Weekly Market Update 5/5/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Happy Cinco de Mayo! What Mexican army victory does this holiday commemorate?

-

Mother's Day is this Sunday (here is your reminder!) - which U.S. President made Mother's Day a nationwide holiday?

Answers at the bottom.

Market News

- Yesterday the Federal Reserve increased its benchmark interest rate by half a percentage point, which was in line with market expectations. This is the largest rate hike in more than 20 years and is their most aggressive step yet in the battle to curb inflation. The Fed also outlined a program in which it will eventually reduce its bond holdings by $95 billion a month.

- On Tuesday Pope Francis said that Russia’s plan is to end the war on Monday, May 9th. This day is symbolic for Russia with it being “Victory Day” marking the defeat of the Nazis in 1945. I will take this with a grain of salt and believe it when I see it.

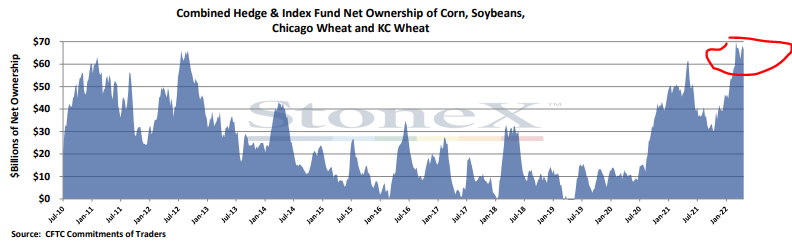

- Managed money has had a major influence on the volatility in commodity markets – with current holdings in major commodities currently estimated to be close to $70 billion. The funds currently are near a record long in the corn market and hold major long positions in wheat and beans. The below graphic does a great job of visualizing the level of “fund” money in the markets through the years.

|

|

Weather

Cooler weather this week will give way to warm temperatures this weekend and into next week, with highs in the 80s. Someone's rain dance must have worked, because our draw area received much-needed moisture this week. It's nice to see our area green on the NOAA precipitation map, as chances for precipitation currently are forecasted for the middle part of next week as well.

|

|

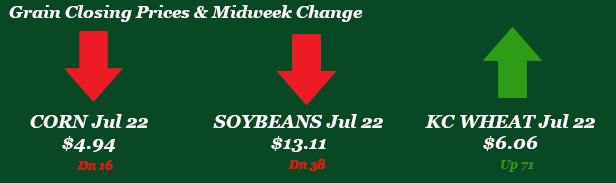

Corn

Corn started the week and the month of May by gapping lower as managed money has sold off from their near record high. Tuesday saw a gap higher to open due to current planting numbers but ended up in the red as well. So far today has been nothing to write home about with little news for bulls to grab hold of. Export inspections were solid this week at 66.3 million bushels shipped, the highest for this current year 21/22 but still behind seasonal pace to meet the USDA’s expectations. Export sales were unspectacular reporting 30.8 million bushels of old crop and 29 million of new crop bushels sold. Friday’s CFTC report showed corn selling 18,455 contracts off the long and bringing the current position for managed money to 360,655. Kansas is right in line for corn planting pace at 35% complete, 5-year average of 36%. Nationally though the U.S. is still far behind coming in at 14% planted, we were 42% planted at this point last year. Much of this is due to the cold and moisture seen in the north with North Dakota and Minnesota at 0% planted. Next week forecast look to be dry and warmer across the majority of growing areas and a great chance for planting to really pick up the pace.

Wheat

After some weakness ending last week wheat has managed to rebound some, gaining roughly 50 cents. Last Friday showed managed money sitting long at 45,407 contracts, with not much change from the week prior. Export inspections for the week came in about average at 14.1 million bushels versus last week’s 10.6 million bushels and the 10-week average at 14.2 million bushels. Monday’s crop conditions showed winter wheat conditions still at 27% good to excellent for the U.S., while Kansas conditions declined 1% to 25% good to excellent. Winter wheat looks to be headed about 23%, with Kansas at 10%. Spring wheat gained little off of last week in the way of planting, at 19% compared to 46% planted last year. Spring wheat that has emerged sits at 5% versus 2% last week and 13% last year. Export sales for the week were not favorable, coming in at 4.4 million bushels versus 1.2 million bushels last week and the 10-week average of 6.7 million bushels. NC wheat sales also saw 1.6 million bushels. Fundamentals such as winter wheat conditions and drought, spring wheat and planting delays, and war affecting exports are still driving the wheat market, adding some technical trading as support. Locally basis is hazy, with little in the way of end user bids to drive the local market.

Soybeans

Market seeing little recovery in beans after weakness at the end of last week and into the beginning of this week. Friday’s CFTC showed soybean managed money holding long at 173,477 contracts. Monday’s export inspections pegged beans at 22.1 million bushels, in line with last week’s 22.2 but below the 10-week average of 28.3 million bushels. Soybean planting is still running behind due to wetter weather, with the U.S. at 8% planted versus last week’s 3% and last year’s 22%. Kansas sits 11% planted versus last week’s 3% and last year’s 10%. This week’s export sales showed bean sales at 27.0 million bushels, above last week’s 17.7 million bushels, but well below the 10-week average of 34.9 million bushels. New crop sales were shown at 15.0 million bushels. Locally basis stays flat.

Milo

Export inspections pegged milo at 8.6 million bushels shipped, just below the 10-week average of 9.7 million bushels. Export sales saw 3.5 million bushels sold, the highest number reported since the beginning of march. Planting progress for milo is below the 5-year average of 23% but not by much coming in at 20%. Locally basis remains firm for milo with little to get excited about.

Trivia Answers

-

Cinco de Mayo commemorates the victory of the outnumbered Mexican army over the French army at the 1862 Battle of Puebla during the Second Franco-Mexican War.

-

Woodrow Wilson signed Mother's Day into law in 1914.