Weekly Market Update 09/30/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

The MLB World Series was broadcast on TV for the first time today in what year?

-

What was the nickname for the Ford Model T?

Answers at the bottom.

Market News

-

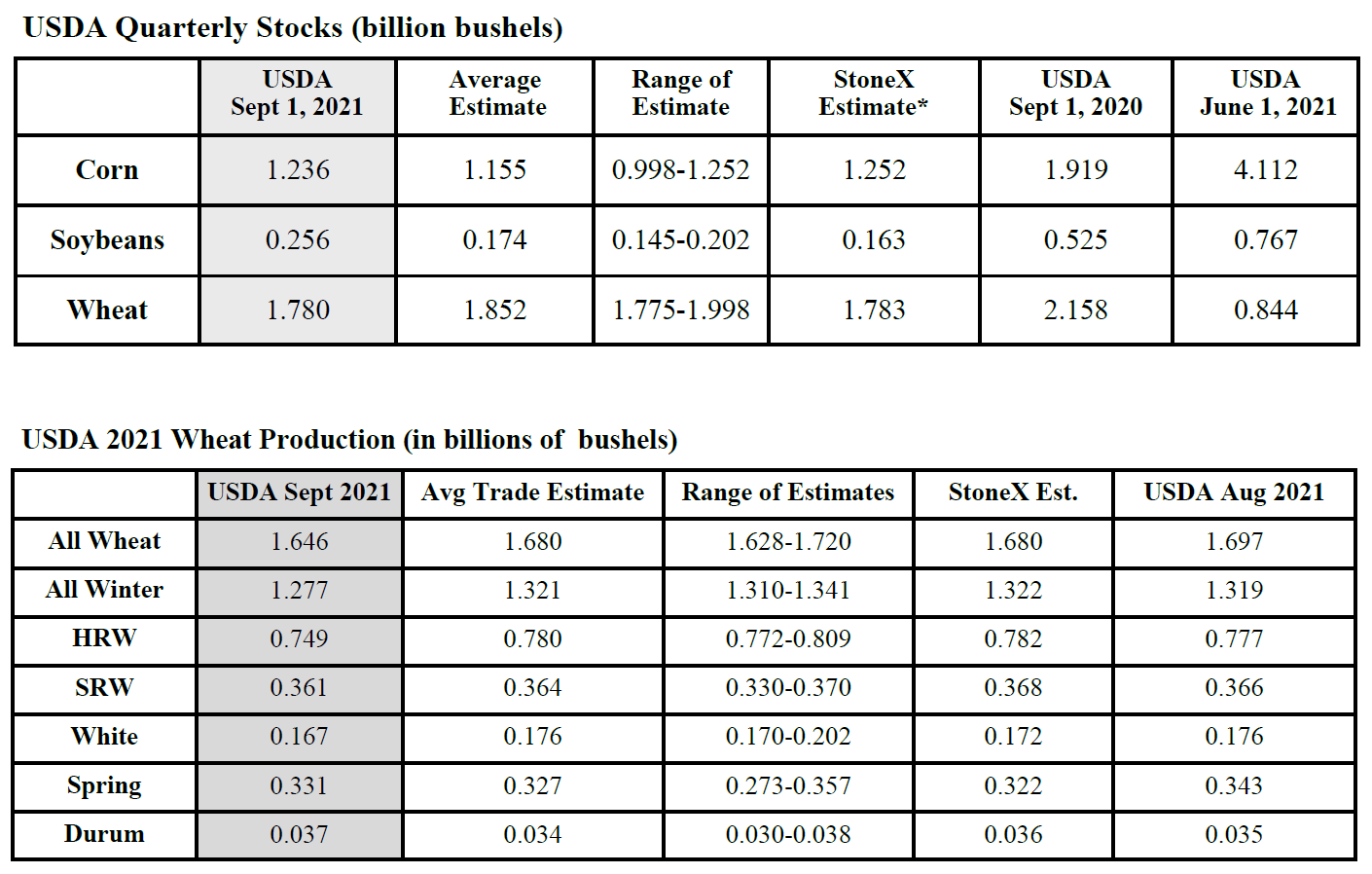

USDA released the Quarterly Grain Stocks report this morning at 11AM. The trade expected drastic cuts to corn and soybean stocks from last year. While stocks are down significantly year-on-year, corn and soybeans were both on the high end of the range of estimates. USDA also lowered wheat production numbers, with hard red wheat numbers seeing a large reduction. Check out the commodity sections and the below graphic for specifics.

-

Stocks are ending a rough September mostly lower today, as heavy selling sets in on the final day of the third quarter. Driving the market are continued concerns about the spread of Covid-19, as well as supply chain constraints and reduced Federal Reserve support. Adding to the pressure is the debt ceiling debate and a potential government shutdown. Even given the dip in U.S. stocks in recent weeks, the indexes are still not far from their record highs.

-

Garden City Co-op is offering a competitive 1% interest rate on proceeds from grain sales that are deferred. Reach out to a grain team member if you have questions or to see if this could be a good fit for you.

|

Quarterly Stocks Report Snapshot |

|

|

Weather

A big chunk of GCC country caught a decent shot of rain overnight, with more chances for rain to come tomorrow and Saturday. Nice rains were realized in many areas where wheat had either been drilled into marginal moisture or hadn't been drilled yet. Temperatures are also starting to make it feel like fall, with highs in the 60s through the weekend and 70s into next week. This week's drought monitor showed little change, except for more dryness starting to creep over central Texas.

|

|

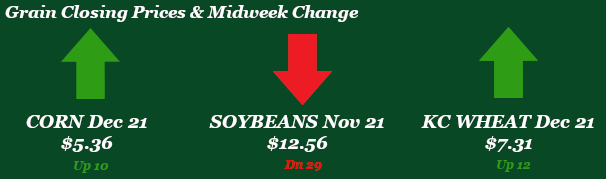

Corn

While corn is higher on the week, it was not necessarily a winner in today's USDA Quarterly Stocks report. Old crop corn stocks were reported at 1.24 billion bushels, which is down 36% from September 2020, but was on the higher end of the range of estimates. Export sales this morning were lackluster at 14.6 million bushels, while inspections were on the high end of estimates at 20.4 million bushels. Yesterday's EIA report indicated that ethanol production declined by 12,000 bpd for the week - the lowest production number this month. Managed money was a buyer of corn, adding 2,121 contracts to bring their net long up to 214,350. USDA confirmed the rapid pace of corn harvest on Monday, reporting the crop at 18% harvested. This is ahead of the five-year average of 15% complete. Ideal weather east of the Mississippi will support continued harvest progress in the Corn Belt, as much-welcome rain delays harvest in southwest Kansas.

Wheat

All eyes have been on the USDA Quarterly Stocks report released today at 11:00 AM. Stocks were tighter as expected. Overall wheat numbers were friendly, with HRW stocks a little tighter than expected. With the bullish numbers reported the KC Wheat market was able to regain losses from Tuesday. Export inspections were sub-par for wheat this week reporting 10.5 million bushels shipped, well below average trade estimates. Export sales were inline for wheat this week at 10.7 million bushels sold, HRW led the way at 5.5 million bushels. Crop progress report showed winter wheat at 34% planted nationwide, this is ahead of last year's pace of 33% and the 5-year average of 32%. Kansas is behind last year’s pace due to dryness, but rains from last night and over the next few days should help alleviate this issue. Last Friday the CFTC report KC wheat as buyers of 1,388 contracts adding to the current long of 39,034 contracts.

Soybeans

Soybeans are the biggest loser from the USDA Quarterly Stocks report. Stocks were decreased, but not near as much as the trade anticipated. This stronger than expected stocks number is sending the bean market into a tailspin today. Before today soybeans had been treading water in anticipation of today’s report. Export inspections pegged soybeans at 16.2 million bushels shipped that was within trade estimates. Export sales were decent as well with 40.2 million bushels sold. This has helped the bean market early on this Thursday morning. Harvest is humming along with 16% completed nationwide, but rains will slow pace just for a short while. Funds showed soybeans as sellers last week, 5,679 contracts sold lowering the long to 49,701 contracts.

Milo

Milo is higher on the week as it tags along with corn futures. Old crop milo stocks were reported at 20.3 million bushels in today's USDA report, down 32% from last year. Export inspections for milo this week were solid at 4.6 million bushels, with China taking 4.4 million bushels of the shipments. Export sales reported at 3.1 million bushels. Basis feels weaker given the lack of any type of aggressive Chinese demand. Harvest is reported at 31% complete, with the Kansas milo crop 11% harvested. Yields are variable as more of our customers get in the field, but rains will delay harvest several days in most areas.

Trivia Answers

-

1947

-

Tin Lizzie