2024 Energy Market Review and Future Key Drivers

Jul 01, 2024

By Jeremy Peebles, Vice President of Petroleum

Amidst the complexities of global energy markets, 2024 has emerged as a year marked by notable stability and strategic shifts. As we delve into the dynamics of WTI crude oil and #2 Clear Diesel prices, it becomes evident that this year's trends reflect a departure from the volatility of recent times. With WTI prices maintaining a relatively narrow range and diesel prices showing comparable stability, stakeholders across industries are navigating a landscape shaped by moderated fluctuations and nuanced market drivers.

WTI Crude Oil Prices

West Texas Intermediate (WTI) crude is the primary oil benchmark for North America, serving as a crucial reference price for buyers and sellers of crude oil. We will focus on WTI prices, as they closely reflect what US consumers pay at the pump.

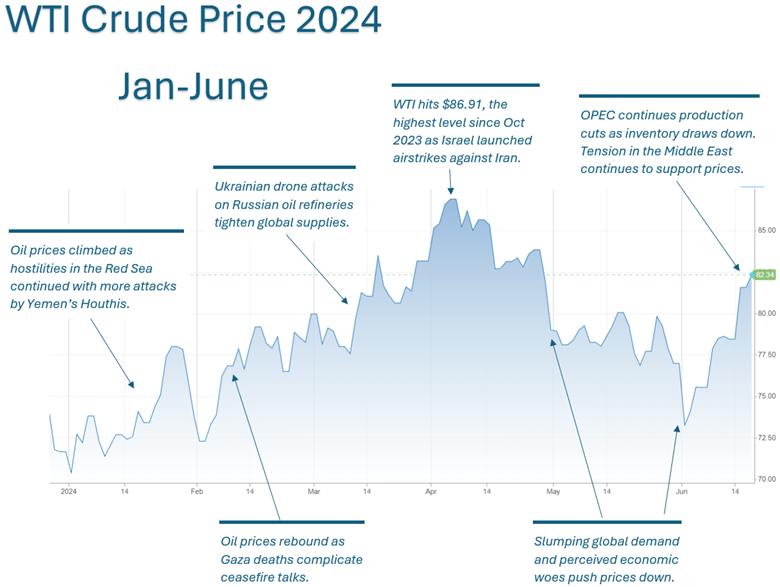

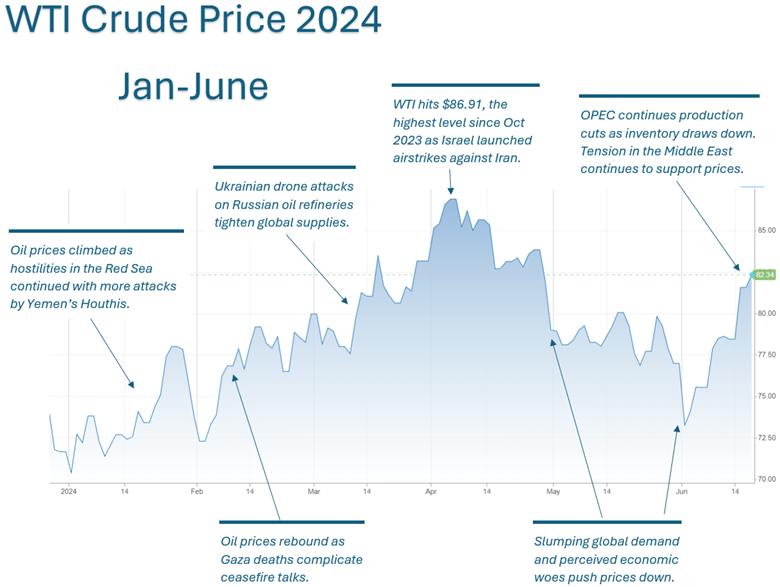

So far in 2024, WTI oil prices have fluctuated between $70.38 and $86.91 per barrel, representing a $16.53 range. This relatively stable price range contrasts with the volatility seen in recent years, where crude prices could swing by $30 per barrel within a few months.

2 Clear Diesel Prices

Similarly, the price of #2 Clear Diesel has ranged from $2.25 to $2.85 per gallon, a $0.60 difference. This stability in diesel prices mirrors the steadiness in crude oil prices.

Comparative Volatility

Unlike the past few years, where we witnessed substantial price volatility—crude oil prices moving by $30 per barrel and clear diesel prices shifting by $2 per gallon within a short period—the market in 2024 has shown more consistent and less erratic pricing trends.

Market Drivers

The graph below illustrates the WTI crude oil prices throughout 2024, highlighting the relatively narrow trading range and providing insight into the factors contributing to this year's market movements.

As we navigate the second half of 2024, the global oil market stands at a pivotal juncture. Shaped by a complex interplay of geopolitical tensions, supply dynamics, and shifting demand patterns, this year's outlook presents a fascinating landscape. Key elements influencing the market include strategic decisions by OPEC, growth from North American producers, a decelerating demand in China, ongoing global conflicts, and the impending US presidential election. Understanding these factors is crucial for anticipating market trends and preparing for the future.

OPEC Dilemma

OPEC faces a challenge in balancing market share with pricing goals amidst rising conflicts and increased output from the Americas. With spare capacity nearing 5 million barrels per day (b/d), primarily in Saudi Arabia and the UAE, the alliance's strategy will be crucial for 2024.

North American Growth

The US and Canada, leading global oil producers, generated over 41 million barrels of oil equivalent per day (boe/d) in 2023. This growth, driven by the Permian Basin, Canadian oil sands, and US shale gas, continues to surge. Despite challenges, a projected increase of 625,000 b/d in 2024 positions North America for significant growth, contingent on stable oil prices above $70/b WTI.

China’s Oil Demand

China's oil demand growth is expected to slow significantly, decreasing from 1.02 million b/d in 2023 to 490,000 b/d in 2024. Factors contributing to this deceleration include a weaker post-pandemic recovery, a cooling real estate market, a shift to a service-oriented economy, and the rise of electric vehicles.

Global Conflict

Tensions between Israel and Iran raise fears of potential disruptions in the Middle East, a crucial region for global oil supply. Historically, Middle Eastern conflicts lead to higher oil prices, at least temporarily. Meanwhile, the ongoing Russian-Ukraine war shows no signs of resolution. The possibility of these conflicts affecting key oil transit routes, military action, or sabotage could directly impact oil production facilities, straining global supply and increasing market uncertainty. Overall, these conflicts contribute to heightened volatility and uncertainty in the oil markets, driving up prices and prompting shifts in global supply chains to mitigate risks.

US Presidential Election

The upcoming US presidential election could significantly impact oil markets due to potential policy shifts and regulatory changes. A new administration might implement more lenient environmental regulations, reducing oil production costs, and roll back incentives for green energy, potentially increasing domestic oil production. Additionally, the administration's stance on international relations with major oil-producing and consuming countries will likely contribute to price volatility and strategic adjustments in the industry.

These elements will shape the oil market for the remainder of 2024, highlighting the intricate balance between production strategies and demand fluctuations. Amidst this complexity, GCC remains committed to providing stability and support to our members. As your trusted expert, partner, and leader in the energy industry, we are dedicated to helping you focus on what matters most: your farm, your family, and your future.

Amidst the complexities of global energy markets, 2024 has emerged as a year marked by notable stability and strategic shifts. As we delve into the dynamics of WTI crude oil and #2 Clear Diesel prices, it becomes evident that this year's trends reflect a departure from the volatility of recent times. With WTI prices maintaining a relatively narrow range and diesel prices showing comparable stability, stakeholders across industries are navigating a landscape shaped by moderated fluctuations and nuanced market drivers.

WTI Crude Oil Prices

West Texas Intermediate (WTI) crude is the primary oil benchmark for North America, serving as a crucial reference price for buyers and sellers of crude oil. We will focus on WTI prices, as they closely reflect what US consumers pay at the pump.

So far in 2024, WTI oil prices have fluctuated between $70.38 and $86.91 per barrel, representing a $16.53 range. This relatively stable price range contrasts with the volatility seen in recent years, where crude prices could swing by $30 per barrel within a few months.

2 Clear Diesel Prices

Similarly, the price of #2 Clear Diesel has ranged from $2.25 to $2.85 per gallon, a $0.60 difference. This stability in diesel prices mirrors the steadiness in crude oil prices.

Comparative Volatility

Unlike the past few years, where we witnessed substantial price volatility—crude oil prices moving by $30 per barrel and clear diesel prices shifting by $2 per gallon within a short period—the market in 2024 has shown more consistent and less erratic pricing trends.

Market Drivers

The graph below illustrates the WTI crude oil prices throughout 2024, highlighting the relatively narrow trading range and providing insight into the factors contributing to this year's market movements.

As we navigate the second half of 2024, the global oil market stands at a pivotal juncture. Shaped by a complex interplay of geopolitical tensions, supply dynamics, and shifting demand patterns, this year's outlook presents a fascinating landscape. Key elements influencing the market include strategic decisions by OPEC, growth from North American producers, a decelerating demand in China, ongoing global conflicts, and the impending US presidential election. Understanding these factors is crucial for anticipating market trends and preparing for the future.

OPEC Dilemma

OPEC faces a challenge in balancing market share with pricing goals amidst rising conflicts and increased output from the Americas. With spare capacity nearing 5 million barrels per day (b/d), primarily in Saudi Arabia and the UAE, the alliance's strategy will be crucial for 2024.

North American Growth

The US and Canada, leading global oil producers, generated over 41 million barrels of oil equivalent per day (boe/d) in 2023. This growth, driven by the Permian Basin, Canadian oil sands, and US shale gas, continues to surge. Despite challenges, a projected increase of 625,000 b/d in 2024 positions North America for significant growth, contingent on stable oil prices above $70/b WTI.

China’s Oil Demand

China's oil demand growth is expected to slow significantly, decreasing from 1.02 million b/d in 2023 to 490,000 b/d in 2024. Factors contributing to this deceleration include a weaker post-pandemic recovery, a cooling real estate market, a shift to a service-oriented economy, and the rise of electric vehicles.

Global Conflict

Tensions between Israel and Iran raise fears of potential disruptions in the Middle East, a crucial region for global oil supply. Historically, Middle Eastern conflicts lead to higher oil prices, at least temporarily. Meanwhile, the ongoing Russian-Ukraine war shows no signs of resolution. The possibility of these conflicts affecting key oil transit routes, military action, or sabotage could directly impact oil production facilities, straining global supply and increasing market uncertainty. Overall, these conflicts contribute to heightened volatility and uncertainty in the oil markets, driving up prices and prompting shifts in global supply chains to mitigate risks.

US Presidential Election

The upcoming US presidential election could significantly impact oil markets due to potential policy shifts and regulatory changes. A new administration might implement more lenient environmental regulations, reducing oil production costs, and roll back incentives for green energy, potentially increasing domestic oil production. Additionally, the administration's stance on international relations with major oil-producing and consuming countries will likely contribute to price volatility and strategic adjustments in the industry.

These elements will shape the oil market for the remainder of 2024, highlighting the intricate balance between production strategies and demand fluctuations. Amidst this complexity, GCC remains committed to providing stability and support to our members. As your trusted expert, partner, and leader in the energy industry, we are dedicated to helping you focus on what matters most: your farm, your family, and your future.