Weekly Market Update 6/9/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Tis the season for NCAA softball championships. Speaking of champions, how many national championships has Oklahoma University had under Patty Gasso?

-

What is the name of the ancient area between the Tigris and Euphrates Rivers where wheat originated and urban centers started and grew?

Answers at the bottom.

Market News

-

COVID-19 appears to have reared its ugly head in China again, as Shanghai and Beijing imposed new lockdown restricions and announced a round of mass testing for millions of residents. While China's infection rate is low by global standards, President Xi Jinping has doubled down on a zero-COVID policy. Continued lockdowns are creating concern about the Chinese economy, disrupted supply chains, and international trade - which in turn could have ramifications for energy and commodity markets.

-

The major stock indexes are down today following disappointing labor market data this morning. Weekly filings for unemployment totaled 229,000 last week, the most since January. Investors are bracing for the Bureau of Labor Statistics’ May Consumer Price Index tomorrow, with economists looking for headline inflation to come in at 8.2%. The European Central Bank confirmed today that they will be following suit with the Fed and begin a string of interest rate hikes in July to battle inflation.

-

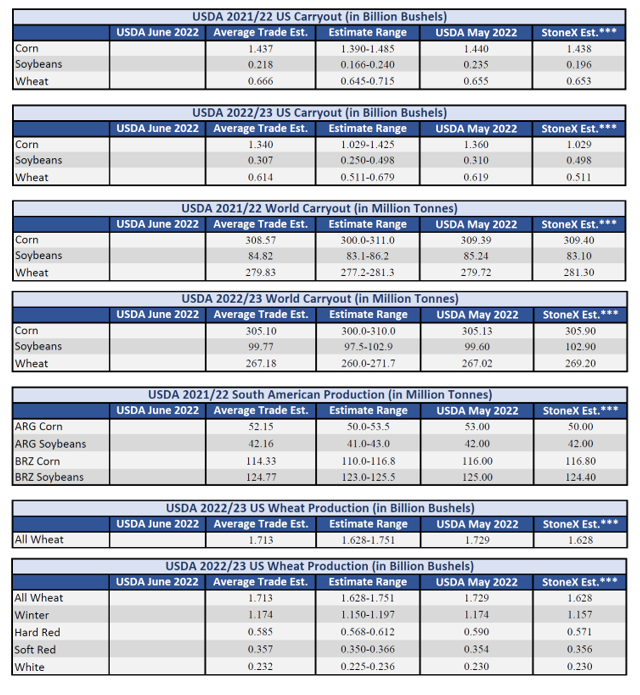

Tomorrow (6/10) USDA will release the June WASDE at 11am. This should mostly be a snoozer - traders are expecting minimal changes to demand on old crop and no changes to new crop. Following this report, the trade will anxiously await the Stocks and Acreage Report at the end of the month, which historically is a huge market mover.

| June WASDE Cheat Sheet |

|

|

Weather

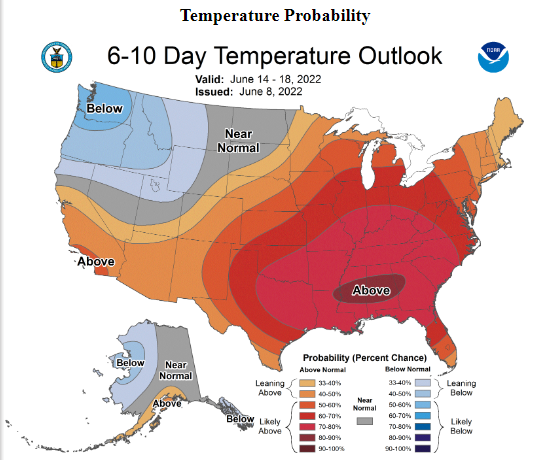

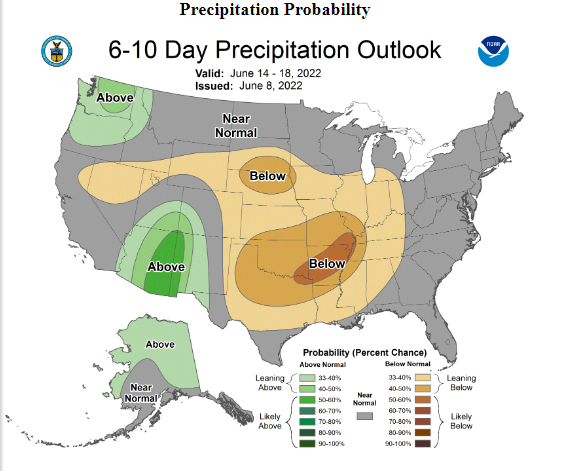

The weather heading into the weekend looks to get toasty, offering to give wheat the last push it needs before harvest.Temps looks to peak in the lower 100's through Tuesday and taper off some on Wednesday. Long range, temps look to settle with high's in the 90's and lows in the upper 60's with precipitation chances settling slightly below normal.

|

|

Corn

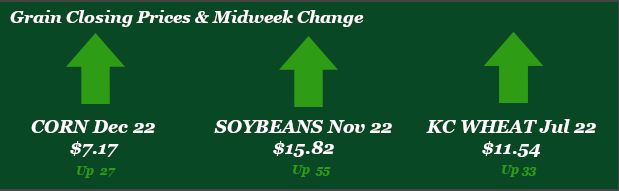

Corn seeing some strength over the past few days on hot and dry forecasts along with a tight cash market headed into the last half of June, gaining roughly 27 cents on the week. Friday’s CFTC showed some sell-off of 22,505 contracts on corn managed money, settling the week at 268,964 contracts long. Monday’s export inspections showed 56.5 million bushels versus 55.6 the week prior and verses the 10-week average of 58.6. Export sales for the week remain sad as current sales came in at 11.0 million bushels and new crop sales were at 2.9 million bushels. This week’s ethanol production dropped week over week by 252,000 gallons while stocks rose just under 3.3 million gallons and demand took a dive. Friday's WASDE looks to stay fairly neutral for corn with the average trade estimate for US carryout seeing little change from May's WASDE, at 1.437 billion bushels. World carryout is estimated at 308.57 million tonnes for corn versus the May WASDE at 309.39 million tonnes. Feed market for corn has bids running high with a tight cash market and freight costs eating at margins. Locally basis remains strong.

Wheat

Wheat is on the downhill slide today, after a volatile week amid changing headlines out of Russia. Early in the week, wheat found strength on weekend stories that Russia was renewing attacks on Kyiv and had destroyed a major grain facility. The strength was killed on later-in-the-week headlines that Russia was continuing talks with Turkey on creating a corridor for Ukrainian grain exports. Expect the market to continue to closely follow this, as strong headlines will be necessary to feed wheat bulls. Reuters reported this week that Brazil is testing a drought resistant GMO variety of wheat. Brazil is the largest world exporter of soybeans, but is a net importer of wheat and desires to be more self-sufficient amid growing concerns about food security. It would be four years until the wheat would be widely planted. Friday’s CFTC report indicated that managed money had reduced their net long by 3,896 contracts, down to 40,650. Export inspections were in line with expectations at 4.4 million bushels. This week was our first week in the new wheat marketing year, and HRW export sales came in at 4.4 million bushels. USDA increased winter wheat conditions by 1% on Monday, up to 30% good-to-excellent. Rains have come this week for much of Colorado, Kansas and Oklahoma, which will slow harvest progress and are creating some concern for wheat quality.

Soybeans

Beans are up on the week, as planting delays in the northern plains, particularly North Dakota and Minnesota, are creating concerns about bean acreage with more moisture in the forecast. Another question mark is how many bean acres will need to be replanted following flooding in parts of the corn belt. USDA pegged the bean crop at 78% planted on Monday, which is in line with the 5-year average. Kansas is estimated at 64% planted. Last week’s CFTC report indicated that managed money was a small net buyer of beans this week, adding 1,563 contracts to bring the net long up to 164,630. Export inspections were lower than expected this week at 12.9 million bushels, down from the previous week at 14.8 million. Export sales were reported at a strong 15.8 million bushels of old crop and 21.9 million bushels of new crop. The focus of tomorrow’s WASDE report will be on carryout, as old crop and new crop demand remain strong.

Milo

Milo riding on corn futures, but demand leaves quite a bit to be desired and basis reflects it. Export inspections this week came in at 8.2 million bushels versus 5.7 last week and the 10-week average of 9 million bushels. Export sales came in at .4 million bushels versus 1.3 last week and the 10-week average of .10 million bushels. Locally basis remains flat.

Trivia Answers

-

OU has clinched 5 national titles and is currently seeking thier 6th under coach Patty Gasso.

-

The cradle of civilization.