Weekly Market Update 2/18/21

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

1. How much does it cost the Federal Reserve to print a $1 bill?

2. How many black keys are on a traditional piano?

Answers at the bottom.

Market News

-

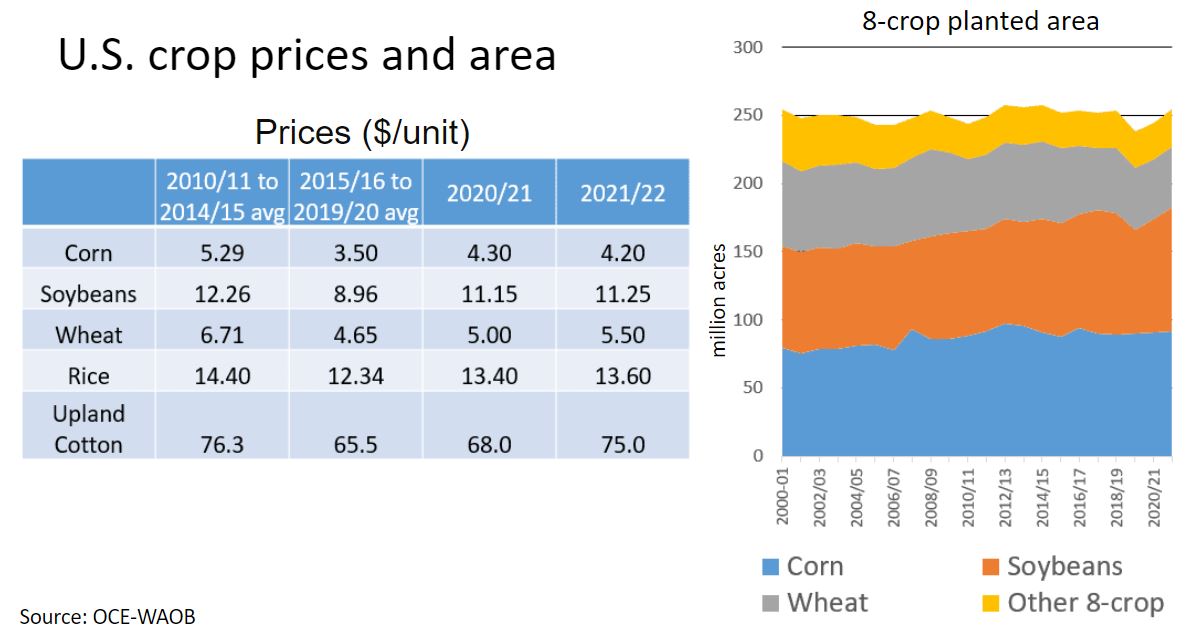

The USDA Agricultural Outlook Forum is taking place via webcast today and tomorrow. This is our first look at the 2021/2022 balance sheet. Today the USDA chief economist put corn acres at 92 million, soybean acres at 90 million and wheat acres at 45 million, all in line with trade estimates. Historically, February planted acres are significantly different than the March report. USDA also expects farm exports to hit a record $157 billion for FY 2021, an increase of $21 billion over the previous year. This is primarily due to continued strong Chinese demand..

-

A slow last week for China as they closed their markets to celebrate the Lunar New Year. Markets are back open in China today. Export sales are delayed until tomorrow because of Monday’s holiday, but shipments of beans to China were solid in Monday’s report.

-

Attention is on the energy market and how that will play out as the country warms back up in the coming days. Oil and natural gas production is slowed in Texas, the largest producing state, due to abnormally cold freezing temperatures. 40% of US crude production is estimated to be offline. Crude is up on the week, trading between $60-61/bbl.

-

Despite weakness today, the US Dollar is also up on the week, in the $90.5-90.9 range in today’s session. Equities pretty quiet. Outside markets are keeping close tabs on the proposed $1.9 trillion stimulus package.

|

USDA Ag Forum Estimated Crop Prices and Area (source: USDA) |

|

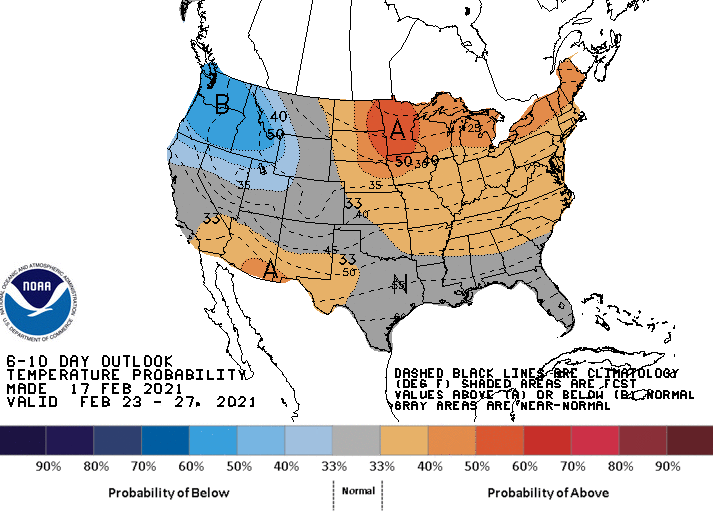

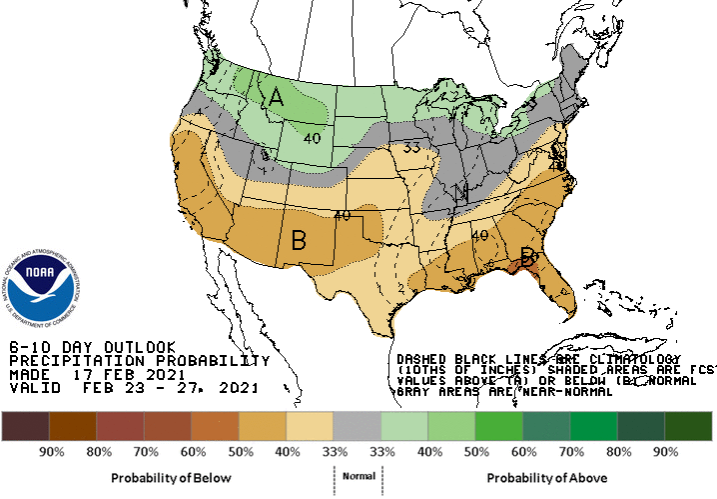

Weather

What a wild weather week it has been… snow in Galveston, rolling electric blackouts, and extended extreme cold temperatures. Luckily, today is the turning point as we head into highs in the 40’s tomorrow and into the weekend. Next week will feel like a heat wave with highs in the 50’s and 60’s. Chances for precipitation are slim to none in the extended forecast.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

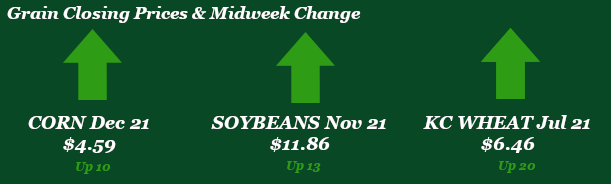

Corn

Short trading week that delayed reports by a day and corn was able to see some upside, gaining 10 cents. Friday’s CFTC showed corn funds holding huge longs at almost 359K contracts. Funds today estimated sitting at 346K long. Corn sales have been quiet with China on holiday. While the export sales report is delayed, export inspections came in below last week at 52.1 mb versus 62.4 mb last week, but up from the 10-week-average of 44.0 mb Ethanol report looks bleak with stocks up and production and demand down, likely due to the winter storm that moved through the Midwest and southern plains. A Reuters poll that came out ahead of the 2021 USDA Ag Forum has 2021 planted corn acres expected at 92.9 million acres, up from the 90.8 million acres last year. Argentina still experiencing enough dryness to affect the corn crop while Brazil is experiencing rains that will slow down harvest and could delay second crop planting. Locally, basis has remained steady.

Wheat

With a short week due to the holiday and markets being closed on Monday wheat started off with a bang on Tuesday with news to run on. Frigid temps across the U.S. are a cause for concern related to winter kill. The rest of the week has been volatile to say the least. Wednesday offset any gains in the market with a down day to the tune of -13. Today has returned most of what has been lost with wheat being up 11 on the day with news of Paris wheat running up due to shrinking global exportable stocks. $6.36 as we speak. Export sales have been delayed until Friday morning due to the holiday mentioned earlier. Friday’s CFTC report showed that managed money were net buyers this week, bringing the net long back up 3,700 contracts to 60,092. Weather is supposed to warm up across the plains after this cold snap. Only time will tell the possible damage from winter kill.

Soybeans

Beans are having a steady week. South America weather continues to improve and indications of their yields are improving as their crop has gotten slightly bigger. Harvest progress in South America is still behind average pace. Another record monthly output for NOPA crush numbers with 184.7 million bushels, above the average trade estimate of 183.1 million bushels and above last month’s 183.2 million bushels. Cumulative Sept-Jan crush now stands at 896 million bushels, more than 50 million bushels ahead of last year’s pace. Export sales are delayed until Friday due to the holiday. CFTC showed beans net long this week at 171,770 contracts added 15,505 contracts this week. The USDA Ag Forum comes out today and gives us preliminary acreage and yield numbers. Acreage is expected to come at 89.4 million acres with yield being 50.9 bushel per acre.

Milo

Milo has been staying strong as local basis levels continue to tick higher. Between strength in corn futures and a strong NC basis, milo could be buying some irrigated acres in southwest Kansas. Export inspections were down this week at 2.8 mb versus 7.9 mb last week and the 7.1 mb 10-week-average.

Trivia Answers

1. In 2020, it cost the Federal Reserve 7.7 cents to print a $1 bill with the Department of the Treasury’s Bureau of Engraving and Printing.

2. 32