Weekly Market Update 3/25/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What is the driest place on earth?

-

What U.S. state has the most tornadoes?

Answers at the bottom.

Market News

-

The Suez Canal in Egypt remains shut down, as a cargo ship ran aground and became wedged in the waterway. This route is a key trade route, accounting for about 12% of global trade. Roughly 175 ships are waiting to pass through, of which 23 are reported to be oil tankers. WTI crude down today, trading just above $58. Brent crude also down, trading both sides of $62.

-

The US dollar has been gaining some strength this week, trading around $92.8 today.

-

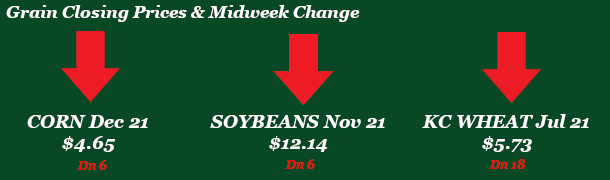

Huge corn export sales in this morning's report, with beans on the low end of estimates and wheat within the range. Market doesn't seem to care much with widespread U.S. rains and risk off selling across the commodities.

-

USDA will release the Quarterly Stocks and Planting Intentions Report next Wednesday at 11AM. This tends to be a market moving report.

-

Markets will be closed next Friday (4/2) for Good Friday. Garden City Co-op offices will also be closed.

|

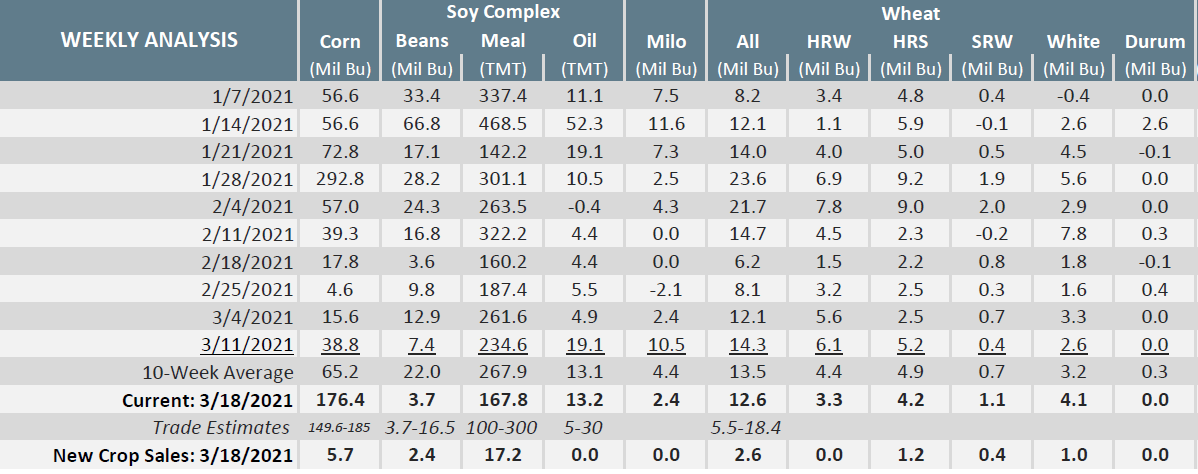

Export Sales Report |

|

Weather

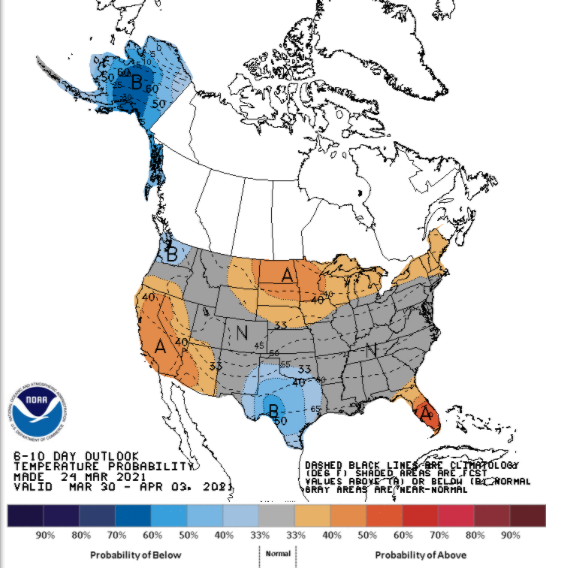

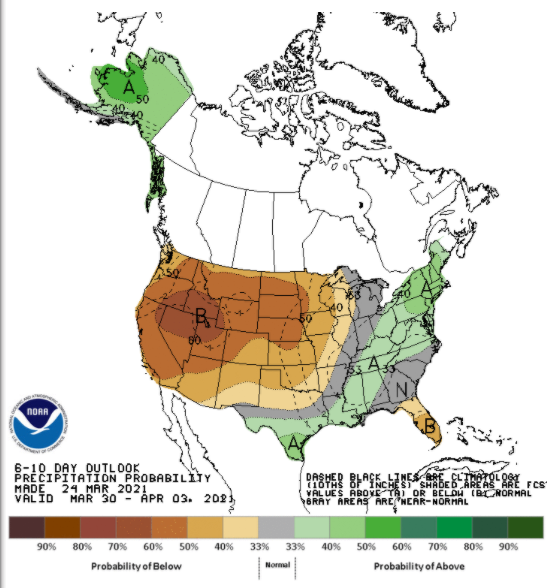

Southwest Kansas has seen some much-needed moisture over the past week with some areas getting in excess of an inch of rain. The 6-10 day forecast has temps sitting around normal for the Wheat Belt with precipitation slightly below normal.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Corn futures are down over a nickel on the week even after last week’s second round of massive export sales. Though downside has prevailed, market upside still has potential into the warmer months. Friday’s CFTC report had corn funds adding 21.8K net contracts on the week, at 370.9K. Export inspection on Monday came in at 77.2 million bushels versus 89.5 last week and versus the 10-week average of 58.8 million bushels. China has shipped roughly 35% of their export commitments as of 3/18, but the question remains as to what happens to ocean freight with the massive amounts of grain China has purchased. IHS Market (Informa) raised its acreage projection for corn to 94.3 million acres versus January’s number at 94.2. This number is also 3.5 million acres above 2020 and beats the 92 million acre number offered by the USDA Ag Outlook Forum. Safras & Mercado reported the Brazilian second-crop corn planting pace sitting at 86%, 4% behind last year’s pace and lower than the 5-year average. Texas corn planting progress sitting at 38% planted as of March 21st which is in line with last year and the 5-year average pace. Ethanol had a gloomy week with 922k barrels per day production, down from a 12-week high of 971k barrel per day. Thursday’s export sales report held a great number for corn with 176.4 million bushels versus 38.8 the week prior and versus 65.2 on the 10-week average. This is the second highest number in the past 12 weeks, just off of January’s 292.8 million bushels. Locally, basis has stayed steady.

Wheat

Wheat has moved to its lowest level of the calendar year this morning. Pressure remains with good moisture, improved crop ratings, and strength in the Dollar this week. State conditions showed good improvement in Colorado (+8%), Kansas (+7%), Oklahoma (+5%), and Texas (+2%) good to excellent. Export inspections came in higher than trade expectations at 23.8 million bushels. Export sales are right in line with trade estimates this week at 12.6 million bushels total, 2.6 million bushels are new crop. Funds showed a sell off of 9,322 contracts this week bringing the total down to 38,342 contracts long. Extended forecasts have shown warmer and drier weather in the 6-10 & 8-14 day maps.

Soybeans

Beans have been mixed this week, showing some strength coming from bean oil, but nothing major for bulls to run on. Export inspections pegged beans at 18 million bushels, toward the higher end of estimates. Export sales this week showed 3.7 million bushels. Something to watch is the total export sales number the USDA has put out for this year. We are well above it and is something the USDA will have to solve at some point if we continue our current pace. South America weather continues to improve allowing harvest to chug along. CFTC report showed a small sell off for beans this week with 3,561 contracts sold bringing the total to 156,040 contracts long. Another item to note and keep an eye on is African Swine Flu within China’s hog herd. Dead hogs were spotted in the river in China and a move in hog prices lower as it appears some areas are rushing hogs to market prior to any kind of ASF mass killing.

Milo

Milo has been fairly ho-hum as corn futures have lost over a nickel the past week and milo basis has seen some weakening. Export inspections pegged milo at 2.8 million bushels this week, down from 11.2 last week and off of the 10-week average of 6.7 million bushels. Export sales also held little hope for sorghum as this week’s sales came in at 2.4 million bushels compared to last week at 10.5 million bushels and the 10-week average of 4.4 million bushels. Locally basis looks to weaken some.

Trivia Answers

-

The Atacama Desert in Chile. There are places in the desert where rain has never been recorded. Arica, one of the desert's largest cities, receives an average annual rainfall of 0.76 millimeters.

-

Texas, with an an average of 140 tornadoes annually, followed by Kansas (80) and Florida (59).