Weekly Market Update 10/07/21

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

How many countries are in the United Kingdom?

-

Name that movie: "It's a full moon tonight. That's why all the weirdos are out."

Answers at the bottom.

Market News

-

Energy markets are making gains today after yesterday's sell off. EIA released its latest International Energy Outlook this week. They are projecting a strong increase in renewable energy into 2050, but also a strong demand for fossil fuels. The report stated that the rising need for energy comes from a projection of strong global economic growth, as well as a growing population. Overall, energy markets feel bullish as inventories continue to get pinched globally.

-

Stock markets are mostly higher today, as investors are happy with an agreement reached in Washington to temporarily avert a government default by mid-month. Lawmakers reached a deal to extend the government's debt limit through the beginning of December. The ongoing debt ceiling debate has been one of a number of concerns in the market in the last several weeks. Traders still have their eyes on supply chain issues, inflation, and what the Fed will do with interest rates.

-

Export sales this morning were mixed, with solid sales to Mexico supporting corn and decent bean sales to China. Milo sales were somewhat disappointing given the large Kansas milo crop that's being harvested.

-

Next week is USDA's October WASDE. No big changes are expected to production/yield at this point, but the trade will keep a sharp eye on any changes that USDA makes to the demand side of the balance sheet. The report will be released at 11 AM on Tuesday (10/21).

-

Our locations now have cash bids posted through Fall 2022. Reach out to your grain team member to see how new crop cash sales could fit into your marketing plan.

|

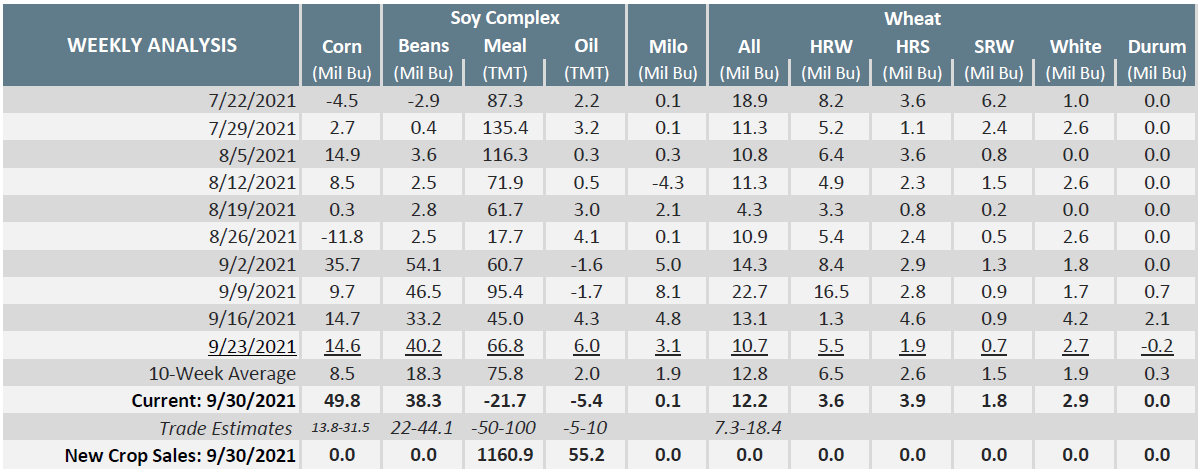

Export Sales Report |

|

|

Weather

The end of last week brought beneficial showers to a large portion of our draw area - slowing down harvest progress but much welcome for wheat going into the ground. Warm, dry weather has dominated this week and should stick around through the end of the week. Rain chances have slipped into the forecast for Sunday, Monday and Tuesday. Temperatures are expected to cool down to highs in the 70s starting Sunday and holding into next week.

|

|

Corn

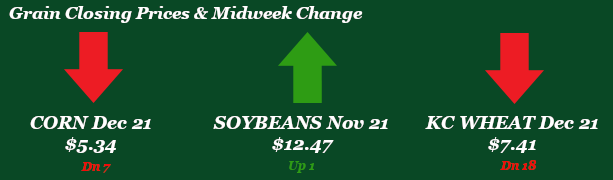

Corn futures are down on the week, seeing some weakness Wednesday into Thursday. Quiet on the news front, with a steady crop progress report and export reports held little surprise. Corn conditions maintained at 59% good to excellent with harvest 29% complete across the US while Kansas corn harvest is at 52% complete. Export Inspections on Monday were 31.8 million bushels versus 25 last week and the 10-week average of 28 million bushels. Corn yield estimates from Stone X this week were cut by .9 bpa at 176.6 bpa while Markit HIS (formerly Informa) estimated corn yields at 176.8. Ethanol did offer a glimmer of hope as production took a solid jump up to 978K barrels per day, which is in line with the 5-year average. This morning export sales were a little bullish at 49.8 million bushels with market expectation of 13.8-31.5 million bushels. Estimated fund position for corn this morning floating around 235k contracts long. Locally, corn basis has seen some strength.

Wheat

Friday continued the party for wheat from the USDA stock numbers, taking the wheat market higher by 27 cents. Monday and Tuesday we saw a little pressure, but nothing major due to limited news. Wednesday saw some green with the wheat market following Paris wheat higher. The overnight market has wheat in the green to start. We will see the market can finish the week strong in the green. Export inspections for wheat this week were above the 10-week average showing 22.5 million bushels shipped, HRS was the leader with 8.6 million bushels shipped. Export sales reported on 9/30/21 were ho-hum for the week with 12.2 million bushels sold, HRS led the way for sales with 3.9 million bushels sold. Last Friday’s CFTC report showed funds adding 7,093 contracts to the KC wheat long of 46,127 contracts. The USDA has pegged winter wheat planting at 47% complete for the U.S. just behind last year’s pace of 50% done. Planting in Kansas was reported at 42% complete behind last year’s 53% done. This is due to the rains we have received in the last 10 days. Rain is in the forecast over the next 7-10 days especially in the Dakotas and Nebraska. Kansas has slight chances over the next 7 days as well.

Soybeans

Soybeans have been steadily trending down this week and for the past few months. The USDA stocks report didn’t help this market trend either with increasing the 2020 crop size. China has been on holiday all this week making the news cycle quiet. Look for the bean market to grind until we get to next week’s USDA WASDE report. Export inspections as of 9/30/21 were solid with 31.0 million bushels shipped. Export sales also joined in on the fun with another solid 38.3 million bushels sold. CFTC showed funds adding 9,610 contracts bringing the current long to 59,311 contracts. Soybean harvest is chugging along. The South American crop is looking for rains, Argentina is the trouble spot as forecasts do not look great. Northern Brazil is expected to get rains and they are much needed in the area. Crop progress report pegged the U.S. at 34% harvested just off last year’s pace of 35%. Kansas is still lagging behind due to rains; harvest is reported at 14% complete behind last year’s pace of 19%.

Milo

Milo feeling a little ho-hum as crop conditions stayed steady and harvest chugs along to 38% complete for the US. Export Inspections this week were 3.0 million bushels while export sales were left wanting at .1 million bushels. Milo new has been pretty quiet. Locally basis is flat.

Trivia Answers

-

The United Kingdom consists of four countries: England, Scotland, Wales and Northern Ireland.

-

Hocus Pocus