Russia-Ukraine War: Three Years of Conflict and the Ripple Effects on U.S. Commodity Markets

Feb 07, 2025

February 24, 2022, Russia invaded Ukraine causing an escalation of the ongoing Russian Ukrainian war. Almost three years later, the war remains ongoing. On January 14, 2025, Ukraine launched a missile/drone attack targeting both ammunition depots and chemical plants on Russian soil. Many Americans are still left wondering; what implications do the continued tensions between Russia and Ukraine have on the U.S. and global commodity markets moving forward?

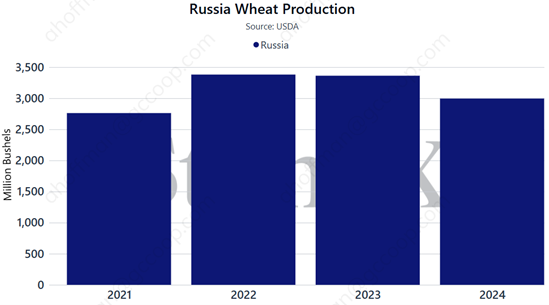

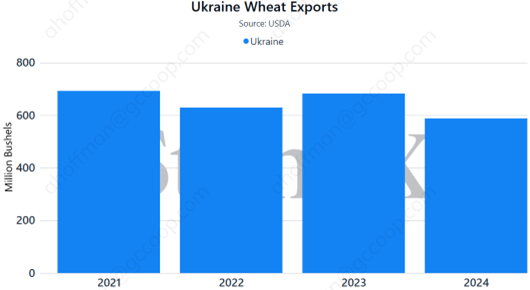

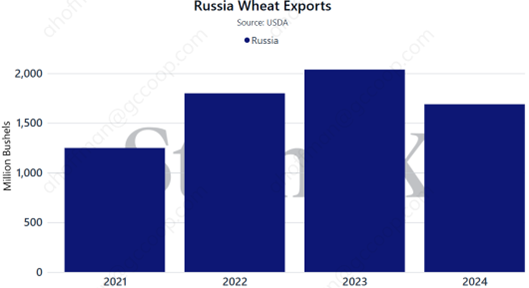

Both Ukraine and Russia are major producers and exporters of key commodities such as wheat, corn, and sunflower oil. A major topic of discussion preluding the invasion of Ukraine, was the belief that production and exports in both Russia and Ukraine would be dramatically cut as war tensions came to a head. Following a record year in 2021, Ukrainian wheat production was decreased in 2022 comparatively but was only marginally lower than production levels in years preceding 2021. Russian wheat production was virtually unaffected. Both Ukrainian and Russian wheat exports did not seem to suffer major losses following the invasion in 2022; Russia even increasing their wheat exports during the 2023 season. The 2024 wheat production and export values for both countries were down slightly as unfavorable weather conditions created a difficult growing season for farmers. While the continued tensions in Russia and Ukraine did have some limitations on crop production and exports, the implications were less than what was potentially expected.

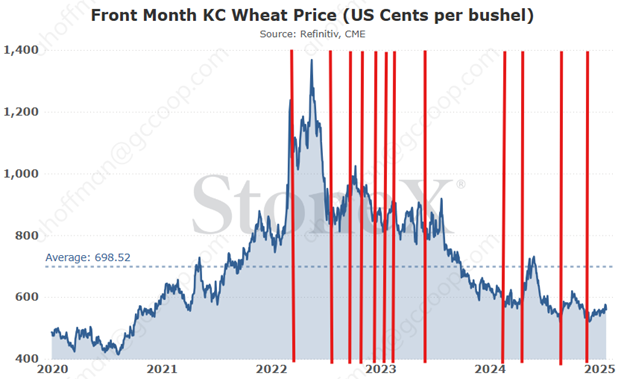

Global wheat and corn prices had seen a gradual upward trend since 2020, but the outbreak of war between Russia and Ukraine early in 2022 sent global prices skyrocketing. Locally, cash bids reached prices exceeding $13 per bushel for wheat, with corn at a cash price of over $9 per bushel in May 2022. Following the Black Sea Grain Initiative, there was a general downward pressure on corn and wheat prices as global supply concerns were eased. Commodity prices throughout 2023 remained stable, returning to pre-invasion levels and lower yet throughout the 2024 respective wheat and corn marketing years.

Timeline of the war:

- February 2022: Russia launches a full-scale invasion of Ukraine.

- July 2022: The Black Sea Grain Initiative was signed to facilitate the safe export of Ukrainian grain from ports in the Black Sea among the ongoing war with Russia.

- September 2022: Ukrainian military forces Russian troops to retreat, reclaiming Ukrainian soil.

- October 2022: Russia signed papers to annex four Ukrainian regions and an explosion disabling Russia’s bridge to Crimea causes retaliation across Ukraine.

- December 2022: Ukrainian president visits the White House following the announcement of $2 billion in military assistance to Ukraine.

- January 2023: The US and Germany announced a gift of advanced battle tanks to Ukrainian forces to aid in their defense against Russia.

- February 2023: Appearance of a new offensive launch in Ukraine by Russian forces, a visit by US president Joe Biden, and the announcement of an additional $500 million in assistance by the US.

- June 2023: Russian mercenary group stages a coup attempt to challenge Putin and Russian military forces – the march toward Moscow was halted a day after the movement began.

- February 2024: Ukraine announced the replacement of top military general and the US stalls additional military aid to Ukrainian military forces.

- April 2024: US House of Representatives passed a foreign aid package including more funding to aid Ukrainian forces against Russia.

- August/September 2024: Ukraine launches the largest foreign attack on Russia since World War II to which Russia launched a counteroffensive in the region in September.

- October/November 2024: Russia joined in war efforts by North Korean troops, Trump elected as US president, Biden allows for the use of long-range US weapons.

* Red lines (from left to right) correspond with timeline events, in chronological order.

While the war is ongoing, there are mixed emotions on whether a negotiating settlement between countries will be discussed in the future. Instead, global commodity markets are more focused on the larger worldwide picture as we move into 2025. Globally, there’s a large quantity of wheat in the supply chain and a recent USDA WASDE report released January 2025 showed an increase in both global production and carryout. While the corn complex painted a different picture, the USDA WASDE report did decrease global corn production by 3.5 MMT. Lower values in corn production estimates have caused some market rally in recent trading sessions, but the sustainability of a long-term bullish market may be limited. Both wheat and corn export demands have remained relatively stagnant, leaving prices to remain mostly stagnant with them.

Seemingly, regardless of the status between Russia and Ukraine, there appears to be a lack of market interest in their affairs/headlines. After the election of Trump, it was reported that Russia was open to negotiations to end the war if peace talks were initiated by Trump. While the implications of increased taxes, tariffs, and sanctions remain unknown, should the end of the war soon be on the horizon, global markets are likely to see a decrease in price fluctuations and increase in overall market stability. For the American farmer, if Russian and Ukrainian production resume to pre-war levels, global crop supply/carryout will subsequently be increased, which could limit the prices received for U.S. commodities in 2025.

For more information and input specifically on local cash markets, please find updates in the recent Weekly Market Commentary from your GCC Grain Origination Team. We encourage our farmers to reach out to their grain originator and discuss a marketing plan that best fits their operational needs.