Weekly Market Update 12/15/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

How long is an Olympic swimming pool (in meters)?

-

Who named the Pacific Ocean?

Answers at the bottom.

Market News

-

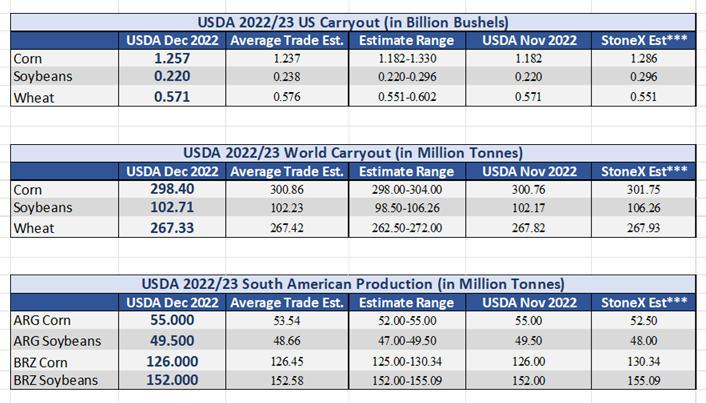

USDA released the December WASDE last Friday morning. It was honestly a snoozer, with USDA by and large kicking the can down the road on changes the trade expected. Only changes to the corn balance sheet were a 75 million bushel reduction to exports, the soybean balance sheet was unchanged, and the all wheat balance sheet was unchanged. Check out the below snapshot for report specifics.

-

The Federal Reserve met yesterday and raised their benchmark interest rate by 50 basis points, to a targeted range between 4.25% and 4.5%. This comes after four other consecutive rate hikes of 75 basis points and is the highest interest rate level in 15 years. Along with the increase came an indication that officials expect to keep rates higher through next year, with no reductions until 2024. The expected "terminal rate," or point where officials expect to end the rate hikes, was put at 5.1%, according to the FOMC’s “dot plot” of individual members’ expectations.

-

The Biden administration is reportedly finalizing plans to send a Patriot missile system to Ukraine - the surface-to-air defense system would help Ukraine repel Russian aerial attacks. Russia has warned that if it sends the systems to Ukraine it will consider the move a provocation that could lead to "unpredictable consequences." This ongoing situation is a stark reminder of the ongoing conflict in the Black Sea.

|

December WASDE Snapshot |

|

|

Weather

If you haven't noticed, it is COLD out there! Temperatures look to stay steady through next week, with winds persisting today and tomorrow. Next Thursday is forecasted to cool off even more, with high temperatures in the 20s and a chance for some snow.

|

|

|

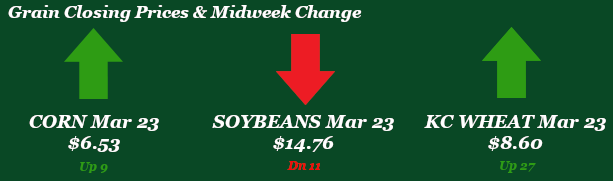

Corn

Corn is content hanging around the $6.50 futures price, after last weeks drop off corn has seemed to have found a landing spot for now. If corn was interested in moving higher the bulls have the ammunition to it today after the export sales report was released. Corn export sales saw 37.8 million bushels sold; this number is actually above the highest trade estimate. I can’t remember the last time this happened. Guatemala was the top buyer followed by Mexico. Corn sales are still on shaky ground if Guatemala is the leading buyer. Export sales projections are still off pace with USDA current numbers too. We did also see a flash sale this morning for Mexico. Export inspections were middle of the pack at 19.9 million bushels shipped. Mexico was the top destination followed by China. Export inspections are also off the pace with USDA projections. Managed money sold off 71,418 contracts according to last Friday’s CFTC report. This would explain the latest slide in the corn market. The current long position for corn sits at 120,213 contracts. Corn like many other commodities are lacking direction and looks to chop around for now until a move up or down can be made.

Wheat

After a strong promising start to the week for KC wheat Yesterday gave back some gains and today is chopping around between red and green on the board. Wheat is looking like it is finding its happy medium to close out the week if no headlines pop up. Export inspections this week were not great at 8 million bushels shipped. HRW was the leading variety with 3.9 million bushels, Japan led all destinations followed by Mexico. Export sales were sold posting 17.2 million bushels sold. HRW & HRS were the leading varieties with 5.3 million bushels sold of each. Unknown led the way for sales followed by South Korea. CFTC report showed KC wheat managed money continuing to liquidate their long position by 7,400 contracts bring the net long to 9,729 contracts. If wheat cannot find direction look for it to continue to chop around between red and green on the board with no significant moves either way.

Soybeans

Soybeans are floundering this week, down more than a dime in the March contract. Weather in South America continues to be closely watched, with early week rains in Argentina not enough to offset the returning pattern of hot, dry weather in Argentina, Paraguay, and southern Brazil. However, most of Brazil is in good to excellent shape and is on track for a record crop - more than enough to offset likely losses in the south. Demand for U.S. beans will be critical for the next month or two as we await the South American crop coming off. Export inspections were so-so, reported at 67.6 million bushels, down from the 10-week average of 74.7 million. Export sales blew trade estimates out of the water this morning, coming in at 108.2 million bushels. The vast majority was sold to China, followed by unknown destinations. Friday's CFTC report showed funds reduced their net long by 2,650 contracts to 99,454. NOPA released their November crush numbers today, with total crush coming in at 179.2 million bushels, below even the most pessimistic trade estimate, and down from 184.5 million last month and 179.5 million last November. Expect beans to keep the status quo headed into the holidays, especially if we continue to lack major headlines.

Milo

Milo saw 200k bushels shipped according to the export inspections report. Mexico was the sole destination for the milo as well. Milo remains very quiet on shipment progress. Export sales were a big goose egg and remain well behind USDA pace.

Trivia Answers

-

50 meters

-

Ferdinand Magellan