Weekly Market Update 12/9/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What Hollywood actor played six different roles in The Polar Express?

-

What is the highest grossing Christmas movie of all time?

Answers at the bottom.

Market News

-

Stock markets are mostly lower today, with both the Nasdaq composite and S&P seeing red. Weekly jobless claims fell to their lowest level since September 1969, evidence of a tight labor market. Investors continue to keep their eye on the risk of the Omnicron COVID-19 variant, with mixed reports of the severity of the illness and its response to vaccines.

-

Crude oil is lower today, currently around 70.62/bbl. Latest forecasts from the EIA show a curb in oil demand and prices amid continued COVID concerns.

-

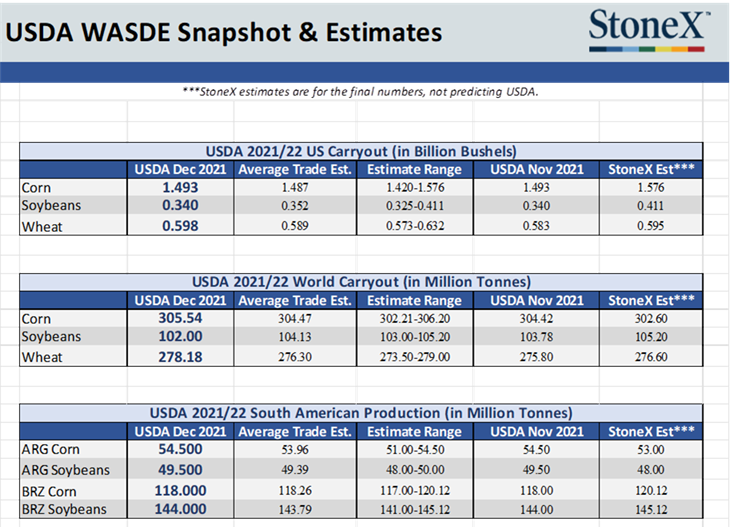

This morning USDA released the December WASDE report. For the most part, USDA kicked the can down the road, leaving domestic supply and demand tables unchanged for corn and beans. World carryout was increased for corn, while decreased for beans. Wheat saw increases to both U.S. and world carryout. For the most part, commodities remained about where they were trading pre-report.

| December WASDE |

|

|

Weather

The weather pattern that we've been in makes it hard to believe that it's December and it looks to remain mostly the same in the next week. Highs are forecasted in the 50s through the weekend, creeping up even into the 70s early next week. Chances for precipitation are slim to none.

|

|

Corn

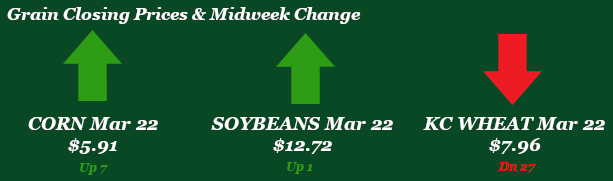

Not too much movement in corn this past week after last week’s drop-and-recovery, and today’s WASDE. Friday’s CFTC report showed sell off of about 51K contracts, though corn funds are still holding a 315K contract long. Monday’s export inspections were ho-hum for corn coming in at 29.8 million bushels versus 31.7 mb last week and the 10-week average of 31.5 mb. Tuesday’s announcement for ethanol by Reuters stated that “The U.S. Environmental Protection Agency…will set reduced ethanol blending volume mandates to account for the impact of the coronavirus pandemic on fuel demand, and reject a significant number of small refinery exemption requests.” According to Reuters, the ethanol mandates will be around 12.6 billion gallons for 2020, 13.8 billion gallons for 2021, and 15 billion for 2022. EIA ethanol report this week came in at 1090 thousand barrels per day, a nice bump from the past few weeks. Thursday morning export sales came in decent for corn at 44.6 million bushels versus 40.2 mb last week, and the 41.3 mb 10-week average. Flash sales for corn this week were Tuesday for 100 TMT to Mexico and 1.08 MMT on Wednesday to Mexico. December WASDE left much to be desired for corn. US carryout came in at 1.493 billion bushels, no change from November’s WASDE. World carryout for corn came in at 305.54 million tonnes versus 304.42 in November. South American production sees no change from the November WASDE. Locally basis stays flat.

Wheat

Wheat has been floundering this week due to lack of story lines and not so great export numbers. Export inspections pegged wheat at 9 million bushels inspected to ship smack dab in the middle of trade estimates HRW was the leader in the club house at 3.8 million bushels shipped. Export sales was also middle of the road at 8.8 million bushels sold HRW once again led the way at 3 million bushels sold. Last Friday’s CFTC report had KC wheat selling 3,241 contracts and lowering the current long to 62,368 contracts. No surprises there with the fund numbers having been an overall down week last week. Wheat was the only commodity that saw any change from the USDA this month. U.S. stocks did see an increase and that is reflected in the negative price action we are looking at today. World stocks also saw an increase. Other than that, tid-bit of information the USDA kicked the can down the road until next month.

Soybeans

Soybeans have been mixed this week, but overall, slightly down. Flash sales this week have buoyed the market and training to keep beans head above water. The main story that remains is South America and the “monster” soybean crop that is growing. Past rains have been very favorable for South America, but the future forecasts are showing a dry spell coming through. Will be interesting to see how this effects the markets and the overall strength of the bean crop. Export inspections for soybeans were at the top of estimates at 82.6 million bushels inspected for shipping. Export sales were similarly at the top of average trade guesses at 60.2 million bushels sold. Funds were sellers last week, selling 15,931 contracts and lowering the long position to 33,425 contracts. Not much to recap with the December WASDE report. The USDA left U.S. soybean stocks unchanged month to month, and South America production was left unchanged as well. World carryout was decreased from November, at 102.00 MMT. Be on the look out for next month’s WASDE and it will include the quarterly stocks report.

Milo

Milo following corn’s cue as per the usual. Export inspections for milo on Monday were 6.7 million bushels versus 7.5 million bushels last week and the 10-week average of 3.7 million bushels. Export sales on Thursday came in at a whopping 12.4 million bushels versus 11.2 million bushels last week and the 10-week average of 6.9 million bushels. Seeing some China-buying on milo, which is nice. Locally basis stays flat.

Trivia Answers

-

Tom Hanks

-

Home Alone