Weekly Market Update 6-30-23

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Commodity markets will be closed for Independence Day next Tuesday, July 4th. GCC offices will also be closed. Grain elevators will be open as needed - please communicate your harvest needs to your elevator manager. We wish you and your family a Happy 4th of July!

**We will not have weekly commentary for the first two weeks in July due to website maintenance. Please reach out to the Grain Team if you'd like timely market information.**

Trivia

-

How many people signed the Declaration of Independence?

-

Where was the Declaration of Independence stored during World War II?

Answers at the bottom.

Market News

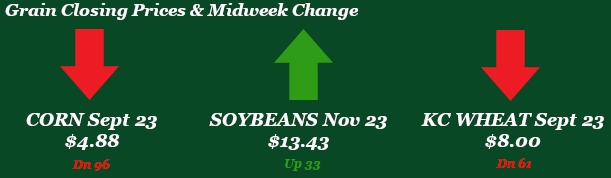

Markets went crazy today after USDA released the highly-anticipated Quarterly Stocks and Acreage Report. Acres had surprises on both sides of the spectrum for corn and beans. Check out the commodity sections below for more information.

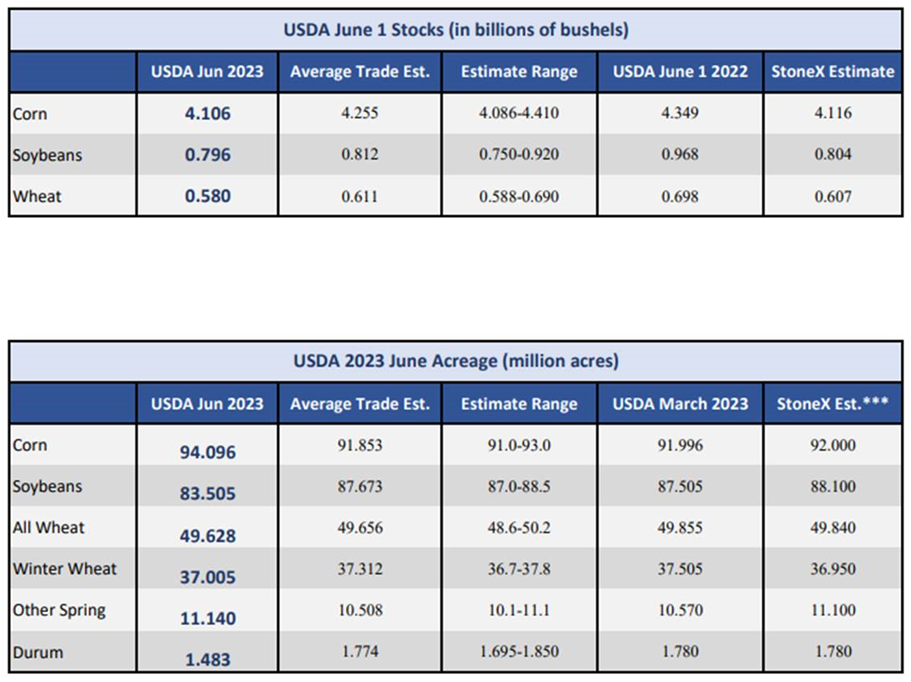

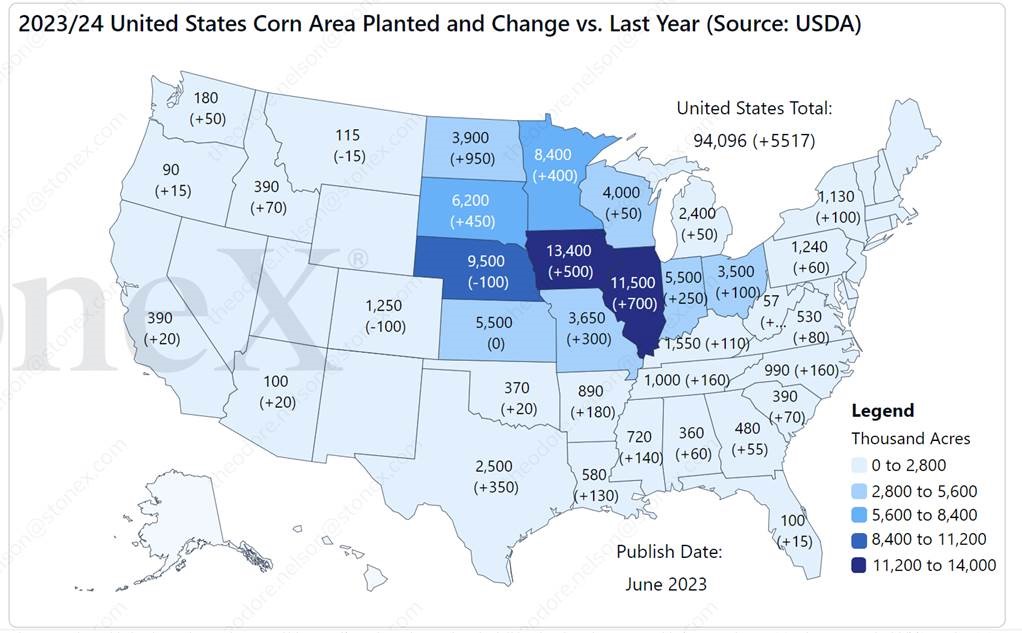

CORN Corn has continued its nosedive, with the December contract down just shy of a dollar in the last week. The Quarterly Stocks and Acreage report is today’s big headline, followed closely by wetter, cooler forecasts and realized precipitation across the Corn Belt. While most of the trade was plugging in a planted acreage number around 91 million acres, USDA printed a whopping 94 million acre number in today’s report. Interestingly, the states with the most major increases are Iowa and Indiana, where conditions are arguably some of the worst. June 1 stocks were slightly lower than the average trade estimates, coming in at 4.106 billion bushels. This is lower than last year at this time. The big question marks are still yield and demand. Crop conditions came in 2% lower than estimated and down 5% week-on-week, with corn at only 50% good-to-excellent. Illinois was hammered down 10%, while Indiana, Missouri, and Minnesota all saw losses as well. However, rains have been falling across parts of the Corn Belt and the extended forecast is calling for wetter, cooler conditions. Last night rains fell in Nebraska, Iowa, Missouri, Indiana and Illinois, but were accompanied by strong winds and hail in some areas. Time will tell on what kind of damage might have been realized. Demand for corn remains a huge bleak spot. Export inspections were their lowest since early February, coming in at only 21.4 million bushels. Export sales were reported at 5.5 million bushels for old crop and 4.9 million bushels of new crop, still 7% behind the pace needed to hit USDA’s estimate.

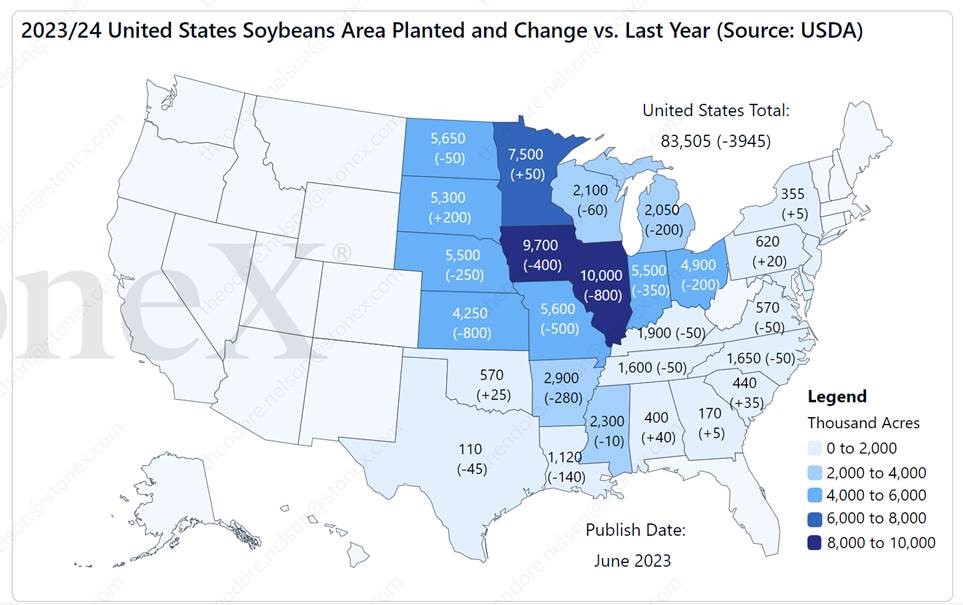

SOYBEANS Soybeans carried the most risk coming into this quarterly report with an already tight balance sheet and it just got a whole lot tighter. Soybean acres saw 3.995 million wiped off the map, total acres for the U.S. now sits at 83.505 million. This makes production issues that much more serious for this crop. Along with acres, stocks were lower than expected coming in at 796 million bushels. This concoction of numbers has led soybeans to skyrocket heading into the weekend. Export inspections were blah this week, showing 5.2 million bushels shipped just ahead of the bottom of trade estimates. Mexico and Japan were the top destinations. Export sales stayed lackluster with 8.4 million bushels of old crop sold and 600k of new crop bushels. Demand remains muted for soybeans with South American soybeans cheap and readily available. Mexico was the top buyer on the week and the only buyer of new crop bushels. Crop progress pegged soybeans at 51% good to excellent this week dropping 3% from last week. We will see if next week gets any sort of boost coming off the rains in the corn belt. Kansas currently sits at 56% g/e down from 63% last week.

WHEAT Wheat has been taking kick after kick to the shins this week after a nice little rally last week. Corn has been weighing wheat down for most of the week. Wheat does have some momentum to take it into the holiday weekend with the USDA’s quarterly stocks/acres report released today. Stocks came in under the lowest trade estimates at 580 million bushels. Wheat acres as a whole saw a decrease bigger than expected. All wheat acres showed 49.628 million, with winter wheat totaling 37.005 million acres. Both numbers were under the trade estimates. Overall, in our area harvest is kicking off with this hot and dry weather moving through. U.S. harvest currently sits at 24% complete up from 15% last week. Export Inspections were pitiful this week with wheat shipping 7.5 million bushels, just above the low end of expectations. Yemen, Japan, & Taiwan were the top destinations. Export sales continue their dreadful drag. This week’s report showed 5.7 million bushels sold, HRW was the top variety with 3.6 million. Japan and Mexico continue to be the top buyers.

MILO Milo has been taking a double whammy, running down with corn futures and taking a hit on basis with limited demand. In today’s acreage report, planted milo acres were reported at 6.8 million acres for all purposes, with 5.94 million of those being for grain. Acres intended for grain harvest are up over 1.35 million from last year. Milo stocks were reported at 53.0 million bushels as of June 1st, down 51% from last year. USDA estimated on Monday that the U.S. crop was 85% planted, behind the 5-year average of 92%. Kansas is still behind pace at only 77% planted, compared with an average of 89%. Conditions fell 3% from last week to 57% good-to-excellent, only 1% behind the 5-year average and significantly better than last year at 43%. Export sales this week were reported at 4.4 million bushels of old crop and 2.4 million bushels of new crop. Milo is slightly ahead of the pace needed to hit USDA’s current target. Export inspections were reported at 2.5 million bushels, way better than last week but still 2% behind USDA’s pace. Export demand remains pretty lackluster for local bushels, with almost all of them moving into ethanol plants that are already covered through new crop. It seems very likely that old crop and new crop cash prices will converge earlier than normal this year since local demand is extremely limited for old crop time slots.

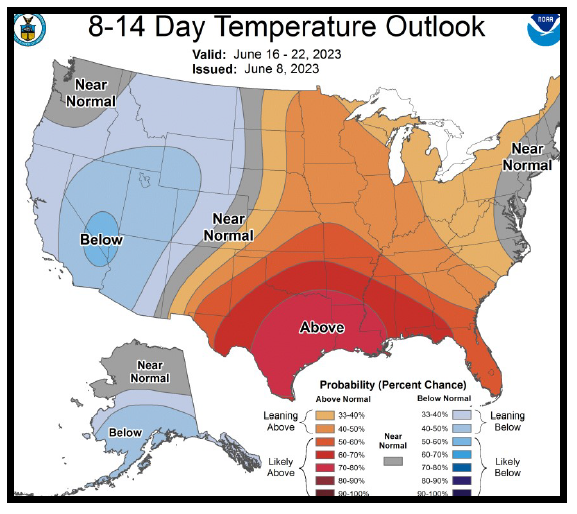

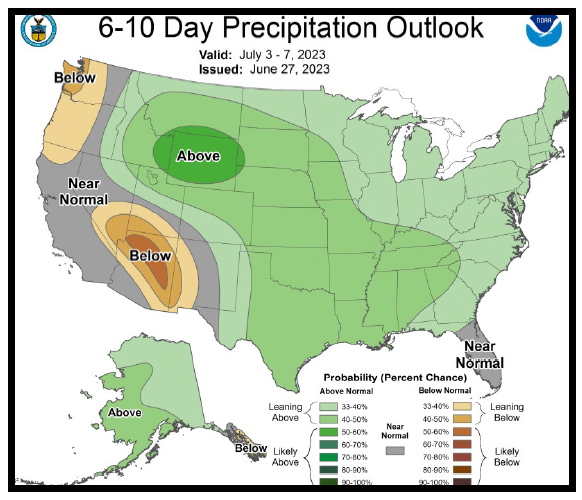

Weather

Temps are heating up as harvest is getting started and we get ready to celebrate our nation’s birth. There’s a chance of rain this evening around 50% in the southwest Kansas, with highs still in the 80s & 90s going forward. Late next week we do have some cooler days in the mid-70s, with isolated thunderstorms in the area to help cool off for a couple days. Winds are expected to be around 10-15 MPH.

|

|

Trivia Answers

-

56

-

Fort Knox