Weekly Market Update 2/3/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

The U.S. Supreme Court houses a full basketball court on the 5th floor of the building. What is the name of the court?

-

The Superbowl-bound Cincinnati Bengals assistant head coach and special teams coordinator Darrin Simmons is from what southwest Kansas town?

Answers at the bottom.

Market News

-

No lull in Russia-Ukraine tensions as the U.S. looks to send 2,000 troops out of North Carolina into Poland and Germany while some 1,000 troops already in Germany could go to Romania. Russian Deputy Foreign Misister Alexander Grushko has deemed this step by the U.S. "destructive" and "unjustified." The decision made by the U.S. has increased tensions and further pushed back opportunity for a political solution. This morning Russian President Vladimir Putin's spokesman Dmitry Peskov urged the U.S. to stop escalating tensions in Europe. The Pentagon has stated that U.S. troops would not fight in Ukraine, but would help support any "Washington allies."

-

Stock market not looking very favorable today as Facebook's parent company, Meta, earnings showed a disappointing fourth quarter, dropping 25%. This news sent the market sliding after a 4-day rally. Dow Jones down 288.60, S&P 500 down 71.15, and NASDAQ down 335.73.

-

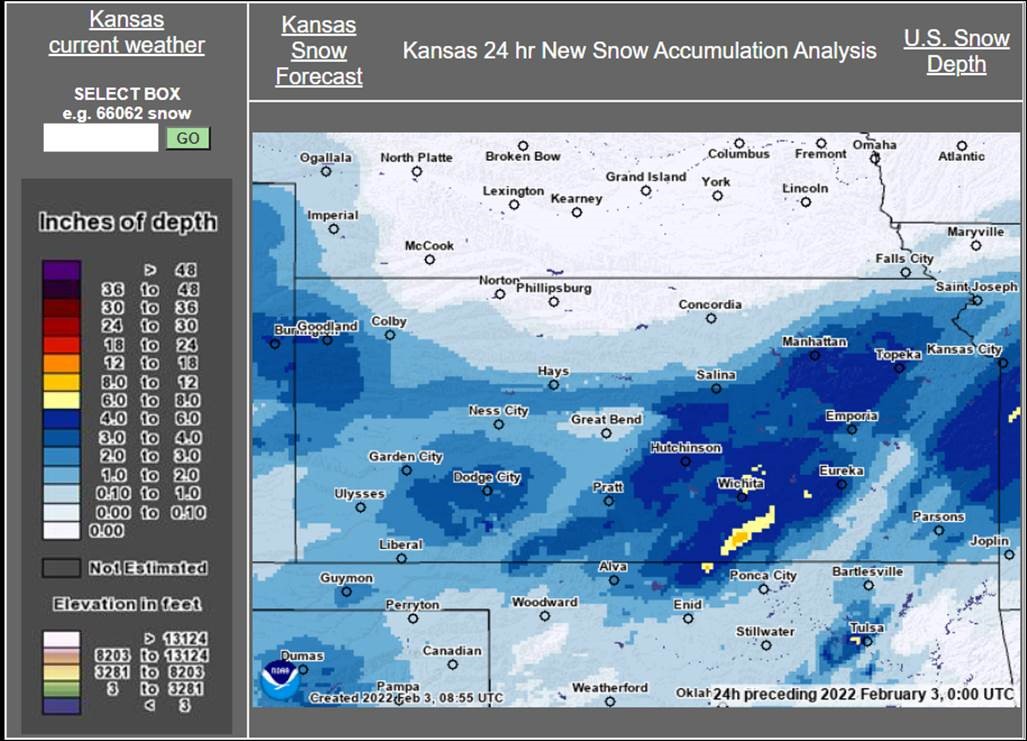

Some much-needed moisture FINALLY hit Kansas as snowfall ranged from .10" to 4" in the southwest portion of the state. The little corner of the wheat belt has not seen beneficial moisture since early fall leaving winter wheat thirsty.

| KANSAS SNOW ACCUMULATION |

|

|

Weather

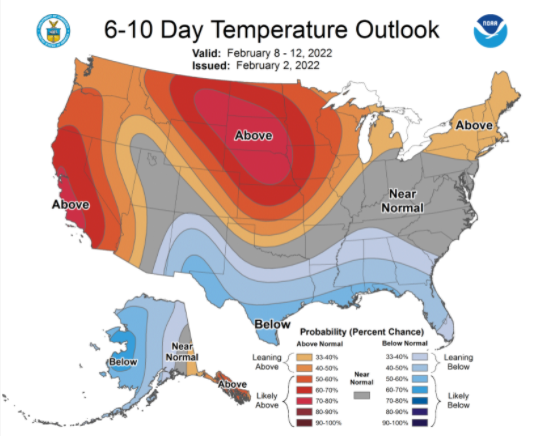

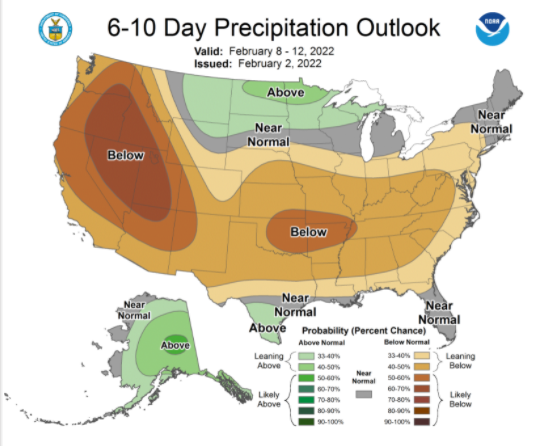

Temps look to warm back up a little after single digits and some much-needed snow hit southwest Kasnas this week. Tempuratures are set to be well above normal in the 6-10 day forecast while precipitation once again backs off and leaves little in the way of hope for more.

|

|

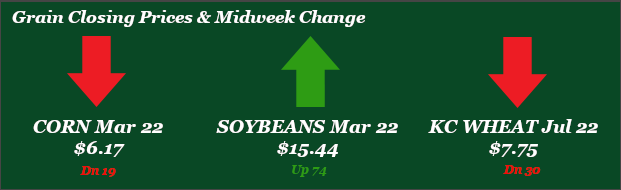

Corn

Corn has been treading water this week. Between wheat trending down and soybeans rallying, it has been wishy-washy for it to grab hold and run with beans. Yesterday’s ethanol report is weighing down the market today with stocks continuing to serge over 5% from last week and are up 30% from October 2021 while production margin has declined due to corn prices and price of ethanol declining. Corn futures are also watching the Russia/Ukraine situation as well and will continue to be monitored. Export inspections for corn reported Monday were towards the lower end of trade expectations at 40.8 million bushels inspected to ship. Export sales for corn were ok at 46.3 million bushels sold. This is just below the 5-year trend for corn. The CFTC report from Friday had corn buying big at 39,082 contracts added to the current long position of 365,605. Look for tomorrow to show corn more neutral. With limited news for the day look for South America rains in the forecast to drag the market lower today.

Wheat

Wheat is seeing some profit taking this week from traders. Monday and Wednesday were especially unpleasant losing roughly 35 cents. The Russia/Ukraine situation is still a major story to keep an eye of but seems to be taking a back seat this week. Look for more “saber rattling” to continue until Russia decides to make a move one way or the other. Wheat inspections this week were weak at 13.3 million bushels inspected to ship towards the lower end of trade estimates, HRW was the leader at 6.7 million bushels. Export sales this week were not good at all. 2.1 million bushels were sold well below the trade guess. This is due to cancellations from multiple buyers. The CFTC report from last Friday showed KC wheat as buyers of 4,515 contracts bringing the long to 40,634 contracts. Look for tomorrows report to show some selling in KC wheat after the overall down week we have had. Snow across the plains should help our overall crop rating for wheat, but it is still very poor and need more moisture.

Soybeans

Soybeans have been the overall winner of the week in terms of market movement. The rally in beans can be attributed to reductions to the South American crop, that no one seems to have a good idea on the size. StoneX Brazil lowered their soybean crop estimate to 126.5mmt down from 140mmt last month. Farmers in South America are holding their crop as well and not letting exporters buy it spurring a rally in prices. Export inspections report from Monday had soybeans at 51.9 million bushels inspected to ship, near the top of estimates. Export sales were decent for beans as well at 40.3 million bushels of old crop sold and 32.4 million bushels of new crop sold. Managed money were buyers of beans from last Friday’s CFTC report totaling 15,565 contracts, bringing the long to 114,895 contracts. Tomorrow’s report will also be in the green. Today we are seeing some pressure probably more from profit taking and traders getting their positions set for next week’s WASDE.

Milo

Milo saw 5 million bushels inspected to ship this week, that is just below the 10-week running average. Export sales for milo came in at 3.2 million bushels sold, overall pretty quiet week for milo.

Trivia Answers

-

"The Highest Court in the Land." The basketball court sits directly above the actual courtroom, so there is no play allowed when court is in session.

-

Elkhart, Kansas