Weekly Market Update 8/11/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

-

This American sprinter tied Jesse Owens Olympic record with 4 gold medals at the 1984 Summer Olympics held in Los Angeles. What is his name?

-

What historic event spurred the United States to create a new space agency?

Answers at the bottom.

Market News

-

Thanks to a fall in gasoline prices, headline inflation decreased from 9.1% to 8.5% in July. On a month over month basis, topline inflations did not change at all since June. This is the lowest monthly change since 2020. This is finally some real data that suggest the worst of this inflation story is behind us.

-

Yesterday the Department of Energy surprised the market with a large build on crude inventories of 5.5 million barrels as oil producers ramp up in the states. Also, as a surprise was a much larger than expected gas draw of nearly 5 million barrels thanks to solid demand.

-

The Dow Jones is approaching lows for the day currently sitting at 33,322.37 up 12.86 points. The high for the week was made earlier this morning at 33,645.26 points. The S&P 500 is also currently close to the day’s low at 4,207.13 down 3.11 points. The NASDAQ is the biggest loser on the day down 72.04 points to 12,782.77.

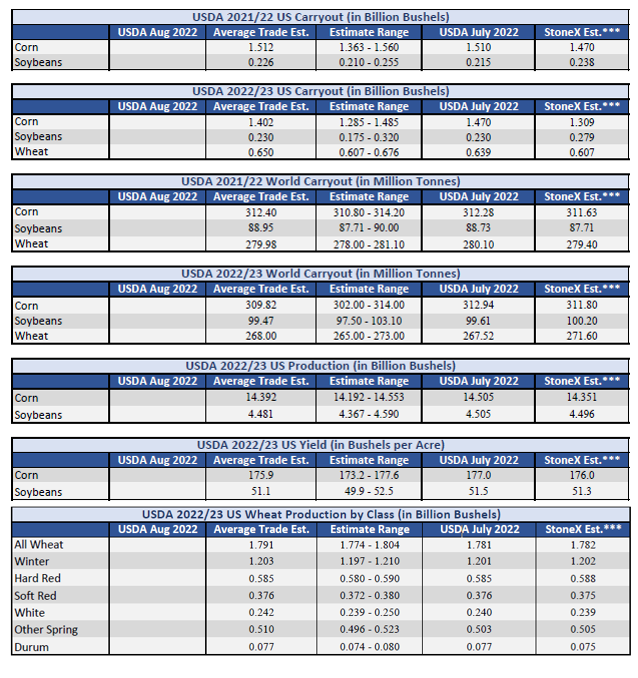

| August WASDE Estimates |

|

|

Weather

We head into the weekend looking at another scorcher for the next few days, but relief is in sight. The middle of next week starts a cooler outlook with some chances of rain. If no rain materializes the cooler temps will definitely be welcomed.

|

|

Corn

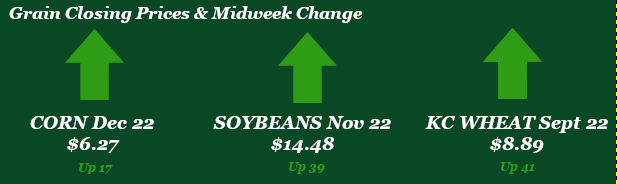

Corn is inching higher this week, trading right around the 200-day moving average. Expectations are that USDA will reduce the yield in tomorrow’s report, translating into a lower carryout for 22/23. Watch out for a volatile trading session tomorrow with the report out at 11am. Hot, dry weather across most of the U.S. has supported the market, with crop conditions falling 3% this week to 58% good-to-excellent. This is lagging behind the 5-year average of 64% good-to-excellent. USDA pegs the crop at 90% silking and 45% in the dough stage. The Kansas crop fell 6% week-on-week, ringing in at only 30% good-to-excellent. Export inspections were lackluster this week at 21.9 million bushels, below the range of estimates. Export sales were okay with 7.6 million bushels of old crop and 7.5 million bushels of new crop. Friday’s CFTC report had funds as net buyers, adding 9,133 contracts to bring their net long to 129,921 contracts. Local basis is weaker in the old crop slot and stronger in the new crop slot, as the prices get closer to converging as we inch towards harvest.

Wheat

Wheat has been a steady riser this week with little headlines. Spring wheat conditions saw a drop of 6% that led Minneapolis wheat higher and KC wheat following. Today we have a weaker dollar to give wheat a boost as well. We saw a decent export inspection report Monday morning with wheat loading 22.2 million bushels slightly above trade estimates. This still puts us behind the USDA seasonal pace. Export sales were middle of the pack with 13.2 million bushels sold, HRW led the way with 7.1 million bushels, Mexico was the top buyer. The CFTC report from last Friday pegged managed money as sellers of 1,049 contracts, bringing their long position to 9,992. The USDA will release their August WASDE report tomorrow at 11 a.m. Estimates are showing an increase to U.S. carryout on adjustments to spring wheat production and demand. Global stocks are also expected to rise.

Soybeans

Beans are on the upward swing this week ahead of tomorrow’s USDA report. The trade will have eyes on two things tomorrow: northern acreage numbers and yield projections. Yields are already threatened in the north due to dryness and there is the possibility of a lower planted and harvested acreage number due to prevent plant. Tune in tomorrow morning to see how it all shakes out. Export inspections this week were higher than estimates at 31.9 million bushels, blowing the 10-week average of 16.6 million out of the water. Export sales were reported at -2.5 million bushels of old crop and 17.5 million bushels of new crop. Demand remains strong both in exports and the domestic crush market, particularly in the west. Friday’s CFTC report had managed money buying 11,795 contracts to bring their net long up to 99,7471 contracts. Crop conditions slipped by 1% this week, coming in at 59% good-to-excellent. USDA has the crop estimated at 89% blooming and 61% setting pods, making weather in the coming days critical across the Corn Belt.

Milo

Milo is garnering strength this week from both higher corn futures and strengthening basis. Basis strength has been more a function of higher corn basis than of anything exciting happening in the milo world. Export inspections were disappointing at only 2.4 million bushels, the lowers number in over two months. Export sales were reported at -0.1 bushels of old crop and 2.7 million bushels of new crop. The U.S. milo crop is pegged at only 29% good-to-excellent, trailing the 61% 5-year average. There have been anecdotal reports that the south Texas crop is down 45% from last year.

Trivia Answers

-

Carl Lewis

-

The launch of Sputnik 1