Weekly Market Update 9/23/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Who designed the BAR automatic rifle used during World Wars I & II?

-

What musician helped fund the USS Arizona Memorial?

Answers at the bottom.

Market News

-

Stock markets and commodity markets alike plunged to start the week on headlines that Chinese real estate giant Evergrande was on the brink of collapse, as it warned investors that it may have to default on some of its $300 billion debt. Beijing is not expected ro provide direct support to the firm, fueling concerns about the serious blow that their fallout could have on the global economy. The company is due to pay $83.5 million in interest on a $2 billion offshore bond today, as well as a $47.5 million dollar-bond interest payment next week, so the market will be watching intently to see if they can come up with the funds. The company was also scheduled to pay interest on a yuan bond on Thursday, but reached an agreement with the bondholders on that payment.

-

U.S. stocks are up today, as the Federal Reserve kept currenty monetary stimulus in place during yesterday's meeting. A statement following the meeting indicated that if economic progress continues, a moderation of asset purchases may soon be warranted. They didn't give a timeline. The Labor Department posted a surprise increase in initial jobless claims last week at 351,000, above the average estimate of 320,000 and higher than the previous week. The U.S. dollar index has eased slightly from a one-month high, trading both sides of 93.0.

- Crude oil is down this morning, but remains above $70/bbl, supported by growing fuel demand and a draw on U.S. crude inventories in yesterday's Department of Energy report. Fundamentals are bullish with tight inventories, missing production and OPEC+ being over compliant on production cuts.

- Next Thursday (9/30) at 11AM is the quarterly grain stocks report. This report is known for its surprises, creating sharp moves in the market. It will provide the final 2020/21 marketing year stocks numbers for corn and soybeans, as well as provide the final wheat productions estimates for this year.

|

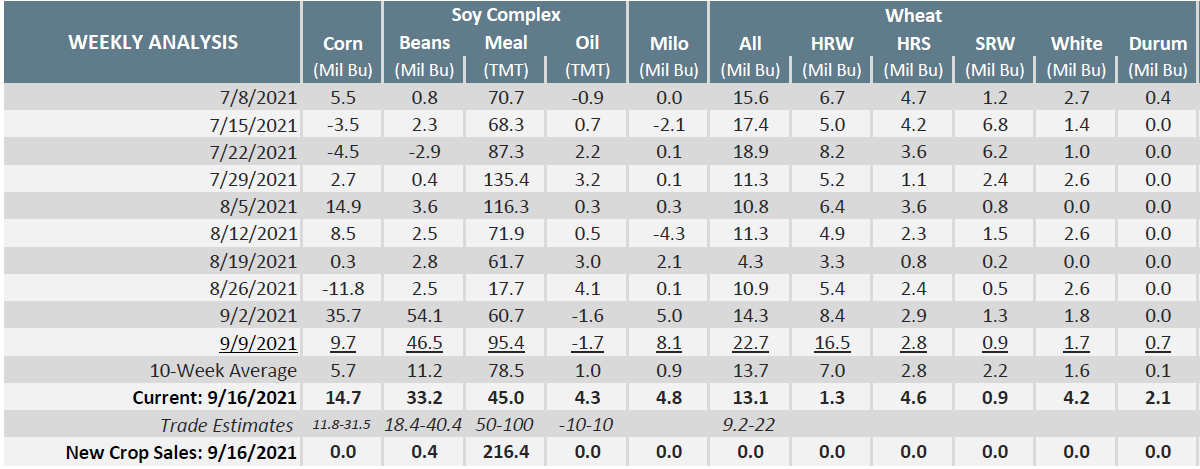

Export Sales |

|

|

Weather

6-10 day forecasts show chances of rain towards the end of next week for western Kansas. Other than that, looks to be sunny and dry, optimal conditions for fall harvest.

|

|

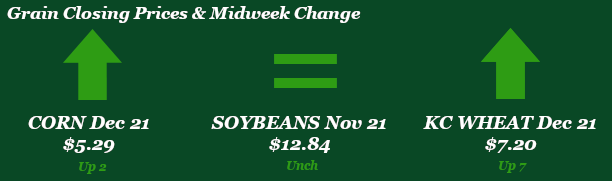

Corn

After all the markets felt the pressure of uncertainty in Asia to begin the week, corn futures are trying to bounce back today despite seasonal harvest pressure. Export sales this morning were on the low end of estimates at 14.7 million bushels, but were still ahead of last week's 9.7 million. Canada, Mexico and Japan were the leading buyers. Export inspections were on the higher end of estimates at 15.9 million. EIA data yesterday indicated that ethanol production was down week-on-week, amid a new round of rumors that the Biden administration is planning to make “big cuts” to biofuel blending mandates. The eastern Corn Belt has received some scattered rains this week, but overall weather has been favorable for harvest progress nationwide. Harvest advanced from 4% complete last week to 10% this week – slightly higher than the 5-year average of 9%. Crop conditions were up 1% to 59% good-to-excellent. Harvest is rolling across GCC country, with most areas reporting average to below-average yields. We wish you all a safe and smooth harvest.

Wheat

Wheat started the week sluggish after the losses from last week, but we have picked up some steam and are trending in the right direction. Wheat has been sparked by Paris wheat the past couple of days. Export inspections were solid for wheat this week at 20.7 million bushels shipped, HRW was the leader of varieties with 8.9 million bushels shipped. Export sales for wheat were within trade guess this week at 13.1 million bushels sold. The CFTC report from last Friday showed KC wheat as sellers of 3,589 contracts lowering the long to 37,646 contracts. Weather maps are showing a better chance of rain next week.

Soybeans

Soybeans forgot to set their alarm on Monday and decided to take the day off. Macro news of the Chinese real estate developer Evergrande’s bankruptcy triggered more selling pressure for beans on Monday. The Chinese holiday ended Wednesday and rumors of them looking for cargoes out of the Pacific Northwest helped buoy the market. Export inspections are starting to pick back up with the gulf slowly opening back up after the hurricane, 10.1 million bushels were shipped within trade estimates. Export sales were decent, but not something for bulls grab ahold of run with 33.2 million bushels sold. Crop progress from Monday report U.S. soybean harvest 6% complete right in line with the 5-year average. The southeast is where the majority has been harvested, but pace is slowly moving north. Funds were sellers for soybeans too, selling 2,136 contracts lowering the long to 55,380 contracts.

Milo

Pressure on corn futures is weighing milo prices down this week, as basis remains largely unchanged in our area. Export sales this week came in at a healthy 4.3 million bushels, down from the previous week but still well ahead of the 0.9 million bushel 10-week average. China bought it all this week. Export inspections were reported at 0.3 million bushels. Harvest is estimated at 25% complete, up 4% from the previous week. Crop conditions were down 1% on the week to 56% good-to-excellent. Milo harvest kicked off in the last week for many of our locations.

Trivia Answers

-

John Browning. He designed the Browning Automatic Rifle (BAR) in 1917.

-

Elvis Presley