Weekly Market Update 10/13/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What energy does an Eolic power station generate?

-

Which metal was invented by British metallurgish Harold Brearly in 1912?

Answers at the bottom.

Market News

-

The October WASDE report was released yesterday. More info below within each commodity writeup.

-

Tuesday it was reported in the monthly Short-Term Energy Outlook, EIA cut it oil price forecast for 2022 and 2023, even as it reduced its expectations for U.S. and global crude oil production. Global recession fears and threats of lowered demand are the main points of uncertainty looking ahead into 2023. The EIA reduced its 2023 production forecast by 2.2% to 12.36 million barrels per day, which would still surpass the record high set in 2019.

-

Outside markets are all looking to move higher this morning. The Dow Jones has reached highs for the week and is currently sitting at 29,710.85 up 500 points on the day. The S&P 500 has also recorded highs for the week earlier this morning and at this time sits at 3,625.95 up 48.92 points. The NASDAQ is in a similar pattern as the Dow Jones and S&P having tested highs earlier this morning and remaining in the green comfortably at 10,495.82 up 78.72 points.

|

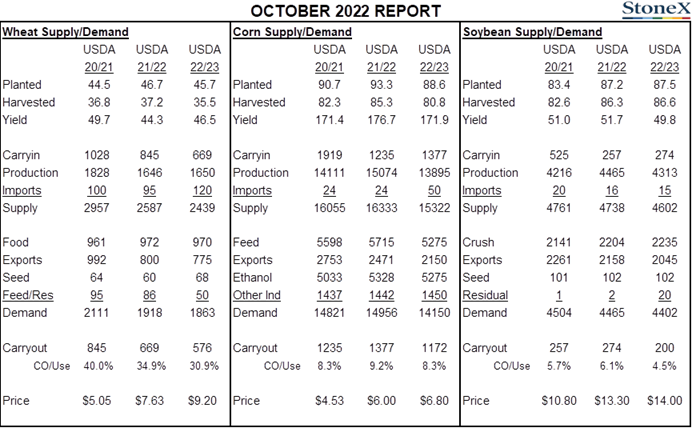

USDA Supply & Demand (Million Bushels) |

|

|

Weather

Not much for rain on the horizon over the next 10 days. Temps look to stick around the 70s during the day time while dipping into the 40s during the night with several nights of lows in the 30s over the next week.

|

|

|

Corn

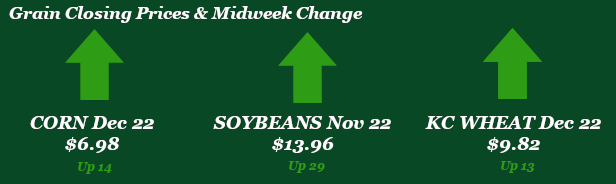

Managed money surged into commodities following Russia’s bombing in the Ukraine over the weekend, but corn has given back most of its gains over the last couple of sessions and seems content to be back to rangebound trading. The October WASDE didn’t hold many big surprises for corn yesterday, but the 2022/23 corn yield was decreased to 171.9 bpa, pulling U.S. production down slightly to 13.895 billion bushels. There were some changes made on the demand side of the balance sheet, with an increase in feed demand and lower export and ethanol demand. Overall, it was a snoozer and the corn market closed the trading session unchanged. Export inspections were lower this week at 18.0 million bushels, down from the previous week at 26.5 million. Due to the Columbus Day holiday, we won’t have export sales until tomorrow. Data from the CFTC on Friday showed that managed money continued to buy corn in the previous week, adding 5,874 contracts to bring the net long up to 243,728 contracts. Corn harvest is rolling along, with USDA estimating the U.S. crop at 31% harvested, up 11% from last week and right on track with our historical pace. Local basis remains steady to firmer. News this week that one railroad union voted down the proposed deal puts a potential rail strike back on the table – this will be important to watch for our local markets, as much of our regional feed demand is expecting to be covered by corn railed in from the East.

Wheat

The wheat market took center stage early this week, with nearby KC wheat trading up almost the limit on Monday after news over the weekend that Ukraine had destroyed a bridge into Crimea and Russia had retaliated by attacking Kyiv and two other cities. This likely means that Russia will not extend Ukraine’s export deal. Further news out of Russia came later in the week, with Russia’s Deputy Prime Minister saying that they are considering the removal of their grain export quota, which would allow larger exports and could have major implications for U.S. wheat export demand. Yesterday’s WASDE report wasn’t a huge one for wheat, but U.S. carryout was lowered to 576 million bushels, down from September but above the average trade guess of 554 million. 2022/23 world carryout was decreased to 267.54 MMT, also slightly above the average trade guess. Friday’s data from the CFTC indicated that managed money is continuing to buy KC wheat, adding 1,726 contracts to bring their net long to 25,631 contracts. Export inspections were reported at 6.4 million, up from the previous week and right in line with the 10-week average of 6.3 million bushels. Drought conditions across the southern plains remain a concern as drills continue to roll, with USDA estimating the winter wheat crop at 55% planted nationwide and 50% planted in Kansas. Locally, basis remains steady.

Soybeans

Soybeans have been steadily higher all week with limited headlines earlier in the week and the market buoyed by Russia and Ukraine news. Yesterday the USDA released their October WASDE report with a surprise in yield for beans. The USDA pegged soybeans with a 49.8 yield for 2022 harvest. This was right at the lowest trade expectation. The drop in production was enough to keep carryout this year equal to the last at 200 million bushels. Chinese demand will continue to drive the bus, but domestic demand is good enough to keep the balance sheet tight. Export inspections came in strong at 35.6 million bushels shipped well above trade estimates. China was far and away the number one destination with 25.4 million bushels. Export sales are delated this week due to Monday’s holiday. Managed money sold off 17,343 contracts and lowered their long to 77,488 contracts. Soybean harvest saw a good jump in the crop progress report, 44% complete was reported Tuesday up from 22% last week. Kansas is up to 30% harvested and ahead of the 5-year average of 21% harvested for this week.

Milo

Cash prices felt strength from corn futures early in the week, but it seems like the board is back to the same old song and dance. Basis feels firmer, as many areas are finding that their milo yields are even poorer than originally thought. Across our draw area, milo harvest is off to slow but steady start. USDA estimates that the crop is 46% harvested nationwide and 25% harvested in Kansas, both ahead of historical pace. Export inspections were up this week, but still at only 0.8 million bushels. Yesterday’s WASDE reduced milo yields from 46.0 bpa in September to 44.6 bpa, pulling production down to 245 million bushels. Exports were reduced, while feed and food demand held steady. Ending stocks are pegged at 23 million bushels.

Trivia Answers

-

Wind

-

Stainless Steel