digits due mostly to strength in corn. Despite a trade expectation of a slight US carryout increase, USDA lowered 2022/23 US carryout slightly to 567 million bushels. This would be the tightest carryout since 2014. 2022/23 world carryout was increased by about a million MMT to 268.39 MMT. On the Stocks and Acreage side of things, wheat stocks came in lower than the average trade estimate at 1.280 billion bushels, while all winter wheat seedings (planted acres) were increased significantly to 36.95 million acres. Managed money reduced their small net long by 94 contracts, according to Friday’s CFTC report, bringing the net long down to only 1,757 contracts of KC wheat. Export inspections this week were reported at 2.0 million bushels, up from the previous week but still behind the 10-week average of 2.9 million. Export sales also disappointing, at only 1.2 million bushels of old crop HRW sold. Cheap offers of Black Sea wheat are taking most global demand, putting pressure on US and Paris wheat markets. Meanwhile, domestic mills seem content to be mostly on the sidelines for the time being. Lack of export and local demand has resulted in weaker local basis.

Soybeans

Beans were lower to start the week but have also found some steam in light of today’s USDA reports. USDA reduced both harvested acres and yield, resulting in a 2022 production number of 4.276 billion bushels, down from the previous estimate of 4.346 billion and lower than the average trade estimate. Most of this reduction was offset by a reduction to demand numbers, with 2022/23 carryout coming out at 210 million bushels – keeping the been balance sheet tight. World numbers were also a big ticket item in today’s report in light of dry South American weather, Argentina’s production was cut by 4 MMT while Brazil’s production was increased by 1 MMT. Paired with a reduction in Chinese imports, overall 2022/23 world carryout was actually increased to 103.52 MMT. USDA December 1 stocks were lower than expected at 3.022 billion bushels. In other news, Friday’s CFTC report indicated that managed money added 14,378 contracts to bring their net long up to 142,994 contracts. Export inspections were down from the previous week at 52.8 million bushels, trailing behind the 10-week average of 77.2 million. Export sales also not stellar, at 26.4 million bushels of old crop and 2.4 million bushels of new crop sold. With the USDA reports in the rearview mirror, focus will now be back on ongoing dry weather in Argentina and how those forecasts play out.

Milo

Export inspections reported 400k bushels shipped with the majority going to Ethiopia. This paces milo 16% off USDA projections. We saw a big fat goose egg for export sale as well. The milo market has remained very quiet for this sales year mainly due to the fact China has not been a big factor.

Trivia Answers

-

Joe Namath

-

Jeff Bezos