Weekly Market Update 9/22/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What pigment decreases in plants during autumn?

-

From which pigment do trees get their brown color?

Answers at the bottom.

Market News

-

Russia had the wheat market on the move this week yet again, with Putin announcing a call-up that could pull 300,000 civilians into military service for mobilization into Ukraine. Thousands of Russians are already receiving draft papers and are being bussed to training, as Putin prepares to close down his borders to prevent military-aged men from leaving. Airlines have already been instructed not to sell tickets to military-aged men barring evidence of approval to travel from the Russian Ministry of Defense. This escalation of conflict comes as Russian-backed separatists in occupied regions in Ukraine say they plan to hold "referendums" on becoming part of Russia in the coming days.

-

Major stock indexes are lower today after the Fed rolled out another 75 basis-point rate hike yesterday for a third straight time. Policymakers expect continued rate hikes through the rest of this year and next, and Chairman Powell's comments on below-trend growth for a period are being translated to "recession" by analysts.

-

Energy markets are seeing strength today despite the bearishness in the weekly inventory reports. News of improved China demand in the 4th quarter is aiding this positivity. Yesterday’s data from the EIA showed a solid jump in refinery activity as utilization rose by 2.1 percentage points (to 93.6% of overall capacity) in an effort to rebuild low product levels. The report also showed builds across the board with U.S. crude’s increase of 1.1 million barrels being about half what was anticipated while distillates grew by 1.2 million barrels (which was three times the estimate). Gasoline’s 1.6 million barrel increase compared to projections that it would be a 400,000 barrel drawdown.

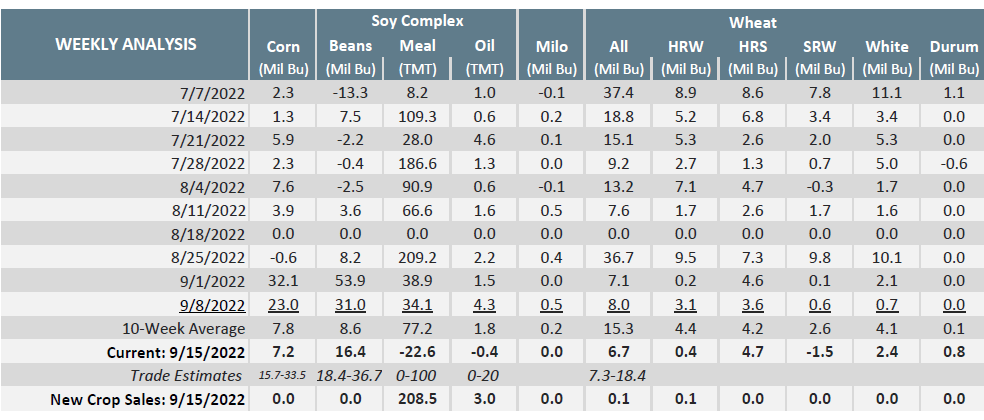

| Weekly Export Sales Snapshot |

|

|

Weather

Today has been a nice change with cooler temperatures and rain in some areas. Highs will be up in the 80s for the rest of this week and next, with nighttime lows in the mid-50s. Chances for precipitation are slim in the extended forecast.

|

|

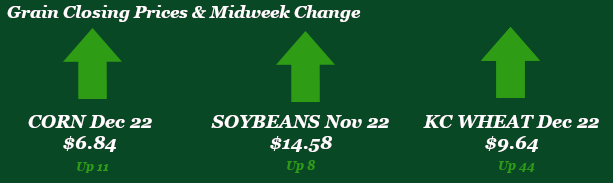

Corn

Outside of Russia-Ukraine and the FED rate hike, news is quiet as grains continue to digest the two headlines. So grab your coffee cup and fill it up because that is about all that is going to keep you awake through this week’s corn news. Yes, we are on the last half of the day, but a cup of joe this late never hurt anyone. On the week, corn has seen an 11 cent gain, closing at 6.88 ¼ on the Dec. Friday’s CFTC report showed little movement in the way of managed money with longs sitting at 229,220 contracts. Corn harvest is chugging along with Kansas 27% complete as the US sits at about 7% complete, but much-needed rains in southwest Kansas have stalled harvest there some. Export inspections on Monday had corn at 21.6 million bushels. Export sales for the week came in quite disappointing at 7.2 million bushels versus 23 million bushels last week. Ethanol saw stocks, production, and demand down for the week as daily supplies creep up. Locally basis steady.

Wheat

Wheat has been leading the charge this week for grains, mostly from headlines out of the Black Sea. Monday started things with a bang closing the day up more than 50 cents. Putin is not backing away from the war and ramping things up with more mobilization and declaring no male from the ages of 18-65 may leave the country. All the macro headlines have been steering the ship this week, but the market has cooled a bit and seems to be treading water for now. Export inspections were decent with 29 million bushels of wheat shipped, led by HRW. China was the number one destination followed by Japan and Yemen. Export sales were nonexistent coming in with 6.7 million bushels sold below the trade estimates. Indonesia and China were the top buyers. Managed money added 5,905 contracts to the KC wheat long rising to 16,992 contracts. With few headlines this morning look for wheat to mosey along looking for direction. Rains across some of the growing areas will be welcomed for wheat planting.

Soybeans

Very choppy week for beans and little direction for them to go. With a surging U.S. dollar weighing on the market beans have found little momentum for the week. China remains mostly absent in the export market and until we get a better idea of what to expect from them look for the market to chugging along where we currently are. Export inspections this week were inline with trade expectations coming in at 19.1 million bushels shipped. China, Mexico, and Japan were the top destinations for the week. Export sales were a no show and below trade estimates for beans as well. Sales totaled 16.4 million bushels, with Egypt leading the way. The crop progress report is pretty much useless at this point, with most know what to expect with this crop but some traders will still trade the numbers. Overall crop condition did drop a point to 55% good to excellent. The CFTC report showed managed money adding 12,498 contracts raising the long to 112,127 contracts.

Milo

Milo harvest kicked off and then stalled as Kansas sits at 2% harvested for the 2nd week in a row. The US aggregate made 1% progress from 23% to 24%. Export inspections this week came in at 0.3 million bushels while export sales saw nothing. Locally basis is steady.

Trivia Answers

-

Chlorophyll

-

Tannins