Weekly Market Update 01/07/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team

Trivia

1. What percent of US farm products are exported?

2. How many passengers fly daily in the United States?

Answers at the bottom.

Market News

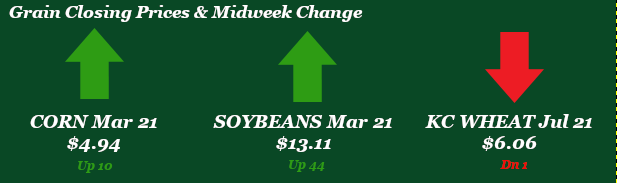

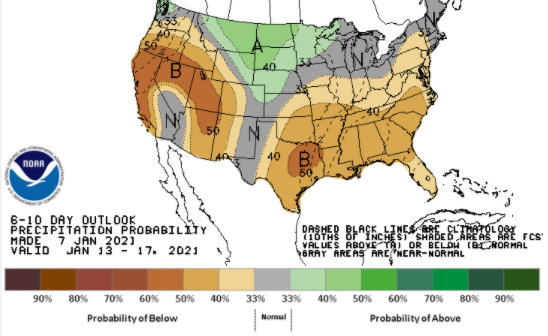

- Markets pulled back slightly today after the massive rally we have seen in all commodities over the past couple of weeks. This rally has really been incredible to watch. We have seen multiple technical signals be wiped out and we have seen any sign of a bearish fundamental be completely trampled. Today we had much softer export sales than we have been used to as well as favorable weather reports for South America. While these could typically signal bearish markets nothing has been able to stop the bull train.

- Markets will likely shift focus to DC as all eyes will be on what happens as we approach the arrival of a new administration. We will likely see many changes in the coming months as we go through the exchange and the markets will be on high alert. The dollar continues to trend higher as well which could have an impact on international markets as we move forward.

- Be on the lookout for the January WASDE set to be released Tuesday the 12th. The report will be out at 11:00am and will be the first look of S&D we get for 2021.

- As mentioned above export sales were a dud this week. This is historical information and must be treated as such. These numbers reflect the last week of 2020 and are probably somewhat skewed by the holidays. Next week will be one to watch to see if we can bounce back from these awful numbers. Soybeans were unable to even reach the bottom end of the estimates and wheat barely squeezed into the estimate range. Corn held its own but nothing to write home about.

| Export Sales Snapshot |

|---|

|

Weather

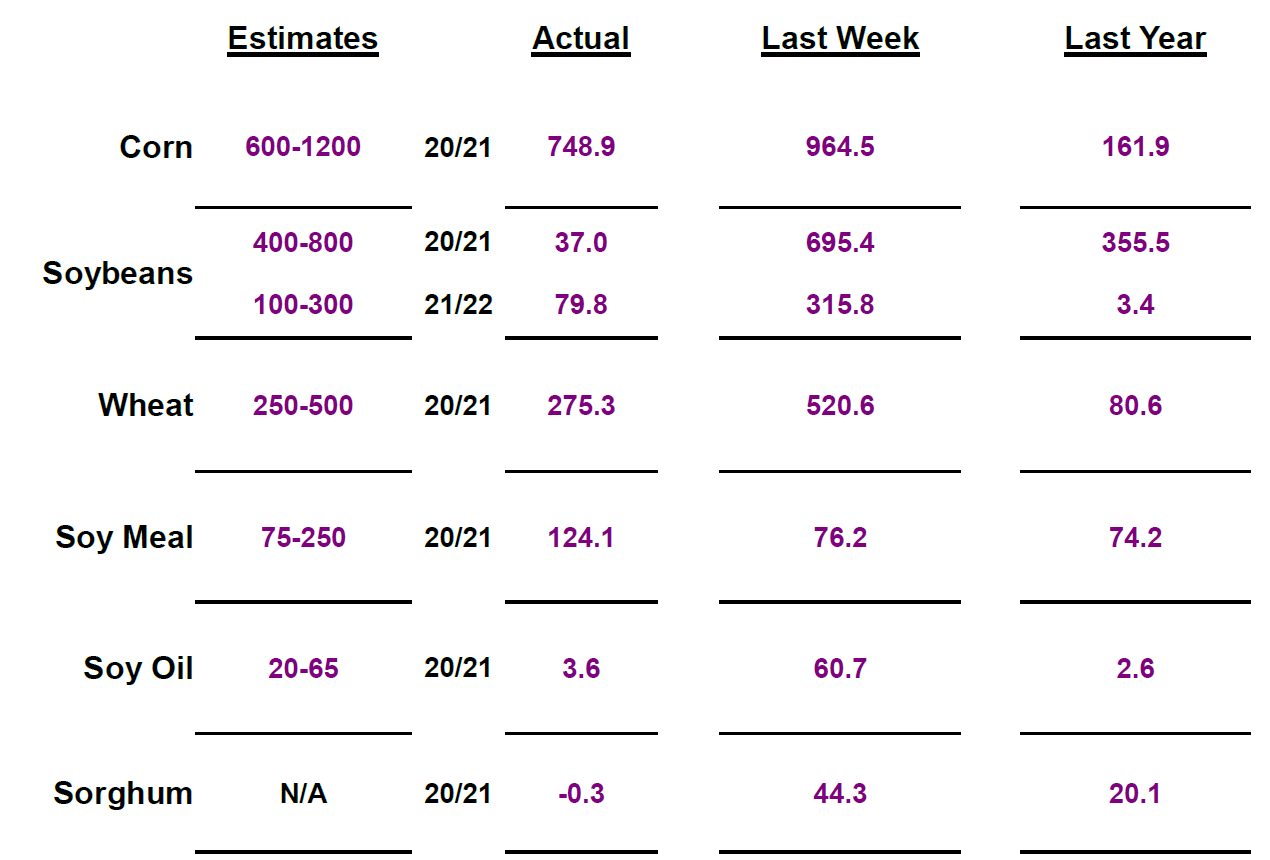

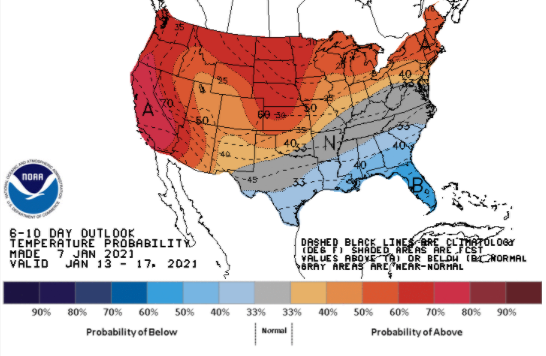

The mild winter continues with highs staying in the 40s and 50s most of the week. Precipitation chances look to be slim to none with Sunday being the only slight chance. Looking at the 6-10 day charts we see the warm temperatures will continue and moisture chances remain average for this time of year.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Corn futures have managed attractive gains through the holidays. Since Christmas CH has managed an over 40-cent gain with CZ holding a 15-cent gain. Over the last year corn has traded a 1.80+ range. Exports were a large added factor to the strength in corn with China, Mexico and Japan being the top 3 importers of U.S. corn. Monday’s CFTC had corn funds long at 332K. Wednesday’s ethanol report held little hope at year-end. Stocks were up WoW while production was down and production levels were still roughly 13% off average. Export sales report this morning also left some to be desired as corn saw 29.5 million bushels move versus the 58.5 mb 10-week average. With high demand nearby, corn stocks could run thin into the summer. Locally basis remains steady for feed and ethanol demand is lighter. Look for pricing opportunities as the market sits higher than normal on futures and basis. Stair stepped offers could be desirable here.

Wheat

Wheat is cooling off today, after following row crops on a wild ride up over the last couple of weeks. Front month KC wheat futures traded at highs this week not seen since early 2015. Managed money is also adding buying momentum, reported on Monday as having added 4,016 contracts to bring their net long up to 55,560 contracts. After a disappointing previous week, export inspections were back in line this week at 4.6 million bushels compared with a 10-week average of 5.0 million. Destinations were Japan, Mexico and Columbia. Export sales were disappointing at 900,000 bushels, compared with a 10-week average of 4.8 million. Taiwan was the primary destination. USDA won’t release crop conditions until we get further into the year, but this week we saw a round of state updates. Colorado is reported at 19% good-to-excellent, down 1%; Nebraska at 37% good-to-excellent, up 2%. December precipitation in areas pushed Kansas conditions up 13% to 46% good-to-excellent. Wheat across our draw area could use a drink in the areas that missed December moisture. Local basis remains steady and this board rally has created attractive selling opportunities in the old and new crop thought. It’s worth considering what levels make sense for your operation.

Soybeans

Despite a cool off today, soybeans have continued to rip higher with bulls in the driver’s seat, up ~$3 in the nearby month in the last 60 days and almost $2 in the November 2021 contract. Issues in South America paired with a weaker US dollar, fund buying and lack of offset by farmer selling have fueled this market. Loading of exports in Argentina has been lagging, with grain inspectors on strike and farmers threatening to go on strike. South American weather continues to be a story of rains in the forecast and delivering, but typically not as much as projected. However, rains have been enough to keep hopes alive of a decent crop. This week’s CFTC report indicated that funds continue to buy beans, adding 7,864 contracts to bring their net long up to 196,487 contracts. Export inspections this week were on the lower end of estimates at 48.0 million bushels, well below the 10-week average of 93.4 million. Export sales were disappointing at 1.4 million bushels in the old crop slot and 2.9 million bushels in the new crop slot. Traders will be watching for what continued export demand means for the already-tight soybean carryout in next week’s WASDE report. For now, the market will continue to keep a close eye on headlines out of South America.

Milo

With corn futures riding high and milo basis strong, many saw $6 milo over the holidays. Current exports came in this morning at 0, though new crop milo saw 3.9 million bushels of sales to China and Unknown. Stocks look to dwindle quickly. New crop milo definition is still a moving target, but with strong futures and a historically strong basis, locking in new crop milo is not a bad idea. Locally basis remains steady.

Trivia Answers

1. About 25 percent of the farm products grown in the United States are Exported.

2. 2 Million, While this has surely changed since Covid-19, about 2 million people were boarding an average of 30,000 flights daily.