Weekly Market Update 1/20/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What team holds the current longest streak of consecutive seasons with a playoff win in the NFL? Who has the all time record?

-

What is the national animal of Scotland?

Answers at the bottom.

Market News

-

Tensions are continuing to mount in the Black Sea region, with President Biden predicting that Russia's President Putin will order an invasion of Ukraine. As many as 100,000 Russian troops are amassed at the Ukrainian border and could double that number on relatively short order. The Black Sea region is the #1 exporter of wheat in the world and Ukraine is also a major player for global corn exports.

-

Stocks closed mostly lower today, despite trading higher during the session, as rising bond yields and concerns about tighter monetary policy continue to weigh on investors. First-time weekly unemployment filings were up last week, as the latest waves of COVID weigh on labor market recovery.

-

We are enrolling bushels in our Alpine Pro contract for corn and milo. This is a contract that prices futures by a combination of committee pricing and a proprietary rules-based algorithm. This contract is especially unique because of its provision that allows a farmer to be released from the contract penalty-free in the case of verified crop failure. The last day to get bushels enrolled is Monday, January 24th. Reach out to a grain team member if you'd like more information.

|

|

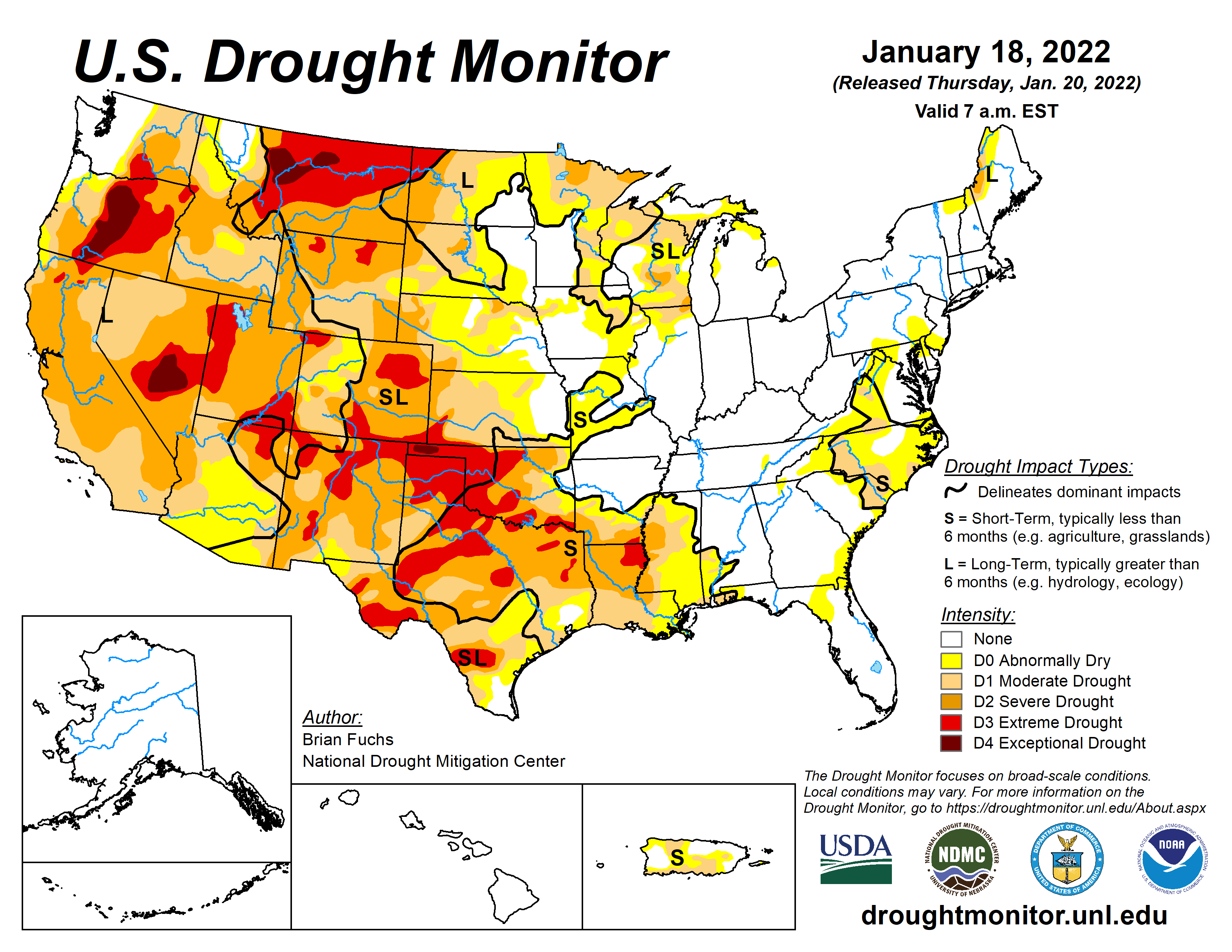

Weather

Frigid temperatures are sticking around today, but are warming up into the 40s and 50s headed into the weekend. Parts of our area received flurries yesterday. Next week looks to repeat a similar pattern, cooling off mid-week and warming up into the weekend. Chances for precipitation remain slim-to-none, with the exception of a slight change next Tuesday and Wednesday. No huge changes in the drought monitor week-on-week, with most of Kansas remaining under at least some classification of drought.

|

|

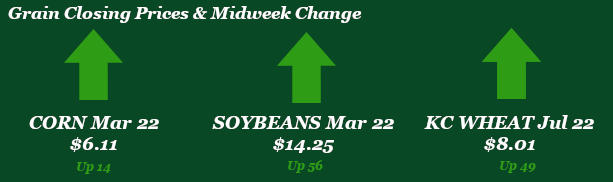

Corn

Corn is higher on the week, mostly riding on the coattails of wheat but also supported by continued concerns in South America. Argentina received rains over the weekend in areas that desperately needed it, but the 6-10 day forecast is back to record heat for northern Argentina and southern Brazil. Northern Brazil has also had some showers, but keep in mind that these showers are creating delays in their bean harvest, which in turn pushes back the planting of their second corn crop. Local estimates of their crop yields have been variable compared to what USDA currently has printed. Friday’s CFTC report indicated that managed money was a net seller for the week ending 1/11, decreasing their net long by 21,526 to 344,379 contracts. Export inspections this week were on the high end of estimates at 47.4 million bushels, with China as the leading destination. We won’t have export sales until tomorrow due to the short week. The market will keep its eyes on the Russia/Ukraine situation and South American weather moving forward.

Wheat

Wheat has been the leader in the club house this short market week. Tensions in the Black Sea between Russia and Ukraine continue to escalate. If Russia were to invade Ukraine wheat would make a jump and it could be a substantial one. Russia and Ukraine are top 3 exporters of wheat in the world. That demand would have to be filled elsewhere. So far on this Thursday the wheat market is taking a little breather, without any new news stories the bears are running out of traction for the short term. Export inspections were toward the high end of trade estimates at 13.6 million bushels inspected to ship led by HRW at 5.5 million bushels. Export sales report for this week is a day behind due to MLK holiday on Monday. Anymore geo-political news headlines to spur a rally need to be watched. Also, we will work our way into a weather market before too long and moisture in the plains is a must.

Soybeans

Soybeans have been on the rally this week too. South American weather has been running headline for a lot of traders. Argentina has received rains and still has some in the future forecasts, but Southern Brazil is where it is dry and the bean crop there seems to keep getting smaller. It is expected for further reductions in the overall crop in the USDA’s February WASDE report. U.S. domestic crush hit a one-month record for December on Tuesday’s NOPA report. Crush showed 186.4 million bushels, almost 1.5 million above the average trade estimate and the highest single-month crush figure on record, ahead of 185.2 million in October 2020. Cumulative Sept-Dec crush stands at 704 million bushels through the first third of the 21/22 marketing year. Down 7 million bushels from last year’s pace. Export inspections for beans were strong reporting 63.2 million bushels inspected to ship, well above average trade guesses.

Milo

Milo saw a decent export inspections number this week at 5.6 million bushels. Export sales are delayed a day this week and will be out Friday. We also had a flash sale of milo to “Unknown” destinations of 126,000 metrics tons.

Trivia Answers

-

Kansas City Chiefs (4); New England Patriots (8)

-

The unicorn