Weekly Market Update 6/16/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Who are the only two non-Presidents featured on U.S. paper currency?

-

What was the first U.S. national park established east of the Mississippi River that is still a national park?

Answers at the bottom.

Market News

-

The Federal Reserve raised its benchmark interest rates 0.75 percent yesterday, their most aggressive rate hike since 1994. Fed Chairman Jerome Powell indicated that he doesn't expect moves of this size to be common, but that he expects to see another increase of 50 or 75 basis points at the July meeting. Through raising interest rates, the Fed is attempting to raise the cost to borrow money, slow economic activity, and bring down inflation that is currently the highest it's been in decades. May CPI rose to a fresh 40-year high at 8.6%, well over the expected 8.2% number.

-

Russia's Deputy Prime Minister said Russia plans to increase their oil production in July, as countries like India and China continue to buy it up. Russian production of oil dropped by about 10% to 10.05 million barrels/day in April from February, after some buyers postponed or refused Russian barrels due to sanctions.

-

Leaders from Germany, France, and Italy met with Ukrainian President Zelensky in Kyiv this week to send a message of European unity, indicating that they would back EU candidate status for Ukraine. Meanwhile, President Biden announced a fresh U.S. infusion of $1 billion in weapons for Ukraine, including anti-ship rocket systems, artillery rockets, howitzers and ammunition. Ukrainian crop production has been reduced, but not quite to the worst case scenario. The European Union Crop Monitoring Service estimated Ukraine’s 2022 wheat crop at 26.9 MMT, down 16% from 2021, with corn at 35.3 MMT, down 16% from last season.

-

Commodity markets will be closed Monday, June 20th in observance of Juneteenth. We will not purchase grain when the markets are closed, but Garden City Co-op offices will be open.

|

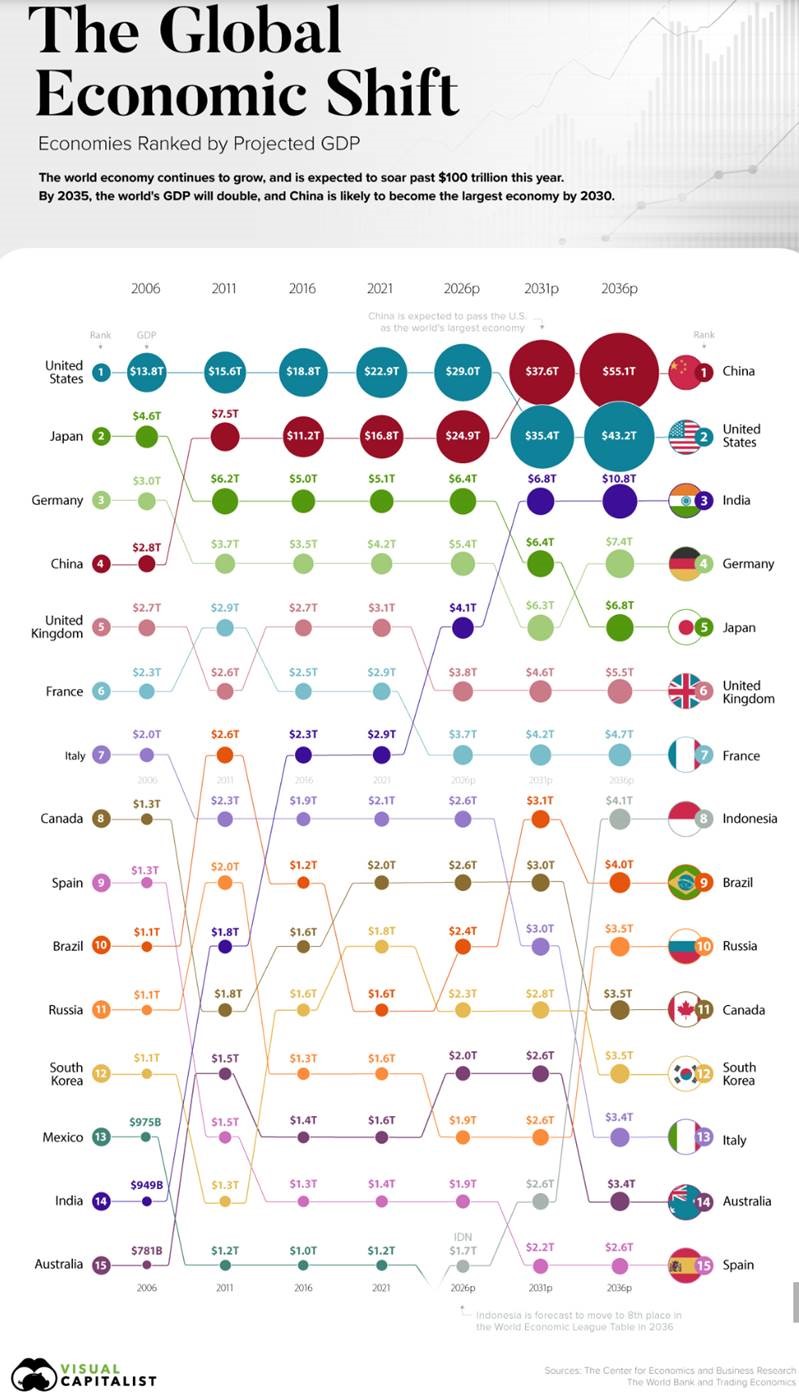

Graphic illustrates an interesting point to consider as world economies evolve - a potential shift in global powers from a GDP standpoint. |

|

|

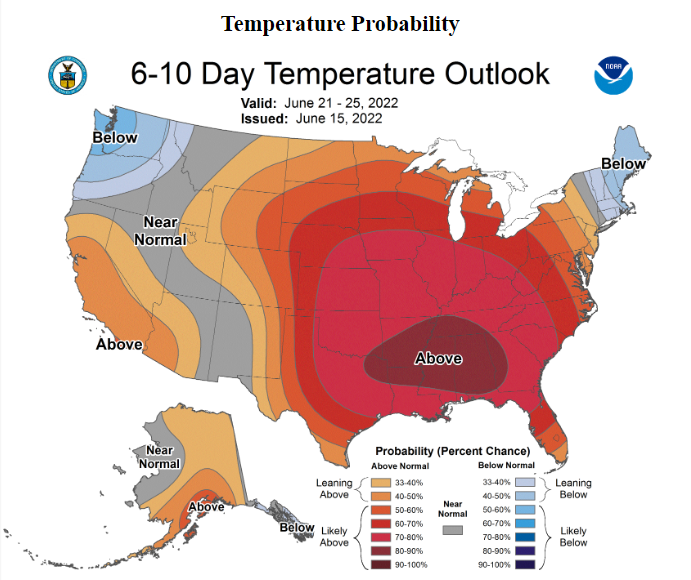

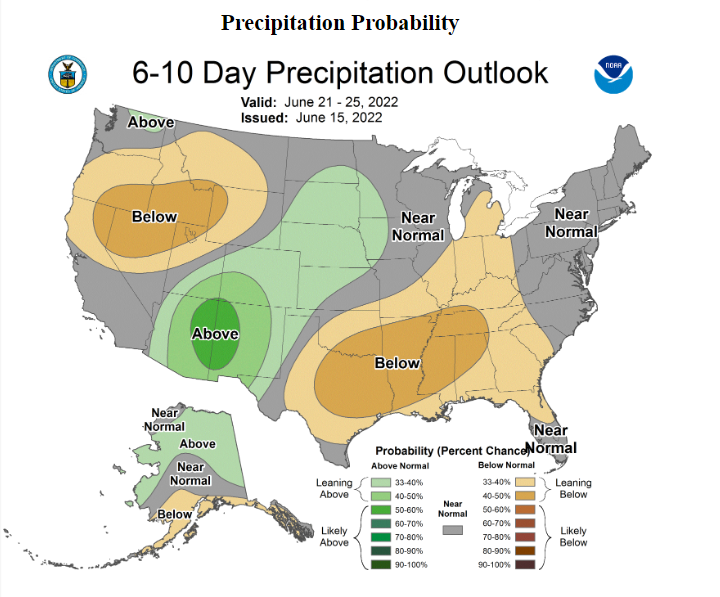

Weather

Weather for the weekend and into the beginning of the week looks to be hot and dry. Temps look to hit high 90s to low 100s for highs, while lows look to be in the high 70s and low 80s. These conditinos are great to help the wheat come off, but southwest Kansas has taken a significant loss in cattle due to the extremely high temperatures. The extended forecast looks to hold highs more steadily in the 90s with lows in the high 60's and low 70s and a slightly higher chance of precipitation.

|

|

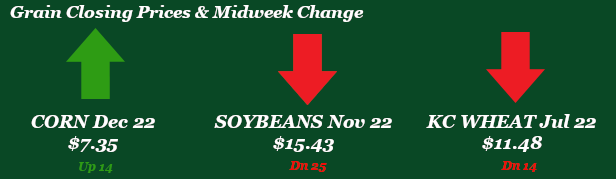

Corn

Corn futures this week have closed mixed with a little strength coming on as the week has progressed. Friday’s June WASDE pegged 21/22 US carryout at 1.485 billion bushels versus the 1.437 average estimate and May’s 1.440 billion bushels. World carryout came in at 310.92 million tonnes versus the average estimate of 308.57 MT and May’s 309.39 MT. The WASDE showed no change in SA production from May’s report. US corn yield remained steady at 177 bpa with 89.5 million acres for the 22/23 crop year. The CFTC report showed a little in the way of sell off on corn managed money, coming in at 264,327 contracts, a 4,637-contract difference form last week. Monday’s export inspections showed sad numbers for corn at 47.2 million bushels versus last week at 55.6 and the 10-week average of 57.9 million bushels. The crop progress report on Monday afternoon had corn planting at 97% complete for the US with Kansas at 96% complete. Corn ratings for the US were at 72% good to excellent, down 1% from last week, but up from last year’s 65% good to excellent. Kansas corn ratings came in a little less desirable at 58% versus 60% last week and last year’s 71%. Wednesday’s ethanol showed stocks down, with production up a tick. Demand is also up. Export sales were also weak this week at 5.5 million bushels for both the current crop year and the 22/23 crop year. Locally basis stays steady. Local shipments have seemed to take a slight ding with southwest Kansas cattle dying from the extreme temperatures. DTN reported this week that 10,000 head have been lost, with the majority being around Ulysses.

Wheat

Wheat is finally in the green this week after spending the last 3 days underwater. Hot/dry weather seems to be the driving factor for bulls. Earlier this week it was announced that Ukraine grain production would be much higher than anticipated, this led to a negative tone for wheat and other commodities. Central Oklahoma is about finished up with harvest and is rolling north into Kansas. Crop progress reported Kansas at 2% harvested on Monday afternoon. After this hot week this number will jump noticeably for next week’s report. Overall the U.S. is reported to be 10% harvested just behind the 5-year average of 12%. Export inspections were middle of pack at 14.3 million bushels shipped. Mexico and Japan were the top destinations with the majority shipped being HRW. Export sales were poor for wheat with 8.7 million bushels sold, HRW again was the leader. Brazil was the number one buyer for wheat. Managed money sold off 3,152 contracts of KC wheat lowering the long to 37,498 contracts.

Soybeans

Beans have been taking some shots this week but look to rebound and make up some of the losses today. The main source for soybeans back tracking has been the energy world taking losses this week, followed by multiple cargos of beans for exports being switched from the U.S. to Brazil. Export inspections were at the top of estimates at 22.2 million bushels shipped. This keeps us above USDA projections for seasonal pace. Mexico and Japan were again the top 2 destinations. Export sales is what is giving soybeans life this morning. Sales reported 11.7 million old crop and 15 million new crop bushels sold. This keeps us well ahead of the USDA pace, but this also put stress on the U.S. to produce come harvest time with all the 22/23 crop year bookings, this makes for a tight balance sheet. Some reports are showing the soybean acres being decreased from the USDA’s projection back in March to be under 90 million acres now. It will be interesting what the acres report looks like come the end of this month, definitely something to watch for. Crop progress pegged soybean condition for the country at 70% good to excellent just ahead of the 5-year average of 68%. The CFTC report had managed money selling beans last week to the tune of 5,702 contracts, lowering the long to 158,928 contracts.

Milo

Milo just following the corn future's cue as per the usual, while basis remains flat. Sorghum crop progress this week had the US 66% planted versus 56% last week and 69% last year. Kansas came in at 54% planted, close to last year’s 56%. Conditions were pegged at 47% good to excellent, which is down significantly from last year’s 73%. Kansas came in above the US average at 55% good to excellent versus 74% last year. Export inspections showed milo at 5.5 million bushels versus 8.2 last week and the 10-week average of 8.5. Export sales were weak again at .1 million bushels with no new crop sales.

Trivia Answers

-

Benjamin Franklin and Alexander Hamilton

-

Acadia National Park (1919)