Why Russia and Ukraine Matter to U.S. Ag

Feb 22, 2022

By Cindy Warner, Grain Originator - Ulysses Area

It’s no secret that Russia and Ukraine have had a rough relationship over the past 8 years. It’s also no secret that tensions have come to head in recent weeks. As U.S. troops are mobilized for overseas placement to places like Poland and Germany, many Americans have been left wondering why the issue matters to the U.S. and to U.S. agriculture. While the EU will feel the most direct effects, agricultural demand and pricing is driven so heavily by global markets that the effects will be felt world-wide. From grain prices to available supply to input disruptions, the U.S. could be in for a ride if Ukraine and Russia don’t make nice.

Agriculture is a large source of commerce in both Ukraine and Russia. Ukraine uses roughly 102.5 million acres of land for agriculture use which comprises about 70% of land in the country. Russia uses only about 13% of its land for agriculture purposes but Russia is the largest country in the world, so 13% equates to about 549.3 million acres used for agriculture, which is about 61% of what the U.S. uses. While Russia uses those acres for primarily wheat, Ukraine uses their land for crops such as wheat, corn, and sunflowers (among other commodities).

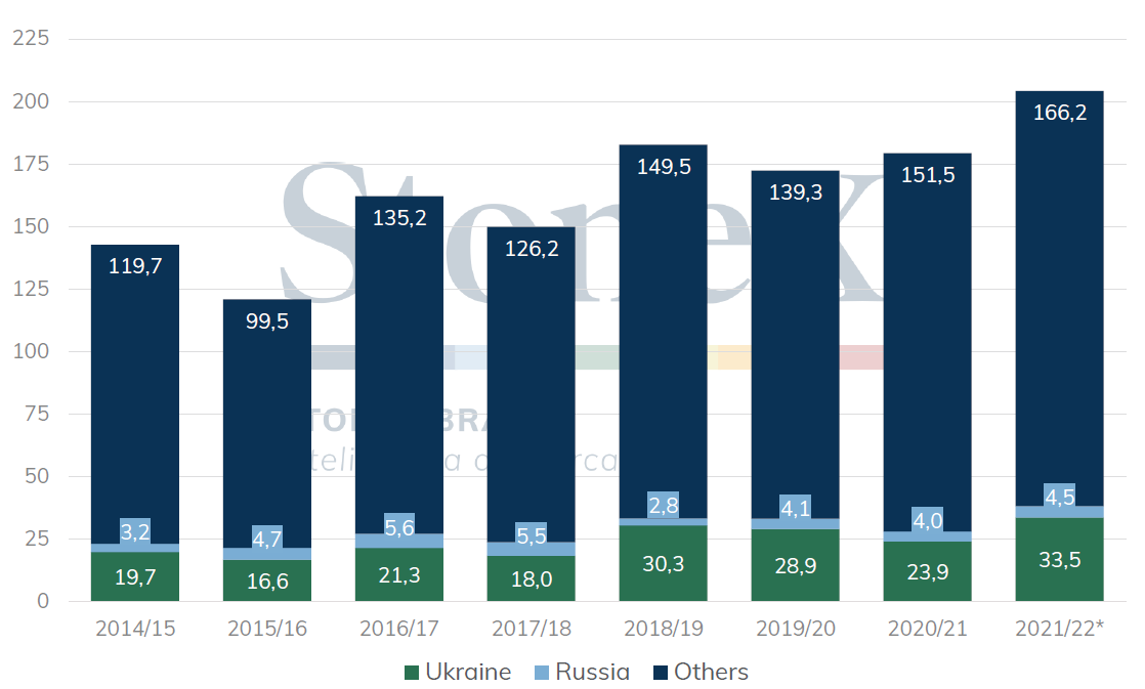

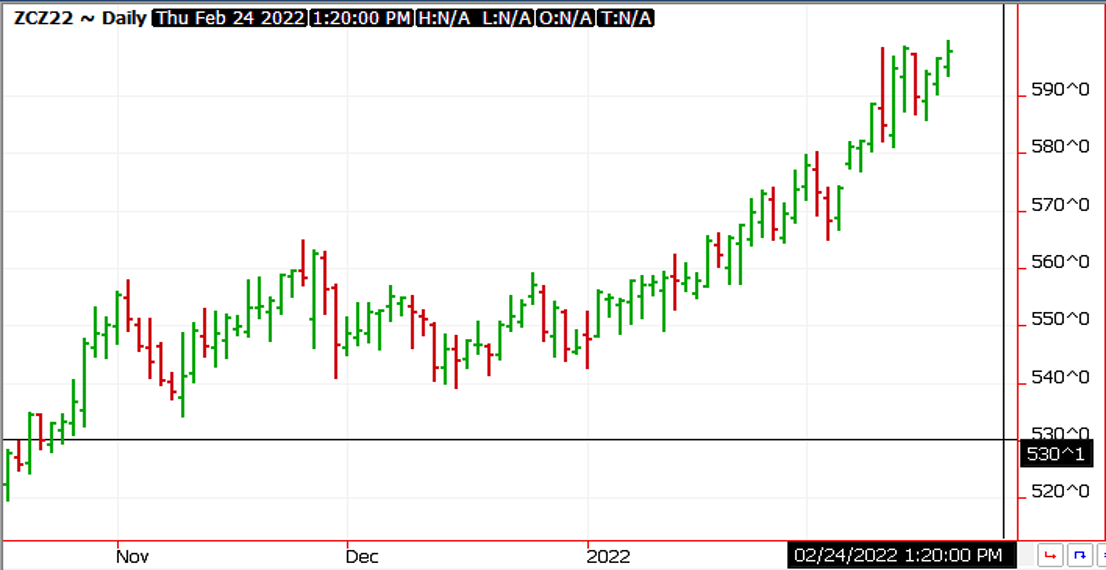

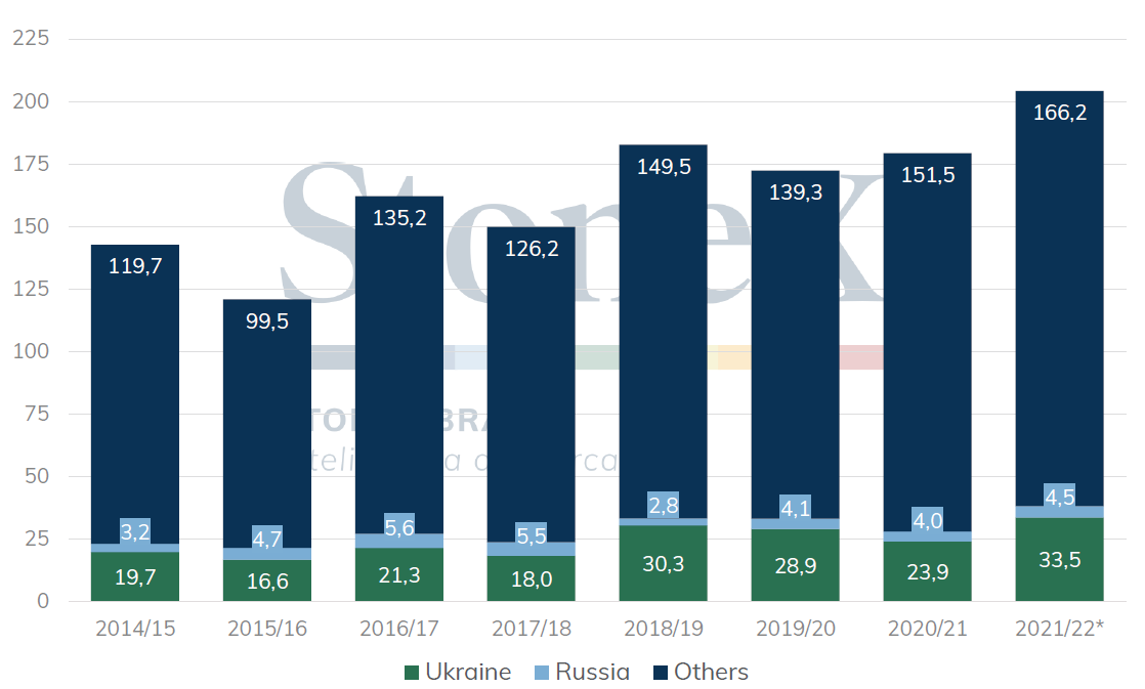

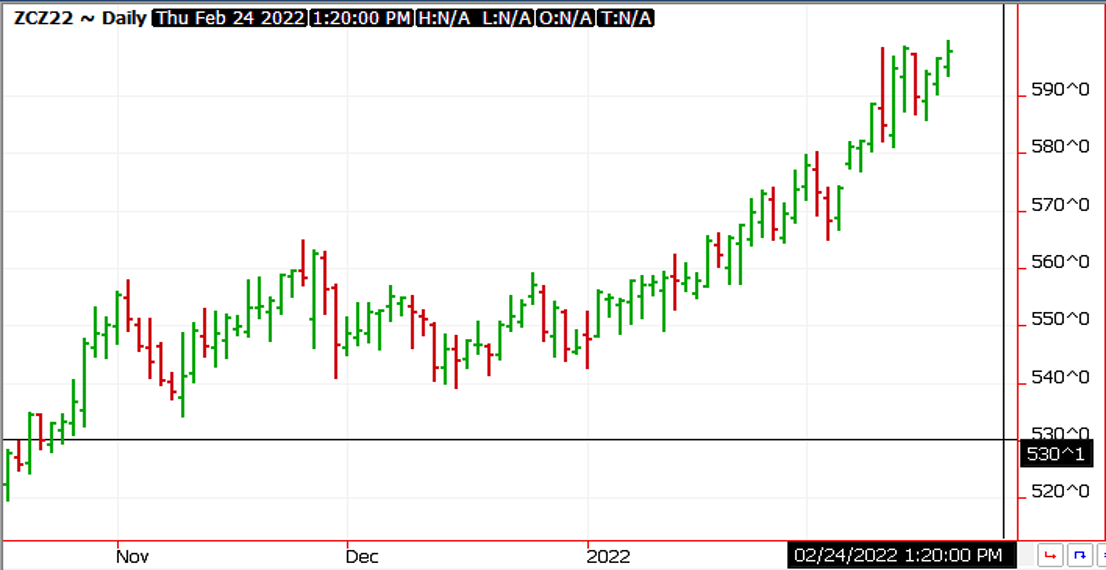

Ukraine and Russia account for a substantial piece of the global export market for corn and wheat. Both countries together made up about 15.5% of world corn exports in 2020/21. Ukraine has been among the top 4 exporters for corn and was the 3rd largest for the 2020/21 season, accounting for 13.3% of corn shipped world-wide. Ukraine is on pace to top last year’s exports; however, that pace could be cut short quickly should a war break out. For the 2021/22 season the world is facing tight global stocks for corn and South America (another large corn exporter) is facing production challenges that could further affect global supply, driving world prices higher. December corn has traded a roughly 57-cent range since the beginning of 2022 and has strengthened about 50 cents, looking to trend higher should the conflict continue.

2014-2022 Corn Exports, charts courtesy of StoneX

*USDA estimated

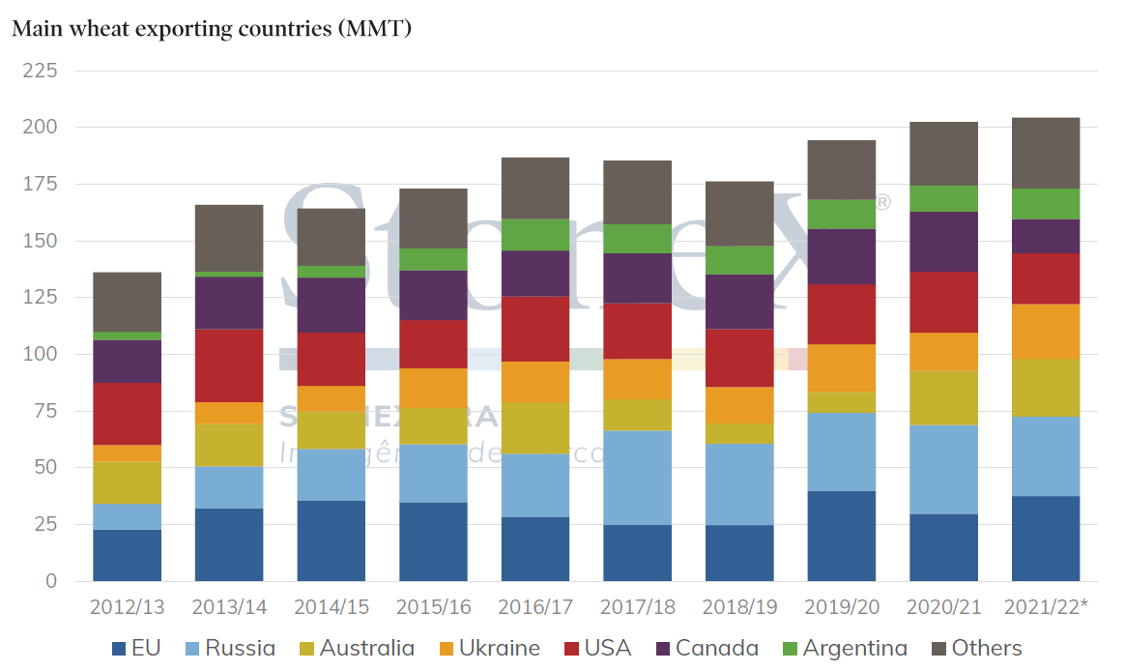

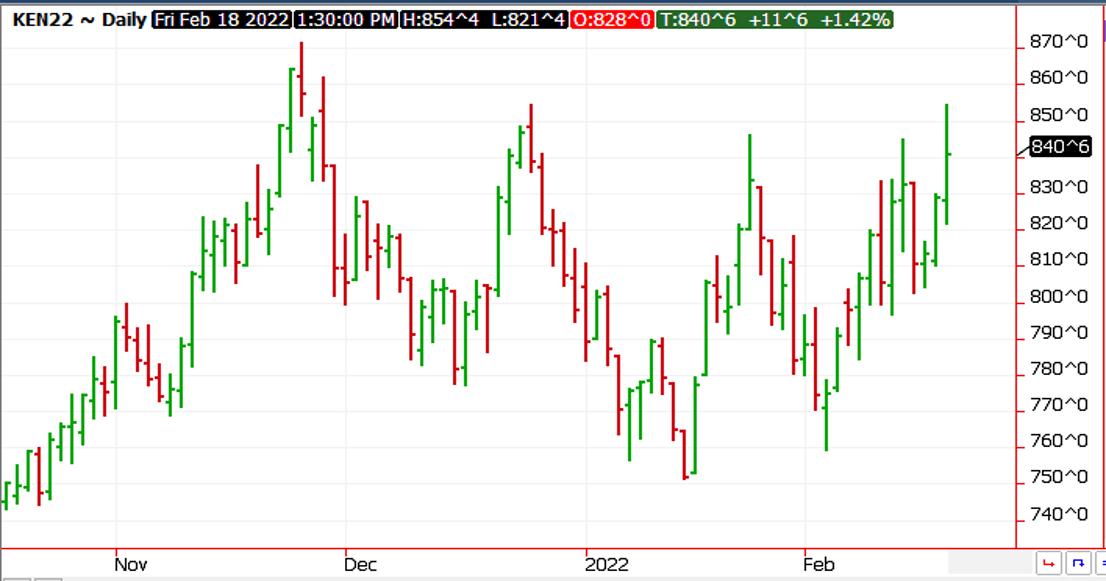

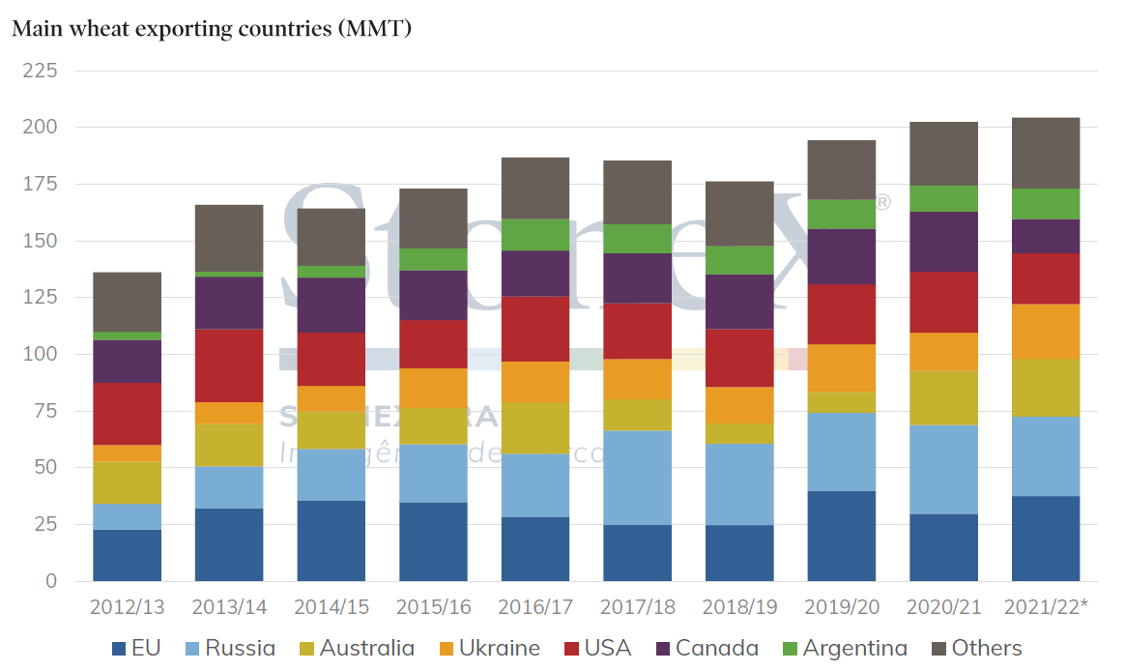

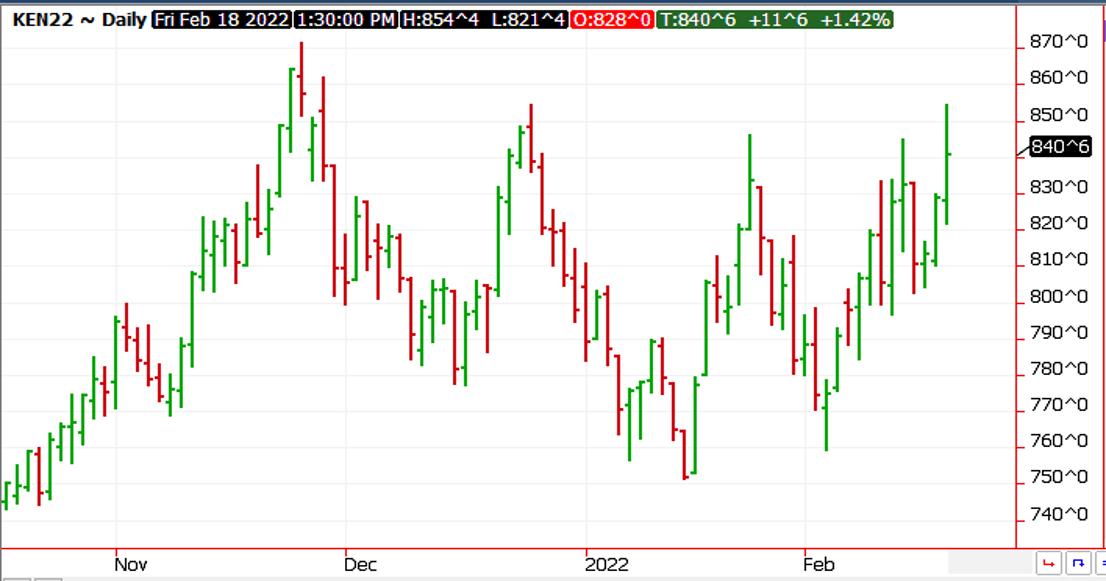

Black Sea wheat is a large global market driver, and Ukraine and Russia comprise about 90% of Black Sea wheat production. In addition, Russia and Ukraine make up roughly 1/20th of exports. Between 2010-2021 Ukraine’s wheat trade has steadily increased, as has Russia’s. Over the past 15 years, Russia has become the world’s wheat powerhouse exporting more wheat than the U.S. for the past 7 seasons. Continued conflict with Russia and Ukraine will affect about 10% of world wheat exports for this season and, like corn, can affect future production. Since the beginning of the year, when tensions became more prominent, July KC wheat futures have seen a 51-cent gain and traded over a 1-dollar range, with some volatility in between.

In addition to grain product and price disruptions, Russia is among the top NPK exporters. Ongoing conflict could affect availability and price for nitrates, phosphates, and potash. The country could be more subject to sanctions like export barriers with the U.S and other NATO countries. As Russia prepares for what could be an invasion into Ukraine, oil and natural gas supplies could be disrupted. Increasing prices and supply issues will lead to further production nightmares for nitrogen fertilizers.

As the Russo-Ukrainian conflict progresses, the U.S. will see continued price volatility, increased world demand for grains, and ongoing input supply issues. As U.S. farmers continue to trade unicorn markets, it is wise to discuss a pricing plan with your grain originator and your agronomist.

It’s no secret that Russia and Ukraine have had a rough relationship over the past 8 years. It’s also no secret that tensions have come to head in recent weeks. As U.S. troops are mobilized for overseas placement to places like Poland and Germany, many Americans have been left wondering why the issue matters to the U.S. and to U.S. agriculture. While the EU will feel the most direct effects, agricultural demand and pricing is driven so heavily by global markets that the effects will be felt world-wide. From grain prices to available supply to input disruptions, the U.S. could be in for a ride if Ukraine and Russia don’t make nice.

Agriculture is a large source of commerce in both Ukraine and Russia. Ukraine uses roughly 102.5 million acres of land for agriculture use which comprises about 70% of land in the country. Russia uses only about 13% of its land for agriculture purposes but Russia is the largest country in the world, so 13% equates to about 549.3 million acres used for agriculture, which is about 61% of what the U.S. uses. While Russia uses those acres for primarily wheat, Ukraine uses their land for crops such as wheat, corn, and sunflowers (among other commodities).

Ukraine and Russia account for a substantial piece of the global export market for corn and wheat. Both countries together made up about 15.5% of world corn exports in 2020/21. Ukraine has been among the top 4 exporters for corn and was the 3rd largest for the 2020/21 season, accounting for 13.3% of corn shipped world-wide. Ukraine is on pace to top last year’s exports; however, that pace could be cut short quickly should a war break out. For the 2021/22 season the world is facing tight global stocks for corn and South America (another large corn exporter) is facing production challenges that could further affect global supply, driving world prices higher. December corn has traded a roughly 57-cent range since the beginning of 2022 and has strengthened about 50 cents, looking to trend higher should the conflict continue.

2014-2022 Corn Exports, charts courtesy of StoneX

*USDA estimated

Black Sea wheat is a large global market driver, and Ukraine and Russia comprise about 90% of Black Sea wheat production. In addition, Russia and Ukraine make up roughly 1/20th of exports. Between 2010-2021 Ukraine’s wheat trade has steadily increased, as has Russia’s. Over the past 15 years, Russia has become the world’s wheat powerhouse exporting more wheat than the U.S. for the past 7 seasons. Continued conflict with Russia and Ukraine will affect about 10% of world wheat exports for this season and, like corn, can affect future production. Since the beginning of the year, when tensions became more prominent, July KC wheat futures have seen a 51-cent gain and traded over a 1-dollar range, with some volatility in between.

In addition to grain product and price disruptions, Russia is among the top NPK exporters. Ongoing conflict could affect availability and price for nitrates, phosphates, and potash. The country could be more subject to sanctions like export barriers with the U.S and other NATO countries. As Russia prepares for what could be an invasion into Ukraine, oil and natural gas supplies could be disrupted. Increasing prices and supply issues will lead to further production nightmares for nitrogen fertilizers.

As the Russo-Ukrainian conflict progresses, the U.S. will see continued price volatility, increased world demand for grains, and ongoing input supply issues. As U.S. farmers continue to trade unicorn markets, it is wise to discuss a pricing plan with your grain originator and your agronomist.