Weekly Market Update 10/20/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Which U.S. President was the first to be depicted on a circulating coin?

-

What metal are pennies primarily made of?

Answers at the bottom.

Market News

-

Stocks closed lower for the second day in a row, as investors weighted several key earnings reports and kepy an eye on the bond market, where Treasury yields continue to climb. The Dow Jones Industrial Average slipped 90.22 points, or 0.30%, to 30,333.59. The S&P 500 fell 0.80% to 3,665.78. The Nasdaq Composite shed 0.61% to close at 10,614.84. The benchmark 10-year Treasury yield reached a high of 4.239% on Thursday, trading at levels not seen since 2008. Rising rates have been a headwind for stocks all year, as the Federal Reserve continues to try and cool off inflationary pressures not seen in decades.

-

In the week ending October 15, the figure for initial jobless claims was 214,000, a decrease of 12,000 from the previous week's level of 226,000. U.S. consumer prices increased more than expected in September as housing costs and rents surged by the most since 1990 and the cost of food is also on the rise, reinforcing expectations the Federal Reserve could deliver a fourth straight 75 basis point interest rate hike.

-

Headlines continue out of the Black Sea, with rolling blackouts across Ukraine beginning today after Russian attacks on energy infrastructure saw the nation lose at least 40% of its power-generating capacity. Meanwhile, Russia says that any extension or expansion of the Ukrainian grain export deal would depend on the West easing sanctions on the export of fertilizers and chemicals. The deal is up for renewal next month.

|

U.S. 10 Year Treasury Yield |

|

|

Weather

More of the same dry weather to come, but it does look like our area might get a chance at some cooler weather next week. Highs remain in the 80s through this weekend, but dip down into the 60s next week with nighttime lows in 30s. National Weather Service is predicting a strong storm system on Sunday that could produce intense southwest winds, with gusts of 50-60 mph expected.

|

|

|

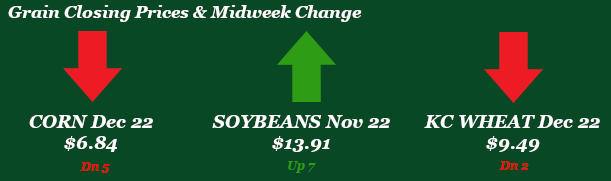

Corn

Corn has been slightly trending down this week with little headlines and news to carry the market. We are seeing a little bounce today and are looking to finish in the green for the first time all week. Export inspections were weak for corn at 17.7 million bushels shipped. Mexico and China were the top two destinations. Water levels on the Mississippi River remain low and is affecting exports out of the gulf immensely. Some relief should be on the way with weather maps showing good chances for rain, but will it be enough to ramp up traffic is the big question. Export sales stunk with 16.1 million bushels sold, close to the bottom end of trade expectations. Mexico was the number one buyer with just over 7 million bushels purchased followed by Japan. Export sales are still 10% below USDA export pace for the year. Harvest progress is picking up steam and reached 45% complete according to Monday’s crop progress report, this is above the 5-year average of 40% harvested. Kansas harvest is chugging along at 73% done well ahead of the 5-year average of 64% complete. Managed money added 23,649 contracts raising the current long to 267,377 contracts.

Wheat

After a downward slide to start the week, wheat has found some strength today and is closing in the green. Weather continues to plague wheat country, with the southern plains begging for a rain while the forecasts continue to come up short. Our draw area could desperately use a rain on recently planted wheat. USDA estimates that the U.S. crop is 69% planted and 38% emerged, while Kansas is reported at 64% planted and 33% emerged. Data from the CFTC reported that managed money was a modest buyer of KC wheat, adding 877 contracts to bring their net long up to 26, 508 contracts. Export inspections this week fell short of estimates at only 4.5 million bushels, down from the previous week at 6.4 million. Export sales were also disappointing at 2.1 million bushels of old crop and 0.2 million bushels of new crop – facing headwinds of a strong U.S. dollar paired with a strong and uncompetitive flat price. Mixed signals out of Russia with talks of an extension to the Ukraine export deal floating around, but never any solid news. Meanwhile, attacks between the two countries are reported to be ongoing. Futures will continue to chase any headline coming out of the Black Sea, while local basis remains steady.

Soybeans

Soybeans have had a quiet start to the week with very little news and volume but are finding momentum today. China has come back to the table to buy beans and we saw reported flash sales this morning with 201k metric tons to China and 132k metric tons to unknown destinations. On top of that soybeans saw a very strong weekly export sales report. These are guiding beans higher today and looking to finish strong after a sluggish start this week. Harvest is continuing at a fast pace jumping up to 63% completed for the U.S. up from 44% last week. Kansas is reported at 45% harvested ahead of the 5-year average of 34%. Export inspections remained strong for soybeans with 69.2 million bushels shipped, China was the number one destination with 49.6 million bushels. Even with multiple decent to strong weeks soybean shipments are still 7% behind USDA projections. Last week the CFTC report showed managed money selling 11,750 contracts lowering the long to 65,738 contracts. NOPA crush numbers were reported for September on Monday. Crush showed 158.1 million bushels, a full 3.5 million below the average trade estimate, though still above 153.8 million bushels a year ago. The September figure is down from both 2018 and 2020. The USDA is looking for just over a +1% year-over-year soybean crush increase in 22/23, or roughly 30 million additional bushels total crush.

Milo

Milo has continued its trend of minimal bushels being shipped with 200k bushels being reported according to the export inspections. Mexico was the destination for all bushels. Milo is 4% behind the USDA seasonal pace. Not much different for export sales with 500k sold, unknown was the top destination followed by Mexico. Export sales is well of the USDA’s seasonal pace too at 18%. Milo harvest hit 57% complete for the U.S. right in line with last year’s pace of 58%. Kansas bumped up to 39% harvested slightly behind last year’s pace of 42%. Local basis remains firm and strong for the week.

Trivia Answers

-

Abraham Lincoln (1909 on a one-cent coin)

-

Zinc