Weekly Market Update 6/30/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What newspaper originally published the Declaration of Independence?

-

How many people signed the Declaration of Independence?

Answers at the bottom.

Market News

-

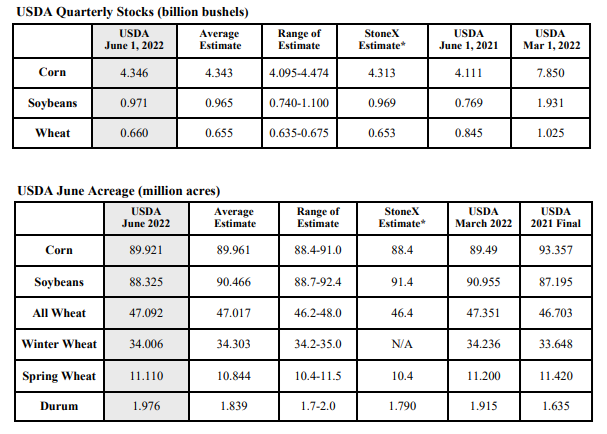

Today was the always highly anticipated Quarterly Stocks and Acreage report. Despite historically being one of the largest market movers of the year, the report didn't hold many surprises for the trade. Check out the commodity sections and the below graphic for specifics. With this report in the rear view, the market will be back trading weather as we head into critical parts of the growing season.

-

Stocks are lower today, as the S&P 500 prepares to cap off its worst first half in more than 50 years. The Dow is on track for its worst quarter since the first quarter of 2020 and the Nasdaq is down more than 20% over the last three months, its worst stretch since 2008. Markets are continuing to feel pressure from surging inflation, Federal Reserve rate hikes, the ongoing Black Sea conflict, and Chinese Covid-19 lockdowns. Prospects of a recession will likely continue to weigh markets down.

-

NATO has formally invited Sweden and Finland to join their alliance, a major expansion that directly undercuts Russian President Vladimir Putin as his war on Ukraine rages on. Turkey previously had objections to the two countries joining the alliance but has since struck a deal and dropped them, paving the way for the two longtime neutral countries to enter the defensive bloc. Russia announced that they have abandoned the strategic Black Sea outpost of Snake Island, a major victory for Ukraine that could loosen the grip of Russia's grain export blockade. Meanwhile, reports are indicating that Russian forces in occupied areas of Ukraine could be stealing grain from local farmers and shipping it to other countries.

-

Garden City Co-op offices will be closed on Monday, July 4th for Independence Day. Commodity markets will also be closed. Grain elevators will be open as needed for harvest - please communicate your needs to your local elevator manager.

|

Stocks and Acreage Report Snapshot |

|

|

Weather

Not many changes in the weather pattern headed into the holiday weekend. Hot and dry remain the name of the game. Highs will remain in the upper 90s to over 100 degrees in the coming week with some scattered chances of storms. Kansas Governor Laura Kelly updated drought declarations for all Kansas counties on Monday, with all 105 Kansas counties either in a watch, warning or emergency status. All of our trade territory has been placed in emergency status.

|

|

Corn

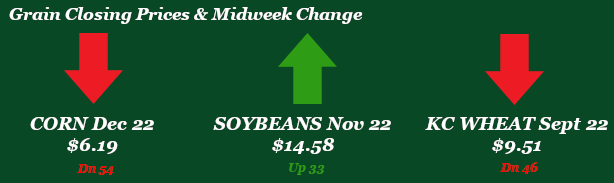

Corn continues to lose momentum as the past couple weeks have seemed like an almost free-fall. 200 day moving average shows some support potential at $6.14, but it could be a glass floor. With rain in the forecast and a slight uptick in acres on today’s quarterly report, corn support could creep through that $6.14 mark and head for $5. The USDA’s quarterly report showed corn stocks within analysts’ estimates at 4.346 billion bushels. Corn acres took a slight uptick from 89.5 million acres to 89.921 million acres with average yield holding steady at 177.00 bpa. However, USDA added a special note stating there were estimated still 4.03 million acres left to be planted. Any changes made to acre planting will be released Friday, August 12. This week’s corn conditions showed a 3% decline at 67% good to excellent versus 70% last week. If conditions continue to creep down, support could be added to the corn market. Monday’s export inspections came in a little better than the past couple of weeks at 49.1 million bushels, but still below the 10-week average of 55.6 million bushels. This week’s export sales came in at a mere 3.5 million bushels with new crop sales under expectations at 4.7 million bushels. Wednesday’s ethanol report showed both stocks and production lower. CFTC report showed sell off of corn funds of 12,921 contracts, still holding a long position of 265,264. Locally basis is flat

Wheat

Wheat was as expected in the USDA stocks and acres report. Harvest continues to roll on and the market is experiencing pressure from that. Export inspections saw 12.9 million bushels shipped close to the bottom of trade expectations. Export sales saw 18.3 million bushels of wheat sold with HRW leading the way with 5.9 million bushels. These export sales numbers were decent, but still not great. The Philippines, Mexico, and Brazil were the top buyers. One silver lining with declining prices is the U.S. is now competitive with the world on wheat prices. Could we see some export sales pick up? We will find out. Crop progress reported winter wheat harvest at 41% complete, up from 25% last week. Kansas jumped from 27% harvested last week to 59%.

Soybeans

No shockers in the USDA quarterly stocks report this morning with the numbers just above the average trade estimates. The real shocker is the acres for beans. The USDA dropped soybean acres 2.65 million from the March acres report till now. Total acres reported was 88.325 million. The market doesn’t seem to be to be buying those numbers, but it is also month end and money flow is a big part of today too. It has been a relatively quiet week leading up to today for the bean market. The biggest driving factor for the bean market this week before today’s report was the crop condition. Crop progress report the soybean crop down to 65% good to excellent, down 3% from last week. Kansas saw a bump of 2% up to 65% good to excellent. It will be interesting to see how the market digests the USDA numbers going into a long weekend. Export inspections were decent at 17.2 million bushels shipped with China as the number one destination. The shipments keep U.S. soybean export inspection progress ahead of schedule for the year. Export sales were a dud with a net cancellation of 4.4 million old crop bushels and 4.7 new crop bushels sold. The expectations are the new crop sales should stay strong going into harvest. Managed money sold off 8,733 contracts lowering the long to 154,413 contracts.

Milo

Milo is on the downhill slide with corn. Milo demand is weak and weighing on basis. This week’s crop progress report showed sorghum at 43% good to excellent versus 46% last week, with 90% of the crop planted. Monday’s export inspections showed milo at 5.9 million bushels, above last week’s 2.8 million bushels. Export sales for the week came in at a disappointing 0.1 million bushels.

Trivia Answers

-

The Pennsylvania Evening Post

-

56