The Latest Moves in the Interest Rate Market

Mar 06, 2025

By Nathan Flores, GCC Associate Grain Originator

Inflation and employment data have dominated headlines during Trump's second presidential term. As of January 2025, interest rates remain high, and the Federal Reserve has not hurried to lower them. Fortunately, recent tariffs have not impacted the grain and oilseed markets, which remained stable prior to the inauguration. However, inflation in January was prevalent for food, energy, goods, and services. According to the Consumer Price Index, inflation rose by 0.5% last month, exceeding the 0.3% median estimate. Core inflation also surprised analysts, coming in at 0.4% in January, higher than expected. Only five of the 73 forecasters had predicted core inflation would rise to 0.4%, and nobody anticipated the headline inflation to reach 0.5%. Behind the numbers:

In his second annual address to Congress, Powell noted: “We know that reducing policy restraint too fast or too much could hinder progress on inflation. At the same time, reducing policy restraint too slowly or too little could unduly weaken economic activity and employment. “We do not need to be in a hurry to adjust our policy stance.” Trump disagrees, commenting through Truth Social, “Interest rates should be lowered, something which would go hand in hand with upcoming tariffs!!! Let's Rock and Roll, America!!!”

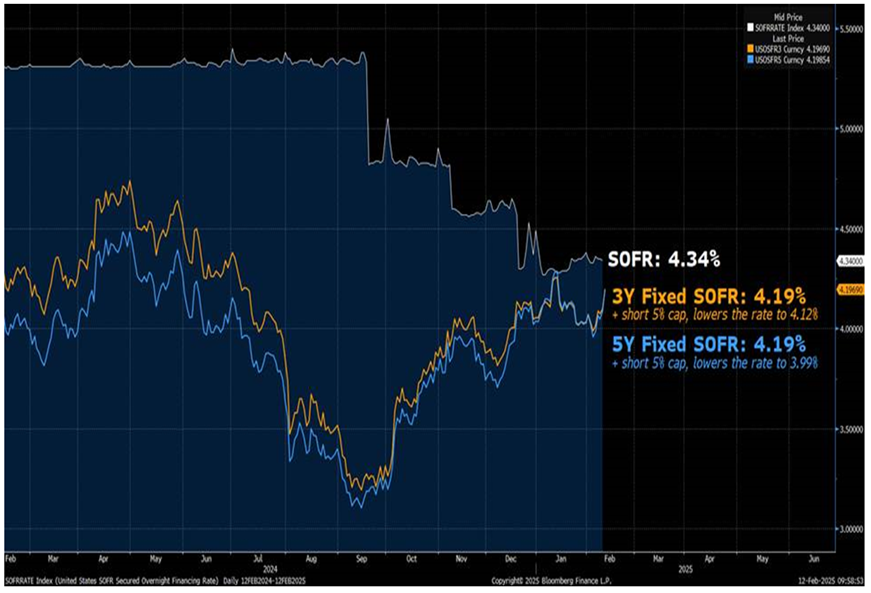

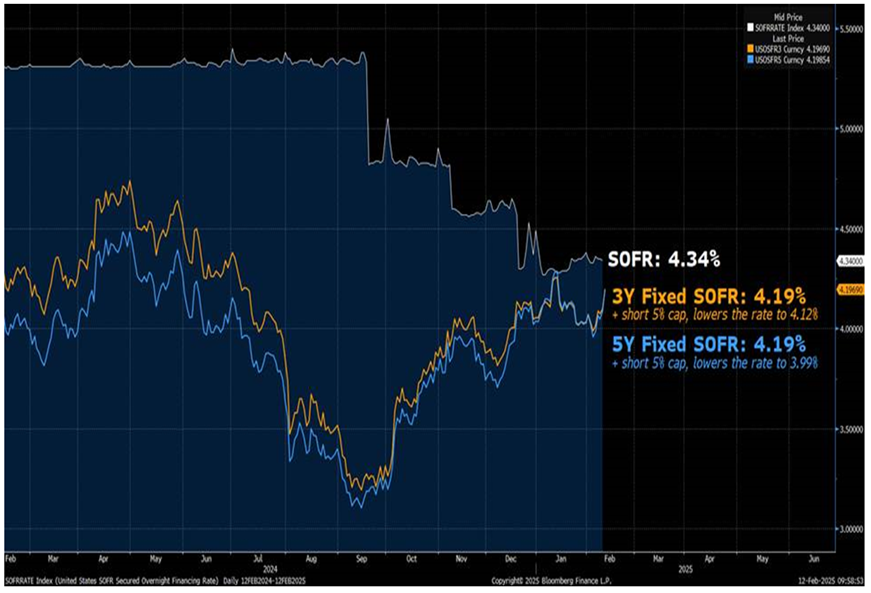

The fixed-rates - secured overnight financing rate (SOFR) Market

Inflation and employment data have dominated headlines during Trump's second presidential term. As of January 2025, interest rates remain high, and the Federal Reserve has not hurried to lower them. Fortunately, recent tariffs have not impacted the grain and oilseed markets, which remained stable prior to the inauguration. However, inflation in January was prevalent for food, energy, goods, and services. According to the Consumer Price Index, inflation rose by 0.5% last month, exceeding the 0.3% median estimate. Core inflation also surprised analysts, coming in at 0.4% in January, higher than expected. Only five of the 73 forecasters had predicted core inflation would rise to 0.4%, and nobody anticipated the headline inflation to reach 0.5%. Behind the numbers:

- Food: Four major grocery store categories saw increased prices last month. Eggs alone rose by 15.2%, marking the largest price spike since June 2015. Eggs account for two-thirds of total food inflation.

- Energy: Gasoline increased 1.8%, but a 6.2% spike in Fuel Oil contributed the most to the 1.1% overall increase in energy prices last month.

- Goods: Apparel became cheaper, but not much else. Used car and truck prices increased last month at the fastest rate since May 2023, while otherwise, ordinary categories like prescription drugs and books rose at their highest monthly pace in over a decade.

- Services: The one bright spot, oddly enough, was shelter. The Owner’s Equivalent Rent held steady at a 0.3% rate, which helped reduce the annual change from 4.8% to 4.6%. In previous reports, shelter costs could account for as much as 70% of overall inflation, but now they only contribute 30%. Additionally, car and home insurance costs played a significant role in driving inflation within the services sector. Car insurance increased by 2% last month, the highest rise since May 2022, while home insurance saw an increase of 1.1%.

In his second annual address to Congress, Powell noted: “We know that reducing policy restraint too fast or too much could hinder progress on inflation. At the same time, reducing policy restraint too slowly or too little could unduly weaken economic activity and employment. “We do not need to be in a hurry to adjust our policy stance.” Trump disagrees, commenting through Truth Social, “Interest rates should be lowered, something which would go hand in hand with upcoming tariffs!!! Let's Rock and Roll, America!!!”

The fixed-rates - secured overnight financing rate (SOFR) Market

- Fixed rates from 2 years to 10 years trade closely together.

- With 1. The Fed on hold, 2. Upside inflation risk, and 3. Downside employment risks – it’s best to keep hedging strategies in the 2, 3, or 5-year part of the curve. These rates provide the same savings as longer-dated ones while allowing flexibility for adjustments if needed.

- Beyond the plain vanilla playbook, I’d consider selling a deep out-of-the-money cap to enhance the rate further. The 5Y rate, for instance, is trading below 4%, while the SOFR forward curve bottoms out at 4.10% over the next 10 years.