Weekly Market Update 4/7/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Kansas University has won 4 men's Division I college basketball championships. What years were the championships won?

-

What American writer/director starred in several iconic European-produced "Spaghetti Westerns"?

Answers at the bottom.

Market News

-

The stock market saw some continued weakness Thursday morning, but managed some recovery into the afternoon. Stocks are trading well off all-time highs with the DOW trading at 34,583, the S&P 500 trading at 4,500, and the Nasdaq trading at 13,897. Equity markets have been disrupted since the Russo-Ukrainian war heightened in February with Russia's invasion of Ukraine. The U.S. did impose another round of sanctions on Wednesday that included a ban on American investments in Russia.

-

Crude oil has dipped off of its March highs and is trading back under the $100/per bbl mark, but there still doesnt seem to be much relief in sight for gas prices. As gas prices across the country broke records last month at an average of $4.33, and averaged $4.16 this week, oil companies are on the defense stating they cannot control market prices that are subject to calculations on supply and demand. Chevron's CEO Michael Wirth stated at Capitol Hill hearings Wednesday, "We have no tolerance for price gouging." Gas prices were on the rise pre-Russo-Ukrainian war, like many goods and services do during high inflation times.

-

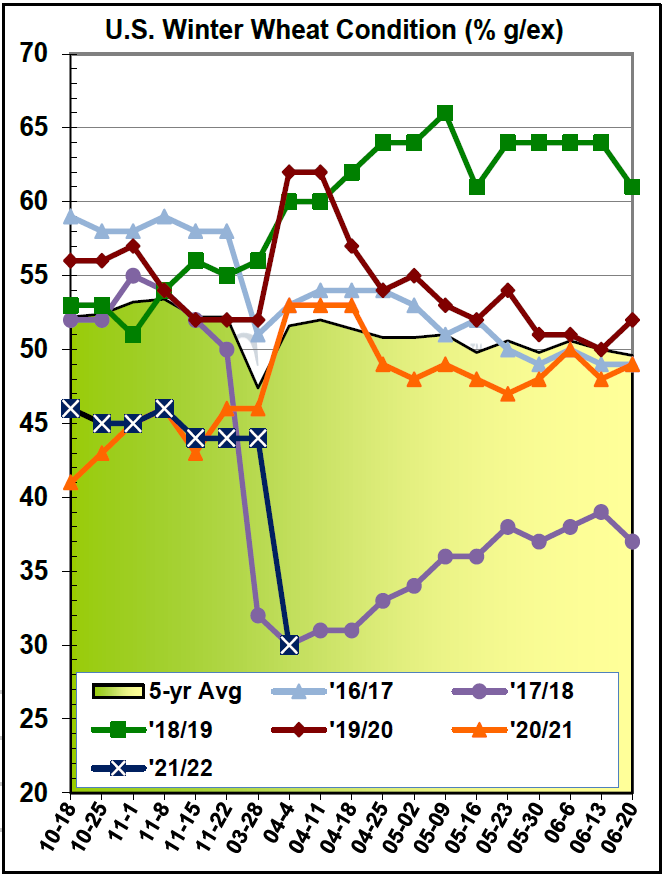

The midwest and high plains took a hit on winter wheat conditions this past week, as drought persists in major wheat-growing areas. Nebraska dropped from 63% good to excellent to 27%, South Dakota dropped from 37% to 27%, Kansas dropped from 61% to 32%, Colorado dropped from 41% to 19%, Oklahoma dropped from 55% to 22%, and Texas dropped from 22% to 7%. Illinois dropped from 85% good to excellent to 48%. The pacific north west is fighting drought as well, as wheat good-to-excellent conditions run well below average.

| U.S. Winter Wheat Condition |

|

|

Weather

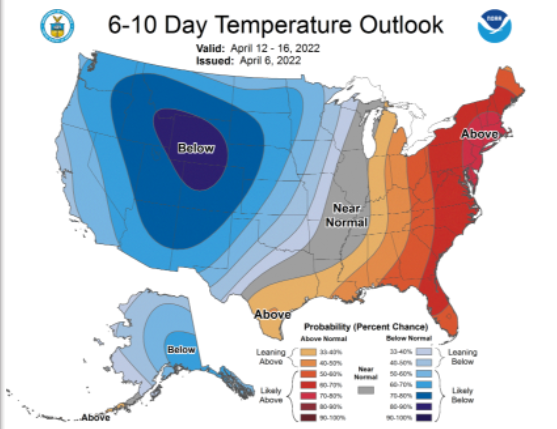

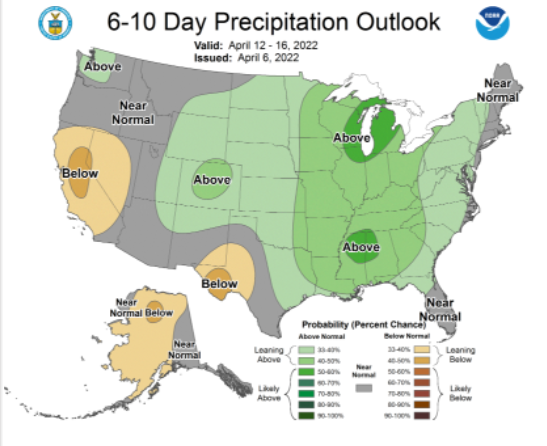

Southwest Kansas has experienced wind gusts up to 60 mph as dust fills the air with no hint to any moisture on the way. Temps look to warm up over the weekend, but will quickly drop back into the 50s and 60s next week with lows in the 20s and 30s. Precipitation chances look grim in the 6-10 day forecast as winter wheat seems to be hanging on by a thread.

|

|

Corn

Corn is quiet today, after December corn tested new contract highs earlier in the week – touching $7.125 in Tuesday’s trade. Flash sales to China of 1.084 MMT between old and new crop gave the market a bounce Tuesday, while the market continues to find support from the ongoing Black Sea conflict. A big question mark remains as to Ukraine’s ability to produce and export corn. Export inspections were decent this week at 60.2 million bushels, but down slightly from last week at 63.6 million. Export sales were also okay at 30.8 million bushels of old crop and 5.7 million bushels of new crop. USDA released their first Crop Progress report of the year on Monday, estimating corn at 2% planted. Texas is easily the frontrunner at 54% planted, but their dry, warm forecast is concerning for seed germination. This week’s ethanol report was a lackluster with production dipping to 1.003 million barrels/day, the lowest number in five weeks. Ethanol stocks also declined for the first time in five weeks but are still historically high. Tomorrow’s April WASDE could create some market excitement – the big-ticket item is what USDA will do with old crop corn exports.

Wheat

Nothing new to report from Ukraine this week as no peace talks materialized. Wheat seems to be somewhat rangebound or trending that way all-be-it a very wide range. The main story for wheat this week was the gap up on Tuesday due to the poor wheat crop conditions report, since the report it has been a slow grind for any momentum either way. Overall winter wheat condition dropped 14% to 30% good to excellent since the last published report back in November. Kansas came in at 32% good to excellent down from 61% good to excellent in November, the 5-year average for this time of year is 45% good to excellent. Export inspections this week remained poor at 10.9 million bushels shipped. The top destination was Mexico most coming from rail shipments followed by the Philippines. Exports sales were unimpressive either at 5.7 million bushels of old crop and 8.2 million bushels of new crop sold. Last Friday’s CFTC report showed KC wheat reducing the long position by 479 contracts down to 45,310 contracts. With little or nothing new from Russia/Ukraine wheat is moving to a weather market.

Soybeans

Beans started off the week hopping on the wheat band wagon riding that bad boy higher. Today soybeans are getting a boost from higher oil prices and are looking to finish the week strong. Export inspections remained strong at 60.2 million bushels shipped, outpacing the 10-week average of 54 million. Export sales were also solid again for this time of year, 29.4 old crop bushels and 11 new crop bushels sold. It will be interesting to see when the South American soybeans hit the export market. It will definitely slow our bean export sales down in a hurry. Beans saw a big sell off from Friday’s CFTC report knocking off 17,919 contracts from the long position. The USDA will release the April WASDE tomorrow at 11 a.m. traders are expecting U.S. and world carryout to decrease. Also, a reduction in South America soybean production is expected. If it remains quiet on the war front the WASDE will be the market mover tomorrow.

Milo

Cash milo is higher with strength in corn futures, while basis is steady to weaker. Export inspections this week were reported at 11.2 million bushels, down from the previous week but still well above the 10-week average of 11.2 million. Export sales were disappointing, with a net cancellation out of China in the old crop slot of 0.4 million bushels.

Trivia Answers

-

1952, 1988, 2008, and 2022.

-

Clint Eastwood.