Weekly Market Update 9/29/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

On this day in 1951 the first colored telecast of a football game took place on this network. Name the network.

-

Aaron Judge tied this former Yankee's homerun record last night with #61. Who is this former New York Yankee?

Answers at the bottom.

Market News

-

Nord Stream pipelines 1 and 2 under the Baltic Sea have leaks. It is unknown what has caused the leaks. Initially reported the European Union blamed Russia for causing both leaks. Now, Russia is saying that "This looks like an act of terrorism, possibly at the state level", pushing back on the EU. Other sources say that the Russian navy support ships and submarines have been seen very close to the locations of the leaks, while Russia is saying that the leaks occurred in the territory that is fully under the control of U.S. intelligence agencies.

-

The DJIA is off the lows for the day currently sitting at 29,372.28 down 311.46, for the week the Dow is down 154.36 points. The S&P 500 is down 65.74 points on the day and at this time sitting at 3653.30. Overall, the S&P is down 37.90 points on the week. The NASDAQ is also down for on the day 286.63 points and is sitting at 10,765.01. For the week the NASDAQ is down 140.06.

-

OPEC+: The group of oil producers are set to meet on October 5th to discuss an oil output cut. One Reuters sources are saying that discussions between members have already began and that a cut was "likely". Earlier this week another source was told that Moscow would be suggesting a cut of 1 million barrels per day. The meeting next week comes at a time of severe market volatility and decision should heavily influence the market.

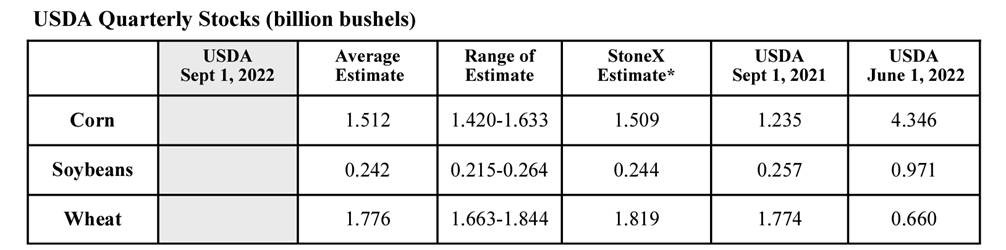

| USDA Quarterly Stocks Preview (Billion Bushels) |

|

|

Weather

This week has been warm and dry with a few spot showers here and there but nothing significant. Look for next week to cool off to the 70s for most of the week with slight rain chances later in the week.

|

|

Corn

Corn has traded back and forth this week, as commodities have been largely following Russian headlines and outside market concerns rather than fundamentals. December corn is down slightly overall on the week. Export inspections were below estimates this week at 18.1 million bushels, lagging behind the 10-week average of 27.3 million bushels. Export sales were in the middle of expectations at 20.2 million bushels of old crop and 6.3 million bushels of new crop. It’s important to note that sales are significantly behind last year and are well below the pace needed to meet current USDA estimates. Friday’s CFTC report had managed money as net buyers, adding 7,266 contracts to bring the net long up to 247,909 contracts. Crop conditions were unchanged on the week, hanging in at 52% good-to-excellent. USDA has the corn crop pegged at 12% harvested nationwide, with Kansas 35% harvested. Corn harvest is off to a slow start across our draw area, while the short crop has basis supported at incredibly strong values. Tomorrow morning is USDA’s Quarterly Stocks Report, the average estimate for corn stocks is 1.512 billion bushels.

Wheat

Like the other commodities, wheat has been back and forth this week depending on the daily headlines surrounding the Black Sea conflict and outside markets. Strength in the US dollar has also been a headwind for the market. Export inspections this week were reported at 5.5 million bushels of HRW, down big from last week at 10.9 million. Export sales were disappointing, with only 0.7 bushels of old crop sold and no new crop sales reported. Funds were net buyers of KC wheat, with the net long reported at 19,059 contracts – an increase of 2,067. Recent rain events have been welcome across the Plains as wheat is getting put in the ground, but the forecast is bleak for the next week to ten days. More above average temperatures and below average precipitation. USDA has the winter wheat crop estimated at 31% planted nationwide and 19% planted in Kansas. Basis remains steady, while cash markets are quiet given a lack of export demand and domestic mills being mostly covered nearby. Tomorrow USDA will give updated 2022 production numbers; the expectation is for slight decreases to winter wheat.

Soybeans

Beans are looking to get up off the mat today after taking a hit earlier in the week. Ideal harvest weather in the US and good planting conditions have helped pressure vales this past week plus the absence of China on the demand side. The World Bank cut its growth for China from 5% to 2.8% which has added to the negative tone showing major economies are slowing down due to the inflation and rising interest rates. Soybean planting in Brazil is making good progress with 9% of the crop in the ground in Parana and Mato Grasso at 2%. Export inspections were terrible with 9.5 million bushels shipped, well below trade estimates. Japan and China were the top destinations. Export sales showed 36.9 million bushels sold, above the high end of projections for the week ending 9/22/22. China was the top buyer followed by Mexico. The CFTC report from last Friday pegged managed money as sellers of 7,436 contracts lowering the long to 104,691 contracts.

Milo

Milo has been tagging along for the back-and-forth in the corn market, while local basis is steady to higher. Export inspections were reported at 0.8 million bushels, up from the previous week at only 0.3 million bushels. Export sales came in at 2.1 million bushels. Crop conditions were up 2% nationwide this week, but still are only at 22% good-to-excellent. Kansas is at 19% good-to-excellent, significantly behind the 5-year average of 61%. Milo harvest has kicked off at a few of our locations, while the overall harvest looks to be mostly disappointing.

Trivia Answers

-

CBS

-

Roger Maris