Weekly Market Update 7/22/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

-

Before the Beatles were formed, John Lennon, Paul McCartney, and George Harrison were originally members of what music group?

-

Who was the first woman to win a Nobel Prize?

Answers at the bottom.

Market News

-

Sell off in today's markets following two weeks of big weather-driven rallies. Weather maps are mixed, but still show mostly hot and dry weather across the majority of growing areas through the end of the month. However, it's a wait-and-see because much of the crop looks decent at this point. Expect more volatility as the weather maps continue to change.

-

Energy markets are recovering after being sharply lower to start the week. Last Sunday, OPEC+ agreed to boost production by 400,000 barrels/month starting in August. Monday was the worst day for U.S. oil since September 2020, trading as low as $65.47. WTI crude oil is up over $1/bbl in today's session, as traders still expect tighter supplies through 2021 as economies continue to recover from coronavirus.

-

Stock markets are range-bound but slightly higher after a surprise rise in unemployment. Weekly jobless claims unexpectedly moved higher to 419,000 new claims, well above the average estimate of 360,000. US Dollar index is hanging out around 92.8, after flirting with lows near 92.5 earlier in the day.

|

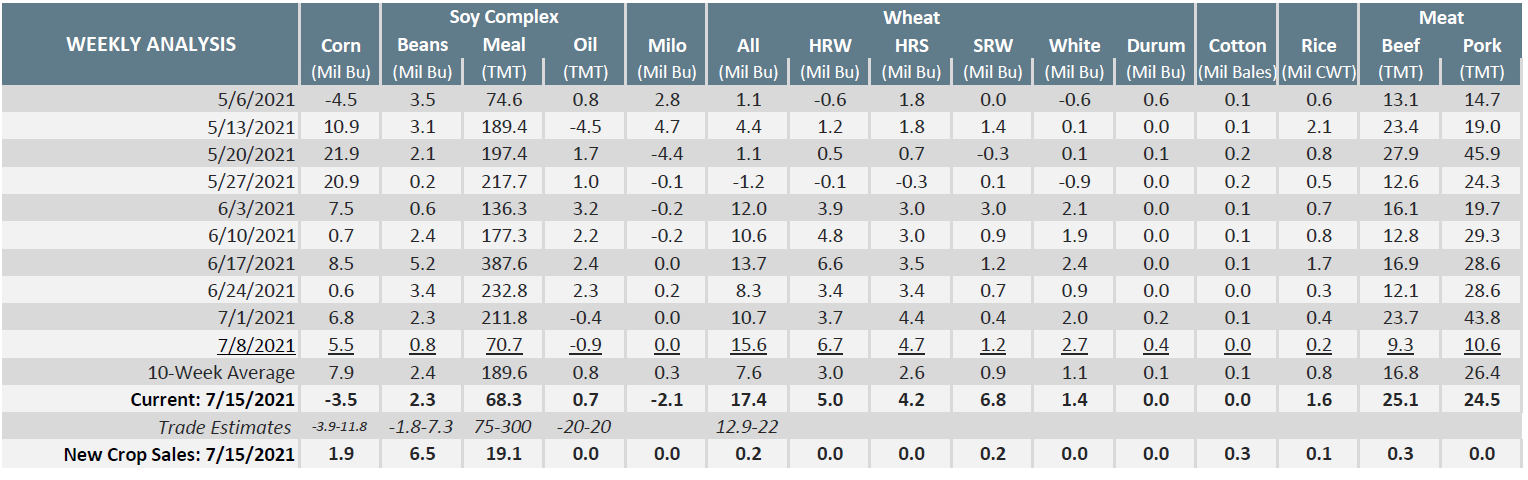

Export Sales for Week Ending 7/15/21 |

|

|

Weather

Hot and dry is the name of the game for our area, with the extended forecast showing above normal temperatures and below normal precipitation. The below weather maps show that this will be predominant across large parts of the Corn Belt in the 6-10 day. Southwest Kansas daytime high temperatures next week are predicted to be in the high 90s, breaking through 100 degrees on Tuesday and Wednesday.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Corn closed down 7 cents on the day, but futures are up 9 cents for the week. Corn looks to be setting up for some sideways trading as much of the crop looks decent and CFTC funds showed another 10K contracts in sell off. Dec corn will still look to fill that ½ gap it can’t quite seem to touch. Market still trading heavily on weather and lack of much substantial news. Monday’s export inspections stayed steady WoW at 39.4 million bushels versus 39.5 million bushels the week previous, still 1% above seasonal pace. Inspection numbers are still well-below the 10-week average of 61.6 million bushels. Crop progress pegged Kansas corn at 74% good to excellent versus 70% last week while US ratings saw no change from last week at 65% good to excellent. The market was expecting a 1% rating improvement but did not see it. Wednesday’s ethanol production showed the second week of decline at 1,028 thousand barrels per day. Export sales report this morning left much for wanting as 3.5 mb in corn cancellations were reflected. Last week sales were pegged at 5.5 million bushels and the 10-week average sits at 7.9 million bushels. Locally corn feels weak, though weakness could be short-lived.

Wheat

We are seeing a selloff today after about a 2-week rally of 80 cents. Not much for storylines other than weather. 11-15 day maps are trending wetter now. Earlier in the week the market was getting support from rumors of China shopping for hard wheat at the gulf, as well as problematic conditions and yields in the EU and Black Sea. Export inspections were strong this week reporting 18 million bushels shipped. Export sales were inline with trade estimates showing 17.4 million bushels of old crop sold. Spring wheat is still the main story in the wheat complex. The crop progress report lowered the conditions to 11% good-to-excellent. Not a surprise due to the lack of rain in the north. Winter wheat harvest is 73% complete nationwide. Kansas being almost wrapped up at 96% complete. KC wheat funds added 787 contracts to the current long position of 21,667 contracts. We will see if extended weather maps continue to show possible moisture, if so look for pressure on the market to continue.

Soybeans

Weather is the main driving factor for beans at this point in time. The U.S. soybean crop is off to a great start, but the next few weeks are important and will be telling, moisture in that time frame would be greatly appreciated. Extended maps are looking wetter and realized rainfall would be a huge benefit. Beans have been trending down this week, but traders are looking at this as a buy low opportunity. Export inspections this week were a snoozer at 5.3 million bushels shipped, within trade guesses. Loadings to date are running 7% ahead of schedule or 154.8 million bushels ahead of USDA pace with 6 weeks left in the marketing year. Export sales were inline with trade assessments indicating 2.3 million bushels of old crop and 6.5 million bushels of new crop sold. Crop conditions held strong this week improving 1% to 60% good to excellent nationwide. Kansas saw a 6% bump to 68% good to excellent. Funds showed 593 contracts bought this week, this brings the current long position to 82,773 contracts.

Milo

Milo conditions weakened this past week as Kansas ratings came in at 71% good to excellent versus last week at 74% good to excellent. US ratings were pegged at 68% good to excellent versus 70% good to excellent last week. Export inspections were a snoozer for milo coming in at 2.5 million bushels versus 2.9 million bushels last week and the 10-week-average of 3.7 million bushels. Export sales on Thursday also left much to be desired at 2.1 million bushels in cancellations verses last week’s goose egg and the versus the 10-week- average of .3 million bushels. Locally, milo basis stays steady.

Trivia Answers

-

The Quarrymen

-

Marie Curie (1903)