Weekly Market Update 6/24/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

The term SPF is on all sunscreen bottles. What does it stand for?

-

Olympic gold medals are not made primarily of gold. What metal makes up 92.5% of an Olympic gold?

Answers at the bottom.

Market News

-

Weather is dominating the commodity markets, as rains across the heart of the corn belt have eased some of the stress in Iowa and other surrounding states. Dryness concerns remain for the Dakotas and Minnesota.

-

Nasdaq and S&P 500 both rose to record levels today after reported progress on a federal infrastructure spending deal. The proposed bipartisan bill is expected to increase federal spending by $600 billion to invest in roads, broadband internet, electric ultilities, and other federal infrastructure projects.

-

Wheat harvest is rolling across Garden City Co-op country. Overall, we are hearing better-than-expected yields with heavy test weights and low protein. We hope you all have bountiful and safe harvests.

-

USDA will release the June Acreage and Stocks Report next Wednesday. This historically is a big market-moving report. All eyes will be on where USDA pegs planted corn and soybean acres, with the trade expecting an increase based on high prices and favorable planting weather.

|

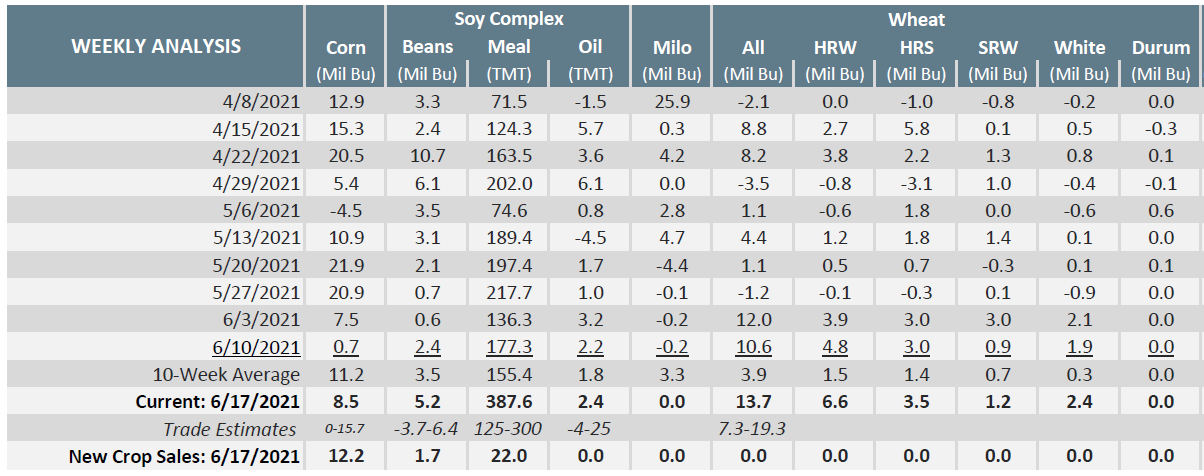

Weekly Export Sales Report |

|

|

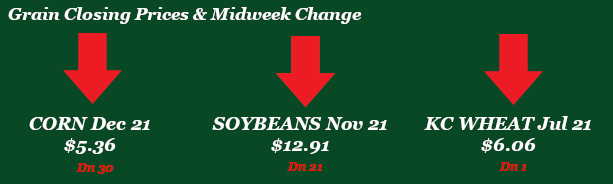

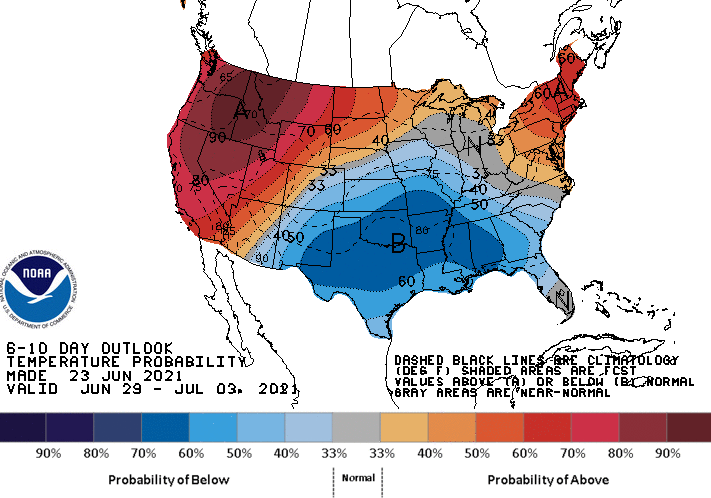

Weather

After a week of scorchers, Mother Nature looks like she's going to give us cooler than normal temperatures for the next several days. Highs are forecasted in the 90s today and tomorrow, but the weekend and early next week cools off to highs in the 70s. Today and tomorrow have chances for thunderstorms and slight chances for rain remain in the forecast into next week.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

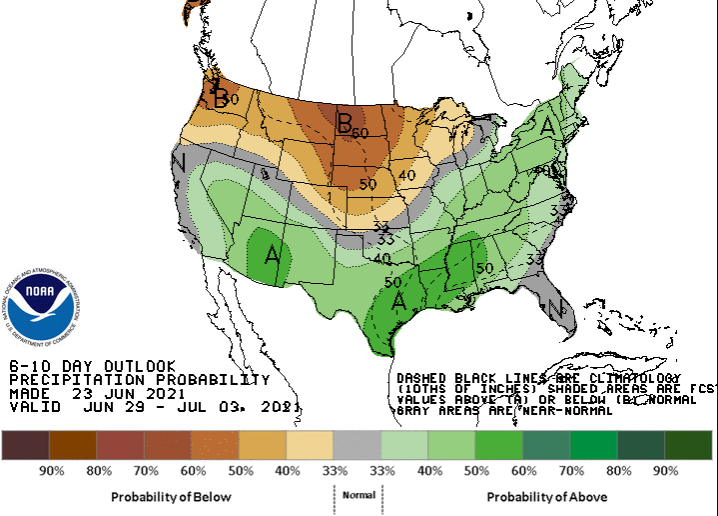

Corn

Rain makes grain. Corn futures took a tumble last Thursday on fundamentals, though Friday into Monday did offer decent price recovery. However, recovery was short lived as decent rains moved through the corn belt on Tuesday pushing corn futures lower and left bears licking their lips. Monday held a data push with corn export inspections at 58.3 million bushels, the CFTC report showing corn funds at 252K long, and crop conditions declining with the U.S. at 65% good to excellent (down 3%) and Kansas at 71% good to excellent (down 4%). Ethanol still seems to be hanging on to the “pre-covid normal” levels as stocks, production, and demand are all stronger this week. Export sales this morning remain on the weaker side for corn at 8.5 million bushels for the current marketing year and 12.2 million bushels for the 21/22 marketing year. Locally basis is weaker and corn seems to be at a standstill. You can’t pay anyone to take the stuff.

Wheat

If you want to say there is a winner in the grain complex this week it would be wheat. The northern areas that are struggling with spring wheat caused KC wheat to get a bump yesterday and has kept the other days from being big downers so far this week. Weather is still the storyline for grains with rain chances across the corn belt increasing and putting pressure on futures. The crop progress report from Monday shows winter wheat harvest 17% complete for the U.S. Kansas is at 13% complete, down from last year’s 23% and the 5-year average of 24%. Export inspections for the week came in above the trade estimates at 20.2 million bushels shipped. Export sale were within trade guesses at 13.7 million bushels, hard red winter wheat was the leader with 6.6 million bushels sold. Funds showed KC wheat pulling back from their long by 2,226 contracts bringing their net long to 17,487 contracts.

Soybeans

There have been multiple export sales this week to China and unknown destinations, but this still has not been able to pull the market back up. The sale announced this morning has the market off its lows to start this morning. Projected rains have remained strong throughout prime bean growing areas. Planting is almost wrapped up across the country, Kansas is 90% complete. Condition ratings fell from 62% last week to 60% this week. Kansas got a 3% bump up to 68% good to excellent. It will be interesting if the projected rains occur what the crop condition could improve to. No big surprises for soybean inspections this week, 6.4 million bushels were shipped. Export sales was another snoozer coming in at 5.2 million bushels sold, with 1.7 million bushels of new crop sold. Soybeans were the big sellers this week on the CFTC report, selling off 33,991 contracts bringing the existing long position to 107,492 contracts.

Milo

Milo just kind of hanging on for the ride as corn does its volatility thing. Basis seems to be hanging in there as planting is finishing up. Crop progress this week had Kansas sorghum 85% planted with the US aggregate at 88% planted. Crop condition came in at 74% good to excellent for Kansas and 73% good to excellent for the US aggregate. Monday’s export inspections had milo at .07 million bushels, and Thursday’s export sales came in with a goose egg, which is better than the past 4 weeks of cancellations.

Trivia Answers

-

SPF stands for Sun Protection Factor. Regular use of SPF 15 can reduce the risk of melanoma by 50%.

-

Silver. The medals are then plated with at least six grams of gold.