Weekly Market Update 9/09/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What was the original name of the Kansas City Chiefs?

-

What was the first year the Kansas City Chiefs played in Arrowhead Stadium?

Answers at the bottom.

Market News

-

The White House has decided to address meat packing concerns to lower food prices for families. "While factors like increased consumer demand have played a role, the price increases are also driven by a lack of competition at a key bottleneck point in the meat supply chain: meat processing. Just four large conglomerates control the majority of the market for each of these three products, and the data shows that these companies have been raising prices while generating record profits during the pandemic," according to the article from the Breifing Room posted on whitehouse.gov. However, packers like Tyson disagree. According to Bloomberg, Tyson "categorically rejects" the conclusions as higher prices were raised by demand during the pandemic. The current administration, along with the USDA, are looking to crack down on price fixing, work on creating a more competitive supply chain, combat climate change through farmers and ranchers, and make cattle markets more transparent and fairer.

-

The labor market is preparing for an influx of workers as pandemic unemployment compensation, pandemic emergency compensation, and federal pandemic unemployment compensation has ended. There has been little incentive to fill any job openings even with rising wages, but now that subsidies have ended the labor market looks to right itself. Outside markets will feel the affects and interest rates look to rise as the labor market continues its recovery.

-

Corn harvest is ramping up in southwest Kansas as drier-than-normal conditions have allowed the dryland crop to come off a bit earlier than usual. Test weights seem a little lower than normal in many areas and moistures are varied.

-

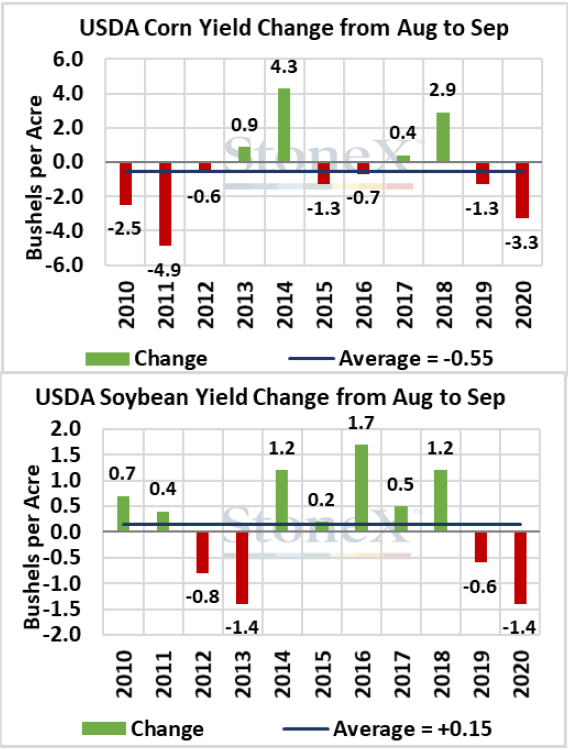

Friday's USDA report will hold yield estimates for the 21/22 crop year. August's WASDE had corn yield pegged at 174.6 bpa, while trade is expecting a 175.8 number for September. 7 out of the last 11 years saw a yield decrease Aug - Sept. While corn prices will start to see harvest pressure, any surprise yield changes will drive the market.

|

10-Year USDA Corn Yield Changes Aug-Sept |

|

|

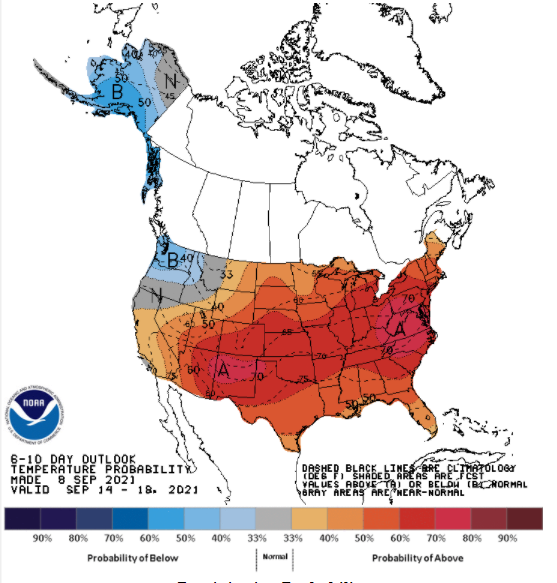

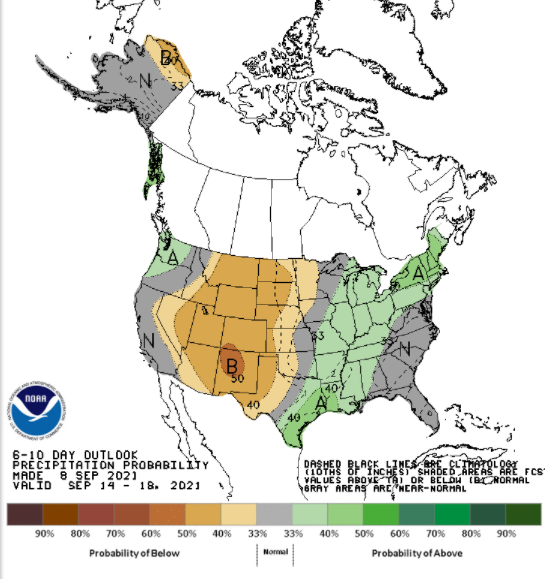

Weather

Dry and hot continues for southwest Kansas as corn harvest ramps up. Temps look to hit in the 100's over the weekend, but taper off into the 80's and 90's at the beginning of next week. Overnight lows look to hit in the 50's and 60's. Chances of any precipitation in the area are slim nearby.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Corn has found itself on a downward tumble ahead of report day. Tomorrow will be information overload – the September WASDE, as well as weekly export sales that were pushed due to the short week. Last Friday’s CFTC report indicated the funds liquidated 12,209 contracts to bring their net long down to 258,785. Export inspections were on the low side of expectations at 10.9 million bushels, with Mexico the largest destination. The Coast Guard re-opened the lower Mississippi River to all traffic this week following Hurricane Ida, as the gulf continues to work towards getting back to business as usual. Staffing and power are the driving issues on terminals that are still shut down. Cooler temperatures and showers across the belt had the market expecting steady crop conditions this week, but Monday’s report pushed the crop down 1% to 59% good-to-excellent. Today’s EIA ethanol report posted a solid bounce for ethanol production and saw stocks fall to a 13-week low. However, this week’s production was the lowest for the first week of September in eight years. Tomorrow could be a wild day with the 11AM WASDE. The trade is looking for increased production based on an increase in both acreage and yield, with this bias further fueled by FSA accidentally posting (and quickly removing) September acreage data on their website yesterday.

Wheat

Wheat continues to churn lower and not much positive news to this point. With hardly any headlines for bulls to grab onto the path of least resistance is lower. The September WASDE is on deck for tomorrow and the majority of traders believe the report will be bearish. Export inspections report this week pegged wheat at 14 million bushels shipped well within trade estimates. The majority to Mexico and out of the Pacific Northwest. Export sales is delayed until Friday this week due to the Labor Day weekend. The fund showed KC wheat as buyers of 314 contracts taking the long to 47,705 contacts. With no new support wheat will continue to grind lower.

Soybeans

Soybeans have been steadily trending down as all the other grains have. Yesterday the FSA had a data dump increasing soybean acres by 897,396 from the August report to 86.2 million acres total. This is weighing down the bean complex today along with an expected bearish WASDE report tomorrow. Export inspections this week for beans was subpar at 2.5 million bushels shipped. Export sales report will be out tomorrow. Crop condition for beans bumped 1% to 57 % good to excellent nationwide. Kansas jumped up 4% to 57% good to excellent. There was a selloff in funds for beans this week decreasing 14,084 contracts lowering the current long to 69,141 contracts. Another flash sale of soybeans to China was reported this morning, but this doesn’t seem to buoy the market under pressure currently.

Milo

Milo just tagging along for this fall in corn futures. Locally, basis feels steady to weaker as we inch closer to harvest. Export inspections were lackluster at 200,000 bushels for the week, with it all headed to Mexico. Chinese demand remains quiet. Crop conditions fell by 1% this week to 57% good-to-excellent, with Kansas unchanged at 56% good-to-excellent. USDA reports the U.S. milo crop at 19% harvested.

Trivia Answers

-

The team was founded in 1960 as the Dallas Texans.

-

1972